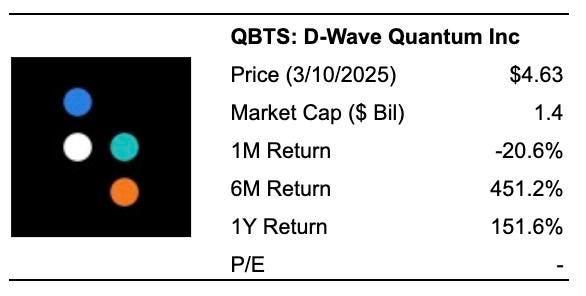

D-Wave Quantum (NYSE:QBTS), a quantum computing company, is set to report its earnings on Thursday, March 13, 2025. The consensus forecast is for a loss of six cents per share on sales of $2.23 million, reflecting a 23% decline in sales and loss narrowing by three cents per share, compared to the prior-year quarter. D-Wave generates revenue primarily through its Quantum Computing as a Service (QCaaS) offerings.

While quantum computing shows significant promise, it remains in a developmental stage and is not yet ready for widespread practical implementation across industries.

The company has $1.0 Bil in current market capitalization. Revenue over the last twelve months was $9.4 Mil, and it was operationally loss-making with $-74 Mil in operating losses and net income of $-74 Mil. While the post-earnings stock reaction will depend on how the results and outlook stack up against investor expectations, a detailed look at historical results can aid you if you are an event-driven trader. Here is how: either understand the historical odds and position yourself prior to the earnings announcement, or look at the correlation between immediate and medium-term returns post earnings and enter a trade one day after the announcement.

However, if you seek upside with less volatility than a single stock, consider the High-Quality portfolio, which has outperformed the S&P 500 and achieved returns greater than 91% since inception.

See earnings reaction history of all stocks

D-Wave Quantum’s Historical Odds Of Positive Post-Earnings Return

Some observations on one-day (1D) post-earnings returns:

- There are 8 earnings data points recorded over the last three years, with 2 positive and 6 negative one-day (1D) returns observed. In summary, positive 1D returns were seen about 25% of the time.

- The percentage remains the same at 25% if we consider data for the last 3 years instead of 5.

- Median of the 2 positive returns = 2.9%, and median of the 6 negative returns =-2.1%

Additional data for observed 5-Day (5D), and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

Correlation Between 1D, 5D, and 21D Historical Returns

A relatively less risky strategy (though not useful if the correlation is low) is to understand the correlation between short-term and medium-term returns post earnings, find a pair that has the highest correlation, and execute the appropriate trade. For example, if 1D and 5D show the highest correlation, a trader can position themselves “long” for the next 5 days if 1D post-earnings return is positive. Here is some correlation data based on 3-year (more recent) history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and subsequent 5D returns.

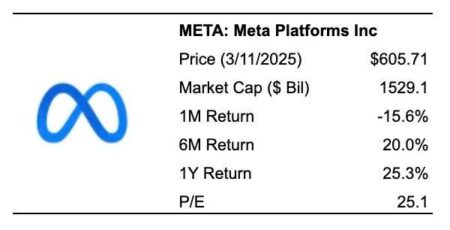

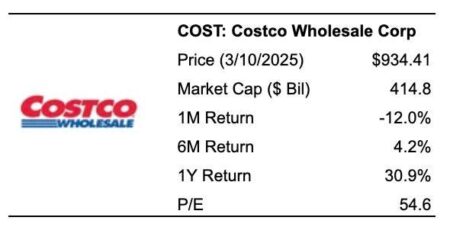

Is There Any Correlation With Peer Earnings?

Sometimes, peer performance can have influence on post-earnings stock reaction. In fact, the pricing-in might begin before the earnings are announced. Here is some historical data on the past post-earnings performance of D-Wave Quantum stock compared with the stock performance of peers that reported earnings just before D-Wave Quantum. For fair comparison, peer stock returns also represent post-earnings one-day (1D) returns.

Learn more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), to produce strong returns for investors. Separately, if you want upside with a smoother ride than an individual stock like D-Wave Quantum, consider the High Quality portfolio, which has outperformed the S&P, and clocked >91% returns since inception.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here