Artificial intelligence has been dominating investment discussions, with some claiming it will revolutionize industries and others warning of a speculative bubble. As a disciplined, long-term investor, I take a measured approach—assessing AI’s impact on businesses while ensuring I don’t overpay for future potential.

While AI is transforming certain industries, I evaluate its impact on individual companies with the same rigorous analysis I apply to any investment. Rather than chasing the latest AI-driven rally, I focus on how companies integrate AI into their operations to enhance productivity, expand margins or improve competitive positioning. Some companies, like Cisco Systems (CSCO), a stock I have long liked, are proving to be clear beneficiaries of AI, not just in theory but in tangible operational benefits.

Cisco: A Case Study In AI-Driven Growth

Cisco describes itself as “the worldwide technology leader that is revolutionizing the way organizations connect and protect in the AI era. For more than 40 years, Cisco has securely connected the world. With its industry leading AI-powered solutions and services, Cisco enables its customers, partners and communities to unlock innovation, enhance productivity and strengthen digital resilience. With purpose at its core, Cisco remains committed to creating a more connected and inclusive future for all.”

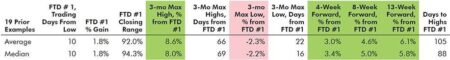

These days, many companies sprinkle the term AI into their press releases to endeavor to excite market players, but Cisco actually is driving profits to the bottom line. The company recently reported a strong fiscal Q2, with earnings of $0.94 per share exceeding consensus estimates and revenue of $14.0 billion coming in ahead of expectations.

More importantly, the company is making significant AI-driven advancements. Excluding the Splunk acquisition, revenue grew 11% year-over-year, fueled by increasing demand from telecom customers and webscalers preparing for the rise of AI connectivity. Cisco’s CEO Chuck Robbins highlighted the company’s three AI pillars: training infrastructure, enterprise cloud inference and AI-powered networking.

With its strong financial position, a $15 billion share buyback authorization and a dividend yield of 2.5%, CSCO continues to offer both AI exposure and solid fundamentals at a reasonable valuation. The stock changes hands today at less than 18 times trailing-12-month earnings and less than 17 times the forward earnings estimate, both figures well below those of many of the Wall Street AI darlings, not to mention the market as a whole.

Stock Selection And Valuation Discipline

I remain cautious of businesses touting AI advancements without clear profitability benefits. The key is distinguishing between firms truly leveraging AI for tangible financial gains and those simply riding the hype. A company with robust fundamentals like strong cash flows and AI-driven efficiency advantages may offer attractive long-term value. On the other hand, I am hesitant to chase lofty valuations for any company, much less one trading on long-in-the-future AI-related promises.

AI’s rapid evolution brings both opportunities and risks. Regulatory challenges, job market disruptions and speculative excesses could introduce volatility, making portfolio diversification essential. I seek exposure to AI beneficiaries across various sectors—including infrastructure, cloud computing and industrial automation—rather than concentrating risk in the most obvious AI players.

For investors looking for more ways to intelligently invest in AI, check out my latest Special Report.

Investment Insight: Decoding AI and Generating Investment Ideas

A Long-Term Perspective

History shows that technological advancements often spark initial exuberance before settling into long-term economic drivers. I remain committed to my disciplined approach, ensuring my portfolio benefits from AI’s potential without falling victim to speculative excess. Patience, valuation discipline and a long-term mindset remain my best tools for navigating new investment landscapes.

Whether AI is a transformative force or another chapter in the tech cycle, I will continue to focus on buying companies for less than their perceived worth—just as we have done at The Prudent Speculator for over 47 years.

Disclosure: Please note that shares of the stocks mentioned are owned by asset management clients of Kovitz Investment Group Partners, LLC, a SEC registered investment adviser. For a list of stock recommendations like these made in The Prudent Speculator, visit theprudentspeculator.com.

Read the full article here