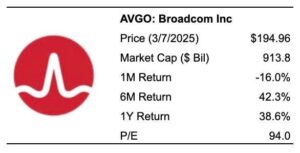

Amid ongoing tariff conflicts and the bold initiatives of the new Trump administration, Tesla stock experienced a significant decline recently, dropping more than -31.6% in under 30 days as of 2/28/2025. Is this dip a buying opportunity? Buying the dip can be a viable strategy for quality stocks when overall market conditions are favorable, especially if the stock has a history of rebounding from such downturns. In fact, Tesla not only meets basic fundamental quality checks but has historically returned an average of 131% in one year and achieved a peak return of 183% following similar dips.

Current Dip Opportunity

It has been under one month since TSLA last experienced a significant dip event – defined as a drop of over 30% within 30 days – and since then, it has returned -10.1%.

The table below compares period-wise returns from the current dip event with historical medians. In this instance, only past median returns are available because the current dip event occurred very recently.

Historical Data on Recovery from Dips

Since 1/1/2010, TSLA has experienced 10 events where the dip threshold of -30% within 30 days was triggered.

- A median peak return of 83% was achieved within 1 year of the dip event

- The median time to reach peak return after a dip event is 228 days

- The median maximum drawdown within 1 year of a dip event is -7.5%

Tesla Passes Basic Financial Quality Checks

To reduce the risk that a dip signals a deteriorating business situation, factors such as revenue growth, profitability, cash flow, and balance sheet strength must be considered. Tesla easily meets these criteria.

Although dip buying is appealing, it must be evaluated carefully from multiple perspectives. This multi-factor analysis is exactly how we construct Trefis portfolio strategies. If you seek upside with a smoother ride than that of an individual stock, consider the High Quality portfolio, which has outperformed the S&P and achieved returns of over 91% since its inception.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here