- The Australian Dollar gains ground as the US Dollar weakens amid lower Treasury yields.

- The AUD could struggle as RBA Governor Michele Bullock maintained a dovish tone by suggesting further rate cuts.

- The US Dollar depreciates as the 30-year Treasury yield falls to 5.03% after pulling back from 5.15%.

The Australian Dollar (AUD) posts gains against the US Dollar (USD) on Friday after registering losses in the previous session. The AUD/USD pair jumps as the Greenback comes under pressure, driven by the 30-year US bond yield pulling back from highs in 19 months. US President Donald Trump’s “One Big Beautiful Bill” passed the US House of Representatives and is on its way to the Senate floor, which has raised concerns regarding the increase in the fiscal deficit in the United States (US).

However, the AUD/USD pair depreciated on Thursday as the US Dollar received support immediately after the release of stronger US S&P Global Purchasing Managers’ Index (PMI) data. S&P Global Composite PMI posted a 52.1 reading for May, rising from April’s 50.6 reading. Meanwhile, the Manufacturing PMI rose to 52.3 from 50.2 prior, while the Services PMI rose to 52.3 from 50.8.

Earlier this week, the Reserve Bank of Australia (RBA) delivered a 25 basis points rate cut, reducing its Official Cash Rate (OCR) to 3.85% from 4.10%. RBA Governor Michele Bullock maintained a dovish tone by supporting the central bank’s rate cut decision. Bullock mentioned that the Board is prepared to take additional action if necessary, raising the prospect of future changes. She also noted that curbing inflation is important and expressed that a rate cut was a proactive step and boosted market sentiment, which was suitable given the state of the economy.

Australian Dollar advances as US Dollar loses ground amid lower treasury yields

- The US Dollar Index (DXY), which tracks the US Dollar (USD) against a basket of six major currencies, is retracing its recent gains. At the time of writing, the DXY is trading around 99.70 as the 30-year yield on US Treasury bond is trading at 5.03% after pulling back from 5.15%, reached in the previous session, its highest level since November 2023.

- The US House of Representatives approved Trump’s budget by one vote on Thursday. The proposal is expected to increase the deficit by $3.8 billion, as it would deliver tax breaks on tip income and US-manufactured car loans, according to the Congressional Budget Office (CBO).

- Fed Governor Christopher Waller noted on Thursday that markets are monitoring fiscal policy. Waller further stated that if tariffs are close to 10%, the economy would be in good shape for H2, and the Fed could be in a position to cut later in the year.

- The US Dollar struggled after Moody’s downgraded the US credit rating from Aaa to Aa1. This move aligns with similar downgrades by Fitch Ratings in 2023 and Standard & Poor’s in 2011. Moody’s now projects US federal debt to climb to around 134% of GDP by 2035, up from 98% in 2023, with the budget deficit expected to widen to nearly 9% of GDP. This deterioration is attributed to rising debt-servicing costs, expanding entitlement programs, and falling tax revenues.

- Australia’s Manufacturing Purchasing Managers Index came in at 51.7 in May versus 51.7 prior. Meanwhile, Services PMI declines to 50.5 in May from the previous reading of 51.0, while the Composite PMI eases to 50.6 in May from 51.0 prior.

- The risk-sensitive Australian Dollar gained support from renewed optimism surrounding a 90-day US-China trade truce and hopes for further trade deals with other countries. Meanwhile, US Treasury Secretary Scott Bessent told CNN on Sunday that President Donald Trump intends to implement tariffs at previously threatened levels on trading partners that do not engage in negotiations “in good faith.”

- The AUD was also affected by Australia’s political unrest. Following the National Party’s withdrawal from its collaboration with the Liberal Party, the opposition coalition disbanded. The ruling Labor Party, meanwhile, took advantage of the unrest and retook power with a more robust and expansive agenda.

Australian Dollar consolidates around the psychological 0.6450 level

The AUD/USD pair is trading around 0.6430 on Friday with a bullish bias, supported by daily technical indicators. The pair maintains its position above the nine-day Exponential Moving Average (EMA), while the 14-day Relative Strength Index (RSI) stays above the 50 mark, both supporting persistent upward momentum.

On the upside, the six-month high of 0.6515, recorded on December 2, 2024, would provide a strong resistance. A decisive break above this barrier could back the pair to test the seven-month high at 0.6687, which was reached in November 2024.

The nine-day EMA of 0.6425 is acting as an immediate support, followed by the 50-day EMA near 0.6369. Further depreciation would undermine the bullish outlook, possibly opening the path toward the March 2020 low of 0.5914.

AUD/USD: Daily Chart

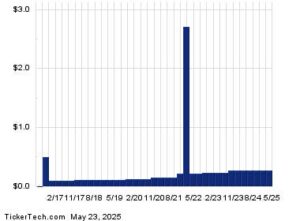

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.35% | -0.24% | -0.37% | -0.23% | -0.42% | -0.36% | -0.33% | |

| EUR | 0.35% | 0.11% | -0.02% | 0.13% | -0.06% | 0.02% | 0.04% | |

| GBP | 0.24% | -0.11% | -0.12% | 0.02% | -0.14% | -0.10% | -0.07% | |

| JPY | 0.37% | 0.02% | 0.12% | 0.16% | -0.05% | 0.02% | 0.06% | |

| CAD | 0.23% | -0.13% | -0.02% | -0.16% | -0.21% | -0.12% | -0.10% | |

| AUD | 0.42% | 0.06% | 0.14% | 0.05% | 0.21% | 0.08% | 0.11% | |

| NZD | 0.36% | -0.02% | 0.10% | -0.02% | 0.12% | -0.08% | 0.03% | |

| CHF | 0.33% | -0.04% | 0.07% | -0.06% | 0.10% | -0.11% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Read the full article here