Topgolf founders Steve and Dave Jolliffe have raised $34 million for a new take on the game of pool.

A deal memo from one of the company’s lead investors reveals its strategy to stand out amid a slew of social sports concepts.

The new venture, Poolhouse, plans to bring Topgolf’s recreational model to billiards. It uses tech to make the game more social and is building a lounge-like experience with higher-end food and drinks than you’d find in a typical sports bar.

The UK-based company plans to open its first location in London next year and then expand to the US.

VC firms Sharp Alpha and DMG Ventures led Poolhouse’s seed round with a primary close in October. The startup is also backed by investors including David Blitzer, Simon Sports, Active Partners, and Emerging Fund.

Sharp Alpha, which shared its 28-page deal memo on the investment exclusively with Business Insider, sees Poolhouse as part of the burgeoning category of “competitive socialization.” Companies are trying to modernize various recreational sports with concepts such as Puttshack, the Jolliffe’s spin on mini golf, the darts chain Flight Club, and racing simulator F1 Arcade, which raised $130 million last year.

Topgolf helped popularize the category with its gamified indoor driving ranges and exposed a new audience to golf. In 2020, Callaway bought Topgolf in a $2 billion deal.

“Who would have thought 20, 25 years ago when Topgolf was created that people would be going in dresses and high heels, having never swung a golf club before, and having a great time playing golf,” Poolhouse CEO and cofounder Andrew O’Brien told BI.

The Topgolf founders positioned Poolhouse as their “most ambitious” and “scalable” business yet, according to deck.

O’Brien said Poolhouse outfits regular pool tables with tech to determine how good or bad each player is early in the game, and then introduces handicaps to level the playing field, such as bonuses for beginners or hazards for pros. A game can include up to 12 people.

The gamified elements are projected onto the pool table, so the facilities don’t need to be as cumbersome as some other social sports concepts.

Where a Topgolf venue can cost more than $40 million to build, O’Brien said Poolhouse aims to spend around $15 million to $20 million per location, though it may spend more in pricey markets like New York or Las Vegas.

Many companies have adopted the “Topgolf for X” model in other areas, from darts to ping-pong to racing.

“All of these venues are fun to visit. Not all of them are investable,” Sharp Alpha wrote in the deck.

The firm, which focuses on sports, gaming, and entertainment, spent over a year evaluating concepts in this space before investing in Poolhouse.

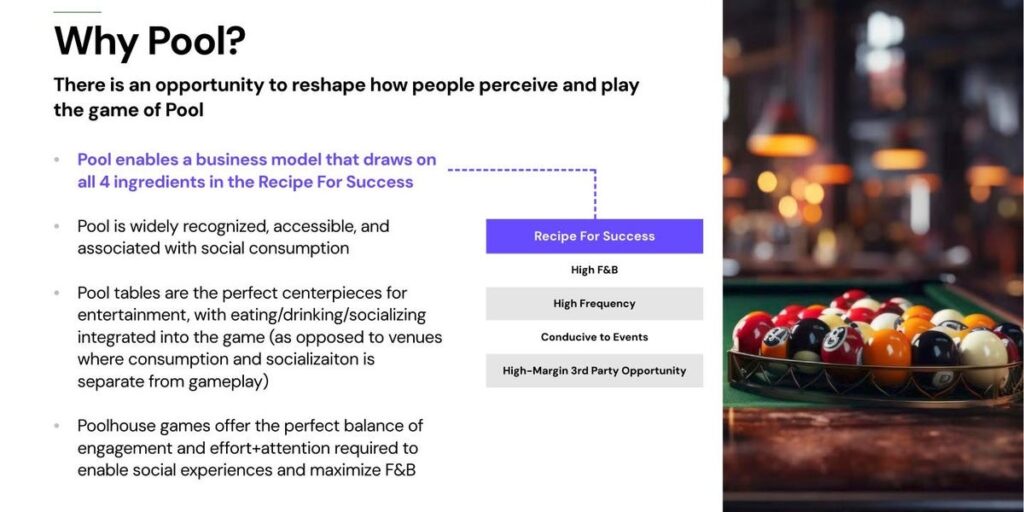

It said successful models have four key elements:

- Strong food and beverage revenue

- High frequency, in that they’re built around an everyday hobby

- Conducive to events like corporate parties or birthdays

- Proprietary software that can create a high-margin third-party opportunity

To that last point, O’Brien said Poolhouse is exploring franchising and licensing to scale its brand beyond its own venues.

