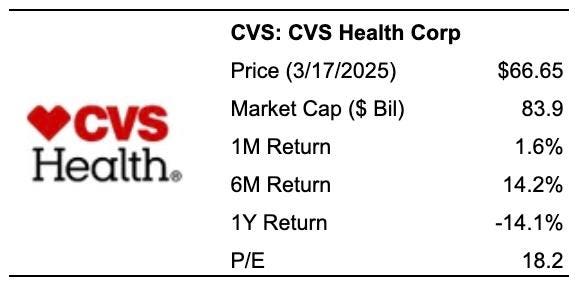

CVS Health stock (NYSE: CVS) has become one of the top performers this year, increasing nearly 50% while the broader S&P500 index has declined by 4%. Investors are optimistic that the company can overcome its difficulties following last year’s 40% drop in its stock price, which was mainly due to rising medical costs affecting profitability.

Several factors have boosted renewed investor confidence, including the company’s strategic focus on improving operational efficiency and reducing costs. In addition, recent changes in the executive team have been welcomed by investors. The firm appointed Steve Nelson, former CEO of the UnitedHealthcare division at UnitedHealth Group, as the new head of Aetna. Furthermore, David Joyner succeeded Karen Lynch as CVS’s new Chief Executive Officer in October last year. Market sentiment also indicates that the Trump administration might introduce more favorable pricing models for insurance companies that cover senior citizens under private plans, which could benefit companies like CVS.

Despite these encouraging developments, potential downside risks should be considered. How would you respond if CVS stock dropped by 40% or more in the coming months? Although this scenario might appear unlikely, past trends suggest it is within the realm of possibility. At present, broader markets are undergoing a selloff amid rising recession concerns in the U.S., partly due to President Donald Trump’s tariffs on key trading partners.

A key point is that during economic downturns, CVS stock could suffer significant declines in valuation. Data from 2020 shows that the stock lost over 25% of its value in just a few quarters, and the effect was even more dramatic during the 2008 recession when CVS lost 45% of its value. With CVS stock having already risen about 50% this year to $65, investors should consider whether adverse market conditions might reverse this trend. If similar economic pressures occur, the stock could potentially fall below $40. However, for those investors looking for lower volatility than what individual stocks offer, the Trefis High-Quality portfolio provides an alternative – having outperformed the S&P 500 and delivered returns of over 91% since its launch.

Why Is It Relevant Now?

Although CVS shows promising potential through its initiatives to improve profitability, investors must also weigh broader economic risks. As a major provider of health insurance, CVS Health is vulnerable to rising costs for medicines and medical supplies, which directly increase healthcare expenses and add pressure to its insurance operations.

Even though inflation worries have eased somewhat, they still remain an important factor. President Trump’s firm policies on tariffs and immigration have renewed concerns about possible inflationary pressures. This uncertainty, along with the U.S. economy’s susceptibility to contraction, increases the likelihood of a recession.

The global geopolitical climate has grown increasingly unstable, marked by the ongoing Ukraine-Russia conflict, heightened trade tensions, and worsening relations with traditional allies such as Canada, Mexico, and various European nations. These external factors add considerable risks to the market environment. See our analysis here on the macro picture. In light of these complex dynamics, investors should closely monitor macroeconomic indicators when assessing their positions in CVS or other similar healthcare investments.

How Resilient Is CVS Stock During A Downturn?

CVS stock has performed slightly better than the S&P 500 index during some recent downturns. Concerned about the effect of a market crash on CVS stock? Our dashboard How Low Can Stocks Go During A Market Crash shows how major stocks fared during and after the last six market crashes.

Inflation Shock (2022)

• CVS stock fell 20.7% from a high of $110.83 on 8 February 2022 to $87.84 on 12 October 2022, compared to a peak-to-trough decline of 25.4% for the S&P 500

• The stock is yet to recover to its pre-Crisis high

• The highest level reached since then was $103.79 on 12 December 2022, and it currently trades around $66

COVID-19 Pandemic (2020)

• CVS stock fell 27.3% from a high of $71.94 on 20 February 2020 to $52.30 on 16 March 2020, compared to a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 16 November 2020

Global Financial Crisis (2008)

• CVS stock fell 45.6% from a high of $44.12 on 5 June 2008 to $23.98 on 9 March 2009, compared to a peak-to-trough decline of 56.8% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 16 February 2012

Protecting Wealth

CVS Health’s Revenues have grown robustly, with an average annual increase of 8.5% over the past three years, outpacing the S&P 500’s 6.3% growth during the same period. However, this growth is also reflected in the company’s valuation, as CVS stock now trades at roughly 12x trailing earnings—a slight premium relative to its five-year average P/E ratio of 10x.

The company’s medical cost ratio has notably risen from 83.8% in 2022 to 92.5% in 2024, marking a significant decline in this key profitability metric. Given current industry trends and company-specific factors, a near-term return to the more favorable 2022 levels seems unlikely.

Considering the potential for slower growth and broader economic uncertainties, ask yourself this question: Will you hold your CVS stock, or will you panic and sell if it starts to fall to $50 or even lower? Holding on to a declining stock is never easy. Trefis partners with Empirical Asset Management—a Boston area wealth manager—whose asset allocation strategies delivered positive returns during the 2008-09 period when the S&P lost more than 40%. Empirical has incorporated the Trefis HQ Portfolio in this asset allocation framework to provide clients with better returns and reduced risk compared to the benchmark index, offering a less volatile experience as shown in the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here