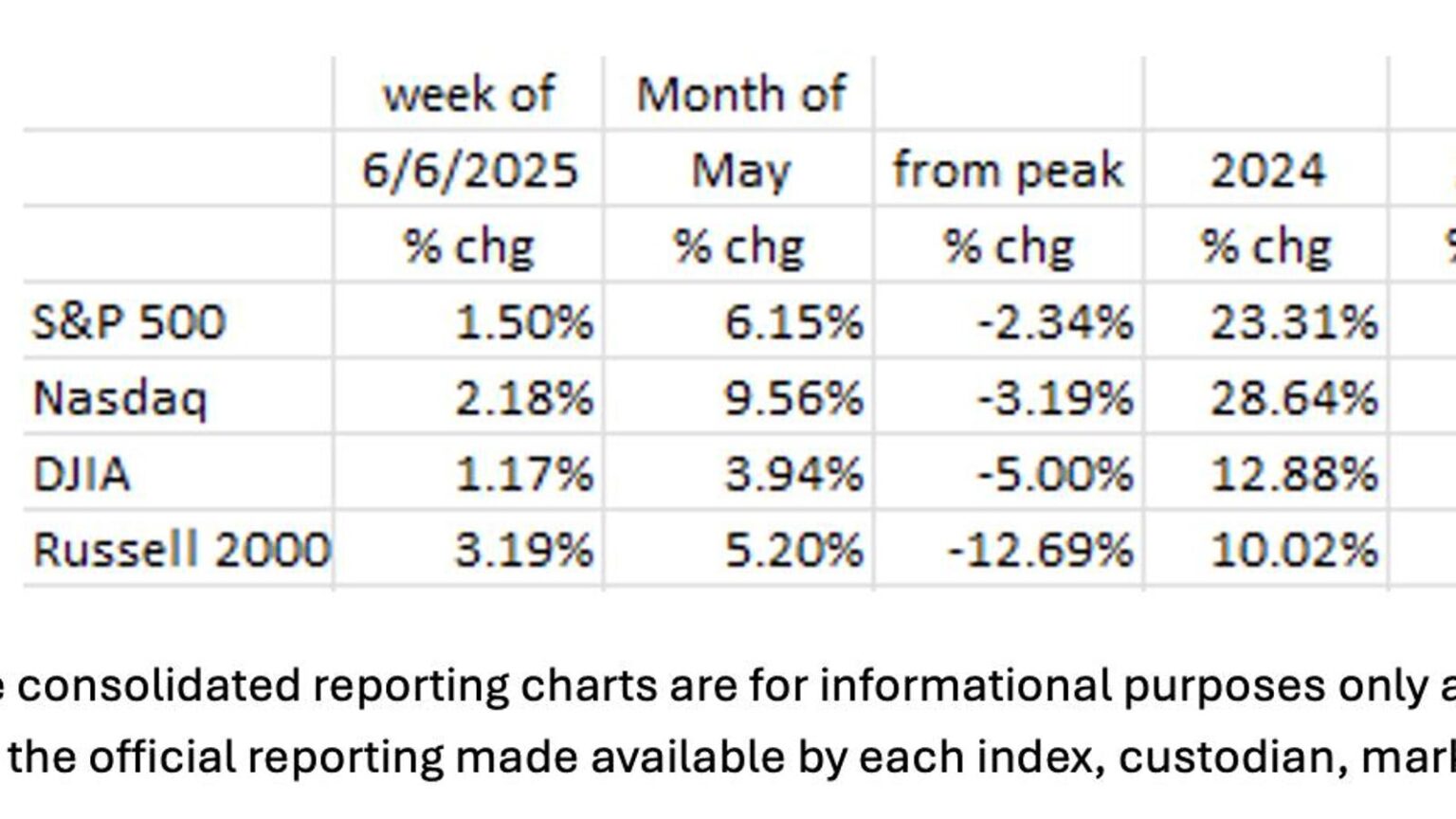

The most anticipated economic news for the week was the jobs numbers. At the headline level, job growth in the Establishment Survey was +139K which came in above the +126K consensus estimate. The financial markets reacted with their typical “shoot first, ask questions later” mentality and the major indexes all gained a healthy +1% on Friday (June 6), bringing all but the Russell 2000 into positive territory for the year (see table). Nevertheless, because the headline was higher than expected, bond yields rose with the 10-year Treasury up 12 basis points for the week (from 4.39% to 4.51%).1 4

For the week, the table below shows that five of the Magnificent 7 were positive. The exceptions were Apple and Tesla. It appears that the Trump/Musk falling out played a significant role in Tesla’s market performance, while Apple was essentially at breakeven for the week. For the year, the table shows huge variance among the seven with four down for the year and three up.

In truth, markets were expecting a much weaker jobs number given the weak results from both the JOLTS (Job Openings and Labor Turnover Survey) and ADP surveys. The JOLTS indicated that layoffs were greater than new hires, now the case in three of the last four months.2 The ADP May new jobs number, at +37K, was the lowest count in more than two years and well below the consensus expectation of +110K.3 Digging deeper into the ADP report, the -13K job loss in the small business sector was the largest loss in jobs in that classification in more than three years; small business is supposed to be the backbone of the economy, so this is definitely concerning.3

But the real story, all but ignored by the financial media, was the drop of -696K in the sister Household Survey, most of which was in full-time jobs (-623K).14 Ignored by the media were the downward revisions to the jobs numbers which totaled -138K for April and May.4 If one was looking at employment “levels” and began with the aggregate number known on Thursday, the net difference between that known aggregate and today’s updated number was +1K (i.e., +139K from the Establishment Survey -138K in revisions).4