Poolhouse’s founders were also a big draw for investors. Danzig described the company as a “textbook case of founder-market fit.”

Here’s the deal memo from Sharp Alpha, which redacted some details:

Poolhouse is looking to bring the Topgolf experience to billiards

Sharp Alpha’s deal memo outlines its investment in Poolhouse and the competitive landscape

The deal memo includes:

- Deal overview

- Opportunity

- Competitive landscape

- Recipe for success

- Product

- Comparable companies

- Team

- Go-to-market strategy

- Risks

- Financial model

It gives an overview of the company, including its investors, concept, and team

Sharp Alpha and DMG Ventures led the seed funding round. Other investors included David Blitzer, Simon Sports, and Active Partners.

The company’s team includes execs with experience in hospitality, food and beverage, augmented reality, and computer vision.

The slide also describes Poolhouse’s business and revenue streams:

What is Poolhouse?

Poolhouse is a software company building a cathedral to tech-enabled pool where gamified billiards tables serve as centerpieces to high-end competitive socialization paired with refined food & beverage. This forms the foundation for a higher-margin revenue mix that includes licensing white label technology and franchising.

Revenue streams

- Poolhouse-operated venues

- Franchise/Joint-venture

- Licensing to 3rd parties

Poolhouse is targeting 3 markets: restaurants, out-of-home entertainment, and events

Poolhouse wants to be considered a “third place,” which is a social setting that’s separate from the home and the workplace.

This slide shows how demand for ‘Third Place’ experiences is surging

It includes charts on the share of American 30-year-olds who live on their own, have ever married, live with a child, or own a home — all of which seem to be trending down from the 1980s through 2023.

It also shows the growth in Google search volume for the terms “how to meet people,” “meet new people,” “where to make friends,” and “feel lonely.”

The memo says the ‘desire for lasting social experiences in altering leisure habits’

The graph shows year-over-year site growth in the UK as of June for commercial businesses like cocktail bars, craft bars, casual dining restaurants, hotels, pubs, and nightclubs. According to the chart, “competitive socializing” outpaces them all.

It says landlords want these kinds of venues

The slide reads:

Mixed-use spaces anchored by entertainment are coveted by landlords

- Increase high-quality foot traffic

- Attract multiple tenant types

- Robust against the rise in online shopping

“A premium competitive socialization venue can have a hugely positive impact on a central London development. The success achieved by F1 Arcade at the ONC location has resulted in improved footfall for the shopping center, a significant halo effect sales increase for other operators, and notably higher rental asks for new incoming tenants.” — Jonathan Peters, the Global President at F1 Arcade (previously CFO at Richard Caring restaurants).

A graph compares site-level EBITDA margins for traditional F&B and competitive socialization.

Sharp Alpha points to a variety of concepts in this space

These include lounges, sports, and arcades.

They offer a range of value propositions

The slide includes a word cluster analysis for four categories in this space: training facilities, watering holes, arcade 2.0, and adult playgrounds.

A map suggests London is a popular launchpad for concepts in this space

It shows locations in London as of March.

Those businesses tend to expand next in the US, including New York, Boston, and DC

The slide shows a map of competitive entertainment businesses in New York.

Successful models for these venues have 4 key qualities, the deck says

These traits include high food and beverage revenue, high visit frequency, conducive to events, and high-margin third-party opportunities.

Poolhouse cofounder Steve Jolliffe says the startup is his ‘most ambitious’ yet

The slide reads:

“Poolhouse is the most ambitious and scalable concept my brother and scalable concept my brother and I have created, representing the pinnacle of our lifelong work. Today, more people play Topgolf than on traditional golf courses in the US, and we aim to make an even greater impact on the world of pool.” — TopGolf and Puttshack founder, Steve Jolliffe

The deck suggests Poolhouse’s tech can be added to any pool table

It explains why the game of pool is ripe for reinvention

This slide reads:

Why Pool?

