As the world transitions to renewable energy, First Solar (NASDAQ: FSLR) is emerging as a leader in the solar industry thanks to its robust balance sheet and profitable operations. Its thin-film solar panels, engineered for maximum energy output, have become the preferred option for utility-scale solar projects. In fact, the company is undergoing a major expansion, particularly in the U.S., driven by government subsidies. With strategic investments in capacity expansion and a solid contract pipeline secured through 2030, First Solar is well-positioned to capitalize on the growing demand for solar energy solutions.

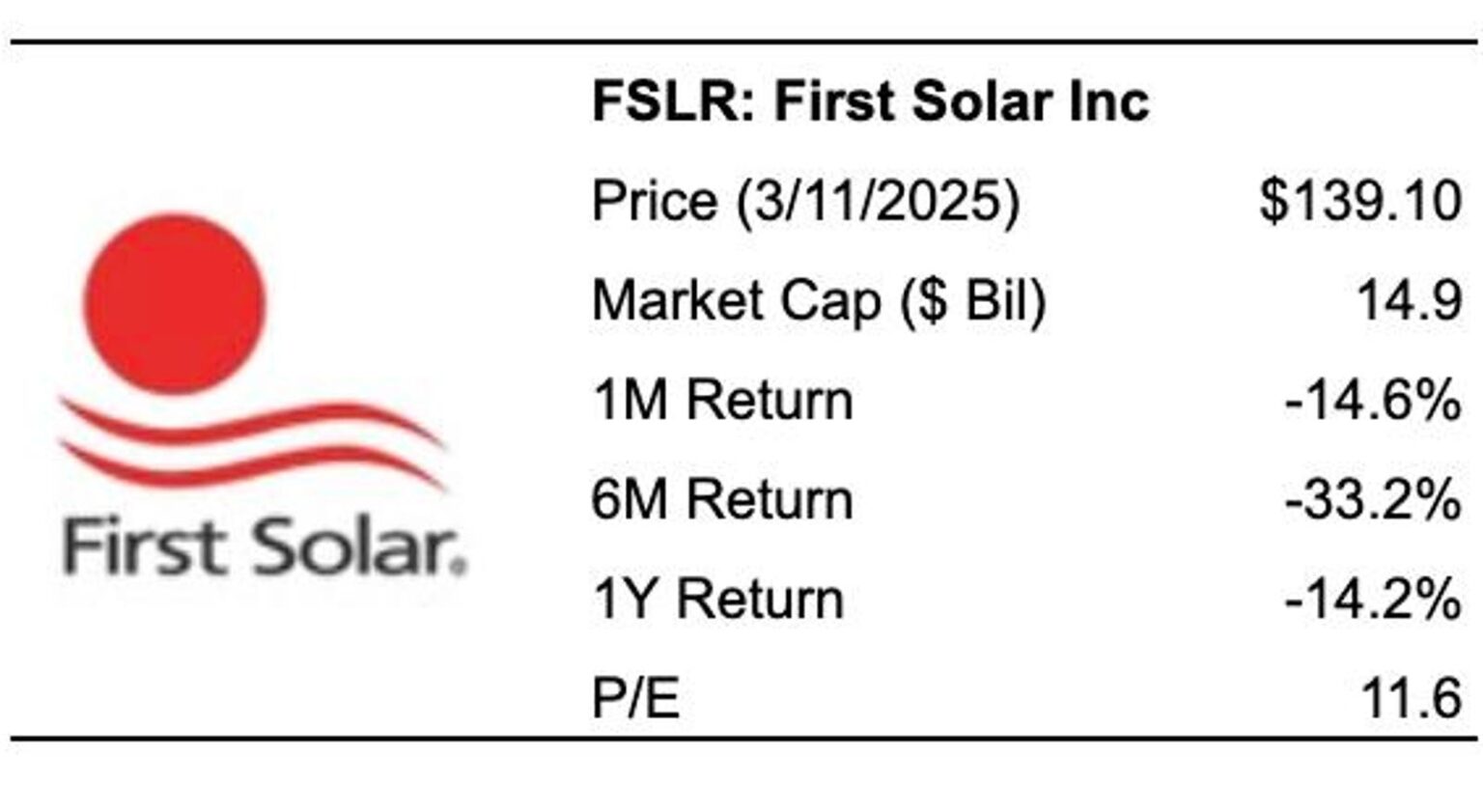

There’s more to consider — With a market capitalization of $15 billion, First Solar has lost 21% of its value year-to-date. Investors should be aware of the company’s vulnerability to economic downturns, as seen during the 2022 Inflation Shock crisis when its stock fell by approximately 25% over a few quarters. This historical precedent raises concerns that First Solar’s current share price of $135 could potentially decline to around $100 if similar market conditions occur again. However, for investors seeking lower volatility than individual stocks, the Trefis High-Quality portfolio offers an alternative, having outperformed the S&P 500 and delivered returns exceeding 91% since its inception.

Why Is It Relevant Now?

With its groundbreaking cadmium telluride technology and strategic presence, First Solar has secured its position as a dominant player in the solar market; however, the prevailing economic uncertainties in the U.S. pose a significant risk that investors should consider. What is that risk?

Regulatory dependencies present a challenge, as any changes in supportive policies such as the Inflation Reduction Act are likely to affect its future profitability. First Solar has provided guidance for FY 2025 operating income between $1.95 billion and $2.30 billion, including anticipated benefits from the IRA. Notably, production credits are expected to contribute between $1.65 billion and $1.7 billion to this forecast. This underscores the significant role that government subsidies play in First Solar’s financial success, a factor that investors might overlook.

Clean energy stocks are navigating a complex landscape characterized by inflation concerns, further exacerbated by the Trump administration’s tariff and tax policies. Additionally, rising interest rates may increase market pressures, potentially reducing demand for solar products. As detailed in our macroeconomic analysis, these factors could potentially push the U.S. economy into turbulence or even a recession.