Readers of this blog know that we are skeptical of the headline Establishment Survey number (+139K) because of the automatic add-on from the small business Birth-Death model. Half or more of the +139K gain came from the Birth/Death Model uncounted add-on. We are even more skeptical given the -696K number in the Household Survey.1 4

The U3 Unemployment Rate held its ground at 4.2%. Since that rate is calculated from the Household Survey (-696K), one can legitimately ask why the U3 didn’t rise. The answer to that lies in the fact that the Labor Force Participation Rate, the denominator, declined, i.e., the labor force shrank, likely because jobs are not as easy to find as they were several quarters ago. With a labor force falling faster than jobs, even a small shrinkage in the number of jobs can work to keep the employment rate up and the unemployment rate down.5

Example:

- 100,000 labor force; 96,000 employed; 4% Unemployment Rate; 4,000 Unemployed

- 98,000 labor force; 94,080 employed; 4% Unemployment Rate; 3,920 Unemployed

From the example, with a lower labor force, while there are fewer people employed, the unemployment rate is the same. In May, the large shrinkage in the labor force kept the U3 Unemployment Rate the same as April’s 4.2% rate. According to Wall Street economist David Rosenberg (June 6 Comment “Was Employment Up +139K…Or Down -696K?”) had the Labor Force Participation Rate stayed constant instead of shrinking, the U3 Unemployment Rate would have risen to 4.6%. The question is: Why did the labor force shrink so dramatically?

The likely answer is that jobs are not as easy to get as they were a year or two ago which discourages people from entering the labor force. (Note the uptrend in the “Jobs hard to Get” chart).5

More Slowdown Proof

The ISM Manufacturing Index fell to 48.5 in May (50 is the demarcation line between expansion and contraction). The chart shows that manufacturing in the U.S. has been contracting since November 2022 with only one recent brief period of expansion in this year’s first quarter. The latest reading, in May, is 48.5.7 In addition, ISM’s Non-Manufacturing Index also showed up in contraction territory at 49.9 in May. While this is barely contractionary, the major focus here is that it is falling, as it was 51.6 the prior month.8

Other economic indicators reinforce the slowdown story. Construction spending fell in April by -0.4%, further adding to March’s -0.5% result. Factory Orders fell -3.7% in April, reversing March’s +3.5% gain. In May, total car/truck sales fell to an annual rate of 15.6 million units from 17.3 million in April, a sure sign of economic slowing.4 In addition, single-family housing starts, retail sales volumes, and core capex shipments all showed lower readings sequentially in their latest releases. Policy uncertainty certainly looks to have played a major role.4 6

The ISM Services Index also fell into contraction territory at 49.9 in May. While this is barely in contraction (i.e., below 50), it was a surprise to the markets as the consensus had forecasted this to be solidly in expansion territory at 52.0, slightly above April’s 51.6 reading.8 When the composite index falls into contractionary territory, history tells us that there is a very low probability that the economy is growing.7 8

The Fed

Given the level of unease and uncertainty in the economy, validated in the Fed’s latest Beige Book, and despite the slowing economy as we have chronicled above and in these blogs over the past few months, market odds of a Fed rate cut at June’s FOMC meeting are 0%. At July’s meeting set: a mere 16.5%. Markets believe that, despite the slowing economy, the Fed is likely to wait until September (59.8%) to lower rates, and it isn’t highly certain that it will do so by then.4 (Imagine what Trump’s Truth Social posts will have to say about Chairman Powell!!)3

Given that other major central banks have lowered their rates (the European Central Bank several times), and from our observations above and in the last several of these blogs regarding a slowing economy, we think the Fed should be lowering rates and performing other easing actions. We wonder where the Fed would be in the absence of Trump’s political pressure and Powell’s insistence on preserving the Fed’s independence from such pressure.3 4

Final Thoughts

Despite the seemingly “strong” jobs numbers in the Establishment (headline) Survey, upon further analysis, it turns out that the reported jobs number wasn’t so strong after all with households, in the sister Household Survey, reporting a near -700K of job losses.1 4 Most of those job losses were full-time, confirming what was reported in the JOLTS and seen in Wednesday’s ADP report. Layoffs are now occurring faster than new jobs are being created.2 3

The U3 Unemployment Rate held steady at 4.2% because jobs, now “hard to get,” caused job seekers to drop out of the labor force at a high rate causing a drop in the labor force participation rate. The combination of a lower number of jobs and a lower number of both job holders + job seekers resulted in no change in the U3 unemployment rate. But clearly, fewer jobs are a big issue. Had the labor force participation rate stayed the same as it was in April, the U3 Rate would have been significantly higher (4.6%), and markets would be expecting Fed action soon.5

Manufacturing is in contraction and now the ISM’s Non-Manufacturing Index has joined it.7 8 Construction spending fell in April. Consumer purchases of autos took a big dip in May. The housing industry, both new and existing homes, is declining.4 All of this, plus continuing policy uncertainty , indicates that the economy will continue to slow in the near-term.4 6

The Fed has a dilemma. Inflation, as measured by the CPI, is well on its way to the Fed’s 2% target. And a slowing economy desperately needs lower interest rates. But Chair Powell doesn’t want to appear to be “bullied” by President Trump into lowering rates given that the Fed is supposed to be “independent” from the rest of government. So, likely, despite the urgent need for lower rates in the U.S., the Fed will “pass” at its upcoming June meeting, and if Trump’s political pressure continues, they are likely to also “pass” at their July conclave.3 4

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here