There is an opportunity to reshape how people perceive and play the game of Pool

Poolhouse is compared to Puttshack and F1 Arcade

The memo points to the recent growth of other companies, including Puttshack, F1 Arcade, Flight Club, and Five Iron Golf.

More examples of companies in the space

A chart breaks down the companies by when they were founded, where they’re based, number of locations, the cost per hour, alcohol association, athletic exertion, dwell time, and visit frequency. Some details are redacted.

The memo introduces the Poolhouse team

The memo says Poolhouse has nine senior members with industry experience in addition to the Joliffes. They include Paul Hawkins from Hawk Eye Technologies, CEO Andrew O’Brien, and COO Matt Fleming.

Poolhouse’s first location will be in London, by the Liverpool Street station

The memo says this is the UK’s “busiest train hub.”

The deck described risks to Poolhouse’s business

Sharp Alpha redacted these details in the version of the deal memo sent to BI.

It also lays out Poolhouse’s revenue streams

The slide reads:

Revenue Streams

Poolhouse-operated venues will serve as a showroom for higher-margin, capex-light revenue streams

- Owned & operated venues (US/UK)

- Franchise locations (rest of the world)

- Tech Licensing (hotels, casinos, pool halls)

It describes the margin profile for Poolhouse’s locations

The flagship locations will be in London and New York, the deck says. They will serve as showrooms for franchise opportunities and white-label customers, such as pool halls or hotels.

Poolhouse plans to charge per person per hour

The details on “revenue assumptions” are redacted.

Sharp Alpha forecasts Poolhouse’s net ROI and site-level EBITDA margins

The forecasts are based on comparable companies. One graph shows net ROI for companies, including F1 Arcade, Bowlero, and Dave & Buster’s. Another shows site-level margins for earnings before interest, taxes, depreciation, and amortization for companies such as Bowlero, TopGolf, and Puttshack.

This slide outlines the financial model

Those metrics include table utilization, food and beverage cost of goods sold, licensing revenue, and capital expenditures per location.

It reads:

The most important metrics in the financial model are:

- Table utilization

- F&B COGS

- Licensing revenue

- Capex per location

We rebuilt the company’s model from scratch, arriving at 7-year estimates summarized on this page. Our diligence process suggested the company may have been a bit aggressive on its utilization projections but too conservative on the EBITDA contributions of the white-label revenue stream.

We specifically sensitize Year 7 EBIDTA below on two key dependencies, F&B gross margin and utilization rate, compared to our base case projections.

The charts in the slide are redacted.

This slide summarizes the memo’s key takeaways

The slide reads:

- Problem: The game of pool is desperate for reimagination at a time when demand for activity-based food & beverage experiences is surging.

- Solution: A cathedral to tech-enabled pool where gamified billiards tables serve as centerpieces for high-end competitive socialization paired with refined food & beverage.

- Traction: Construction is underway at Liverpool Street; multiple U.S. sites are under contract. These locations establish a foundation for a scalable, higher-margin revenue mix through technology licensing and franchising.

- Market size: The out-of-home entertainment market alone exceeds $100 billion within the $2.6 trillion global entertainment and media sector. The events market, including corporate events and weddings, is valued at over $160 billion, while the US full-service restaurant market surpasses $400 billion.

- Investment opportunity: We are leading the company’s $34M seed round alongside the Daily Mail Group, David Blitzer, and Simon Sports ahead of the London launch in Q1 2026, followed by U.S. openings, international franchising, and white-label tech deployments.

- Team: Led by Steve and Dave Jolliffe (TopGolf, Puttshack) and Paul Hawkins (Hawk-Eye), supported by nine senior executives from F1 Arcade, Swingers, TopGolf, Flight Club, and Puttshack.

The memo closes with the Poolhouse logo

It also includes a legal disclaimer