Equity markets took a hit this week with much of the damage coming on Friday (February 21) with losses accelerating into the close. It appears that traders have suddenly realized that the economy has been slowing, including a sharp fall in consumer confidence (a nearly 5 percent decline) from the University of Michigan’s monthly survey,1 falling Retail Sales,2 a decline in new and existing home sales,4 and an inflation outlook that has unexpectedly turned up.1

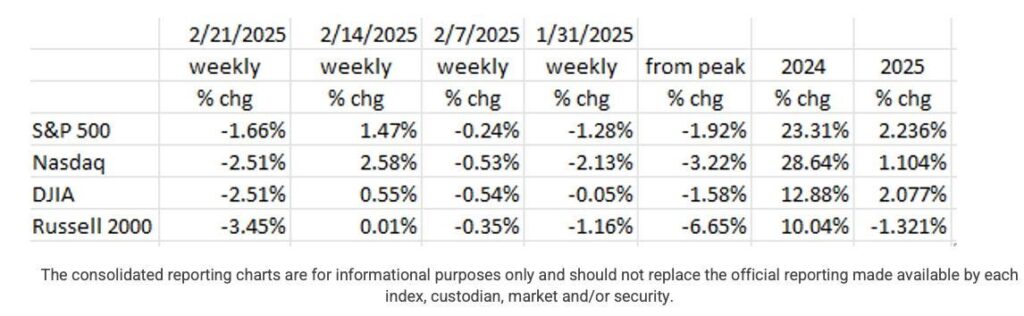

As seen in the table below, equity markets have now fallen in three of the last four weeks. While all but the Russell 2000 remain easily within striking distance of their recent peaks, the market’s mood looks to have shifted, especially after several recent economic reports disappointed.

The Magnificent 7 fared no better this past week with six of the seven giving ground (and five of those six giving significant ground). Only Apple ended the week higher. Year to date, only Meta is up significantly (and it gave back more than -7% this week). The big loser for the year among these seven is Tesla.

Slowing Economy

The economy is in deceleration mode, and it isn’t a new phenomenon, just one that has recently been recognized. In Q4, GDP only grew at a +2.3% annual rate.8 That compares unfavorably to +3.1% in last year’s Q3, and +3.0% in Q2.

Retail sales, always a reliable indicator, fell nearly -1% (-0.9%) in January.2 Some blame this on the weather. But online sales, which always go up during periods of bad weather, fell -1.9% in January, its worst showing since July 2021.2 It appears that post-hurricane rebuild and repair spending has passed. In addition, seasonally adjusted spending on furniture, appliances and autos is falling and apparel (clothing) sales, another reliable sign of consumer confidence, fell -1.2% in January from December levels.2 There was no saving grace in the retail sales report as shown below:

Total Retail Sales : ………………….…. -0.9% M/M January

- Ex-auto : ……………………. -0.4%

- Ex-auto, gasoline: ……….. -0.4%

- Ex-auto, gas, bldg. materials: -0.8% (consensus was +0.3%)

In addition, a recent report by the National Federation of Independent Businesses (NFIB) indicated that small businesses are seeing slower sales. Add to this the recent Walmart projection of slowing sales growth in the upcoming year (only 3%-4%). And now we have significant layoffs of Federal workers which will negatively impact the upcoming employment reports.

Inflation

As we’ve written in past blogs, the CPI is hamstrung by having a large weight (35%) in rents. The data used by BLS for those rents is lagged by nearly a year. Currently, vacancy rates are rising and the number of new apartment units coming on to the market is at a 40-year high. The recent run-up in rental rates looks to be in the rear-view mirror. And suddenly, with credit card debt outstanding having risen to record levels, the rising delinquency rates (and even in the mortgage arena) is finally getting some attention. As a result, we wouldn’t be surprised to see a bit of deflation by Q3.

And worse, Consumer Confidence has started to wane.

Employment

Recently, The Bureau of Labor Statistics released its Quarterly Census of Employment and Wages (QCEW). While the data is a bit stale, it shows a 34% discrepancy when compared to Non-Farm Payroll data (the monthly employment numbers).3 Through September of 2024, QCEW shows that the economy created 1.3 million jobs. On the other hand, the monthly Non-Farm Payroll reports through last September showed 1.98 million net new jobs. That’s a discrepancy of 680,000 jobs (an overstatement of 75,000 jobs per month)!3 So, it appears that the labor market isn’t as robust as the monthly Non-Farm Payroll data would lead one to believe.

Housing

Existing Home Sales fell -4.9% in January from December levels, but were +2.0% higher than January a year ago.4 And while the median price advanced +4.8% year/year (to $396,900), the good news is that it fell -1.7% from December levels and is now flat or down for seven months in a row!4

Sales by region (January):

- West: -7.4% (LA fires?)

- Northeast: -5.7%

- South: -6.2%

- Midwest: 0.0%

On a year/year basis, sales rose 2%, but new listings were up +17%. Not a wonder, then, as to why prices have been soft. As shown on the chart below, New Home Sales are stuck in a sideways rut, while Existing Home Sales have been sagging for the last couple of years (mainly due to high interest rates).

Industrial Production

Industrial Production has flatlined over the past couple of years, finally showing some life in January. But it remains to be seen if such a rise is permanent.6 While Industrial Production is not as important as it was 30 years ago, it still plays a significant role in economic activity.

Leading Indicators

The Conference Board’s Leading Economic Indicators (LEI) fell again in January (-0.3%) and over the six-month period (July to January) are down -0.9%.5 7 The LEI has been signaling economic slowdown for three years, and it hasn’t occurred. As a result, this index no longer has much credence among economists and forecasters. Our view is that the outsized federal budget deficits kept the economy afloat, and now that the Trump Administration and Congress have become a little more stingy, this index is likely to regain some of its former stature.

As for interest rates, markets are waiting on the Fed. So far, the Fed has indicated “higher for longer,” and until that attitude changes, interest rates will remain around their current levels. As noted above, we see a slowing economy, but until the Fed sees lower year/year inflation numbers, interest rates will stay elevated. Currently, markets don’t see a rate cut until late in the year. We think it will be sooner, but a rate cut clearly isn’t imminent.

Final Thoughts

- Financial markets, especially the equity market, appear to have caught wind that the economy is slowing. Late this past week, equities fell hard when Walmart’s retail sales forecast disappointed Wall Street (apparently 3%-4% growth isn’t good enough).

- There are several indicators of a slowing economy. The most prominent is Retail Sales which fell nearly -1% (seasonally adjusted) in January.2 In addition, recent employment data from the Bureau of Labor Statistics (QCEW) has thrown cold water on the monthly Non-Farm Payroll (NFP) reports. Turns out that NFP data overstated jobs by 680K over the first nine months of 2024!

- Housing is also weakening. New Home Sales are trending sideways, while Existing Home Sales continue at low levels.4

- Industrial Production has flatlined for two years. It finally showed some life in January. Whether it can stay at a 2% growth rate remains to be seen.

- Leading Indicators (LEI) continue to forecast a slowing economy.5 7 They’ve been doing so since mid-2022, so they have lost some credibility. Our view is that the outsized federal budget deficits kept the economy afloat. As (if?) those disappear, LEI will become prescient once again.

- Our view on interest rates is that they are too high, slowing housing and private sector businesses. But, until the year/year inflation numbers come down, interest rates will stay elevated – and that’s according to several Fed governors.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here