Economic challenges are further compounded by heightened geopolitical tensions, driven by the Trump administration’s assertive foreign policy. Ongoing conflicts, such as the Ukraine-Russia situation, and increasingly uncertain trade relationships—including renegotiations with traditional allies like Canada and Mexico—create a complex and risky environment for investors.

How resilient is FSLR stock during a downturn?

While investors are hopeful for a soft landing of the U.S. economy, how severe could the impact be if another recession occurs? Our dashboard How Low Can Stocks Go During A Market Crash illustrates how key stocks performed during and after the last six market crashes.

Inflation Shock (2022)

• FSLR stock declined by 24.1% from a high of $84.68 on 7 January 2022 to $64.24 on 13 May 2022, compared to a peak-to-trough drop of 25.4% for the S&P 500

• The stock fully recovered to its pre-crisis peak by 29 July 2022

• Since then, the stock has risen to a high of $300.71 on 12 June 2024 and is currently trading at approximately $133

COVID Pandemic (2020)

• FSLR stock dropped by 49.1% from a high of $59.32 on 20 February 2020 to $30.20 on 18 March 2020, compared to a peak-to-trough decrease of 33.9% for the S&P 500

• The stock fully recovered to its pre-crisis peak by 14 July 2020

Protecting Wealth

First Solar’s valuation appears attractive at the moment, trading at approximately 11x last year’s earnings, which is a discount to its four-year historical average of 19x earnings. However, this valuation multiple could quickly become less appealing if the IRA incentives are repealed. The company’s revenue surged by 27% year-over-year last year, yet its overall bookings dropped by 13%, a metric also known as expected module volume sold.

Given this growth deceleration and the broader economic uncertainties, ask yourself the question: Do you want to hold on to your First Solar stock now, or will you panic and sell if it begins to drop to $110, $100, or even lower levels? Holding on to a falling stock is never easy. Trefis collaborates with Empirical Asset Management—a Boston-area wealth manager—whose asset allocation strategies yielded positive returns during the 2008-09 period when the S&P lost more than 40%. Empirical has incorporated the Trefis HQ Portfolio in this asset allocation framework to provide clients better returns with less riskcompared to the benchmark index; it offers a less volatile experience, as demonstrated in the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here