- Supermicro filed annual financial reports late after an accounting dispute with ex-auditor EY.

- EY dropped Supermicro as a client after raising concerns about its internal financial governance.

- Supermicro said that after it replaced EY with another accounting firm, no issues were found.

Supermicro, the AI server manufacturer and Nvidia partner, has met the deadline for a late filing of its annual financial reports, and is blaming its former auditor EY for the delay.

The tech company, which does business as Supermicro, filed its overdue 10-K annual filing for fiscal 2024 and the first two quarterly reports for fiscal 2025 on Tuesday with the Securities and Exchange Commission.

The filings came months late, putting Supermicro at risk of being delisted from the Nasdaq 100 for failing to meet compliance requirements. The company was granted an extension by Nasdaq in December.

“The Company is now current with its SEC financial reporting obligations,” Supermicro said in a press release.

In an explanatory note included in the filing, Supermicro blamed its previous auditor, EY, for the delay, saying that the reports were late “due to EY’s stated concerns and subsequent resignation.”

According to the filing, the Big Four firm dropped Supermicro as a client in October 2024 after raising concerns to the board in July about the governance and transparency of the company’s financial reporting and the integrity of its senior management.

In August 2024, Hindenburg Research, a now-defunct US short-seller, said it found “glaring accounting red flags” in Supermicro’s financial practices. Hindenburg’s report cited “evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

“We disagreed with EY’s decision to resign as our independent registered public accounting firm for a number of reasons,” Supermicro said in the filing.

Its reasons included that a number of audit procedures were left incomplete when EY stepped down and that a special committee set up to investigate concerns was still conducting its review.

The server manufacturer also addressed the Hindenburg report in the filing. Supermicro denied any wrongdoing and said that the report “contained false or inaccurate statements about us, including misleading presentations of information we previously shared publicly.”

Supermicro, which has a market capitalization of just over $30 billion, appointed BDO, a Belgian-headquartered firm, as its new accountant in November.

BDO found that the financial statements “present fairly, in all material respects, the financial position of the Company,” according to the filings.

The special committee’s review “did not give rise to any substantial concerns about the integrity of our senior management or the Audit Committee, or their commitment to ensuring that our financial statements are materially accurate,” Supermicro said in the SEC filing.

EY declined to comment.

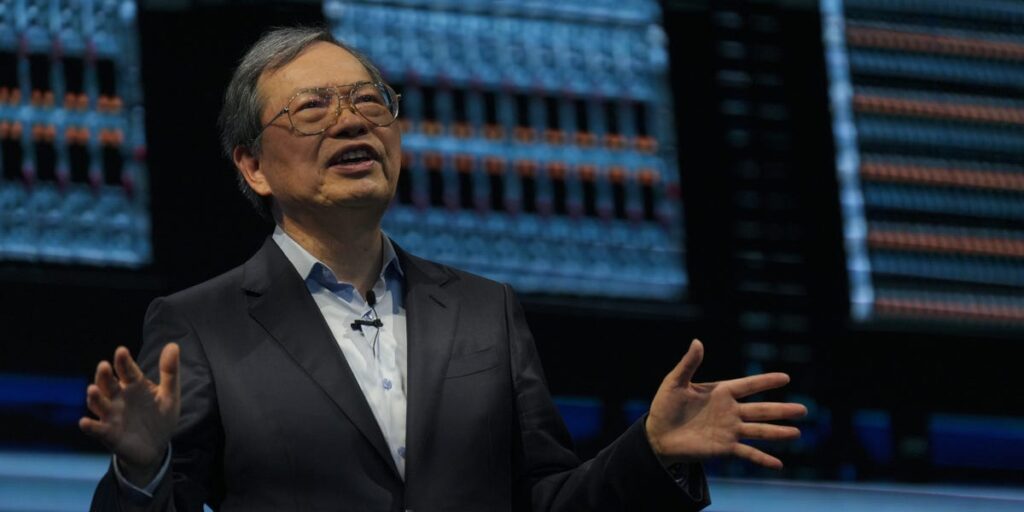

Charles Liang, founder, president, and CEO of Supermicro, called Tuesday’s filings “an important milestone” for the company.

Supermicro’s stock soared by more than 12% on Wednesday after it made the filing and regained compliance with Nasdaq’s listing requirements.

Supermicro was an early launch partner for Nvidia, AMD, and Intel for CPUs and GPU accelerators and has since ridden the wave of AI hype to success.

The server manufacturer has seen its share price explode over recent years, climbing more than 1,000% since the start of 2022.

Supermicro’s shares are up 67% to date this year. The filings show that sales more than doubled from $7.12 billion to $14.9 billion in 2024.

Read the full article here