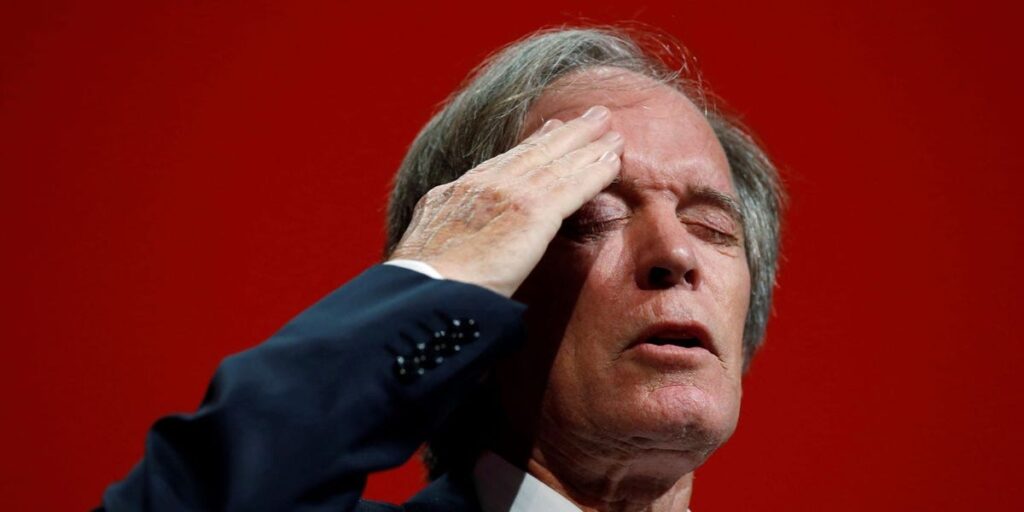

- Bill Gross says he’s frightened every morning to find out what’s happening in markets and the world.

- The “Bond King” told BI he’s worried Trump’s tariffs will fuel inflation and choke growth.

- The billionaire investor recommended four defensive stocks including Altria and AT&T.

Bill Gross says there’s so much bad news right now that he’s scared to wake up each day and find out what happens in financial markets and the world.

“Frankly I am frightened every morning to wake up at 5:30 PST and see what the day brings — markets and otherwise,” Gross wrote in a X post on Monday. “Be defensive.”

The billionaire investor is known as the “Bond King” because he cofounded fixed-income titan PIMCO and grew its flagship Total Return Fund to $270 billion over the course of nearly three decades.

Gross told Business Insider he’s concerned about the US economy slowing as “destructive” tariffs fuel inflation, and Ukraine’s war with Russia threatens to divide Western nations.

“As an investor these factors scare me at 5:30 and throughout the day,” Gross said in an email. “They present downside risks for high p/e stocks especially,” he added, referring to the price-to-earnings ratio, a popular valuation metric.

Economists have pared their US growth forecasts in recent days, citing a combination of President Donald Trump’s new tariffs on imports from countries including Canada, Mexico, and China, and his administration’s efforts to cut government spending, which are being led by Tesla CEO Elon Musk.

The Atlanta Fed’s GDPNow model forecasts an annualized 2.8% contraction this quarter — a dramatic swing from last week when it estimated 2.3% growth.

Defensive stocks

Headline inflation has climbed from 2.4% in September to 3% in January, significantly higher than the Federal Reserve’s 2% target. Economists have warned that businesses will offset the impact of tariffs by raising their prices, fueling more inflation.

Gross told BI that investors should bet on defensive stocks to ride out the economic storm. The octogenarian recommended tobacco stocks, specifically Philip Morris owner Altria and British American Tobacco, which owns cigarette brands Lucky Strike and Camel. He also gave the thumbs up to AT&T and Verizon, two of the largest US telecom companies.

Tobacco and telecom stocks are seen as defensive picks because they offer little growth but sell sticky products that customers are likely to keep buying even in a recession, trade at relatively modest valuations, and pay large dividends, providing support for their stock prices.

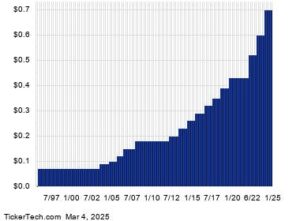

Altria stock has jumped 43% over the past year and offers a 7.1% dividend yield. BAT has gained 35% over the same period and has a 7.4% yield. AT&T is up 61% and has a 4% yield, while Verizon has climbed 10% and has a 6.2% yield.

Read the full article here