Intel stock performed well over the last two days, climbing approximately 12% across Monday and Tuesday. Several factors have contributed to Intel’s recent surge.

Increased AI Chip Manufacturing in the U.S.

Intel has made significant investments in its U.S.-based foundry operations over recent years. Although this unit has struggled—posting a loss of nearly $13 billion last year—there are signs of improvement. U.S. Vice President J.D. Vance recently mentioned at a conference that the Trump Administration aims to have AI chip design and production take place domestically to protect American AI technology and intellectual property. This could lead to regulatory measures promoting domestic semiconductor manufacturing. For instance, tariffs could be introduced to raise costs for foreign chipmakers exporting to the U.S. A shift toward domestic production through tariffs or other policies could benefit Intel’s foundry business as companies seek U.S.-based suppliers to avoid extra costs. See how Trump and New Manufacturing Processes Help Intel Stock.

Major customers like Microsoft and Amazon have already contracted Intel to manufacture some of their custom AI chips, and this trend may accelerate. Unlike Intel, its key rivals, AMD and Nvidia, do not operate their own fabrication facilities and rely on overseas foundries such as Taiwan’s TSMC. As Intel advances its fabrication technology, including its 18A process, competitors may also consider shifting some of their production to Intel. If you’re looking for growth with reduced volatility compared to individual stocks, consider the High Quality Portfolio, which has significantly outperformed the S&P 500.

Positive Reception for Intel’s New Processors

Additionally, Intel’s latest processor, the Intel Core Ultra 9 275HX, has received favorable reviews. Benchmark results from PassMark indicate that the new Arrow Lake-based chip outperforms AMD’s Ryzen 9 processor by approximately 7% in CPU tests. It is also 34% faster than the prior-generation i9-14900HX, with single-thread performance improving by 9%. Unlike Intel’s AI-centric Lunar Lake processors, these chips focus on delivering high performance for demanding creative and productivity workloads.

This launch comes at an opportune moment. Over the last two years, companies have primarily focused on acquiring GPUs to support AI-driven initiatives, potentially neglecting investment in traditional CPUs. As CPU demand rebounds, Intel may stand to gain after experiencing market share declines in both consumer and server segments.

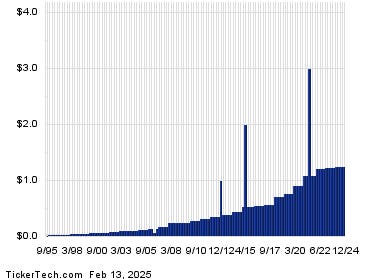

Intel’s Stock Performance

Over the past four years, INTC stock has been highly volatile compared to the S&P 500. Annual returns have varied significantly: 6% in 2021, -47% in 2022, 95% in 2023, and -60% in 2024. The Trefis High Quality Portfolio, which consists of 30 stocks, has been far less volatile and has outperformed the S&P 500 over this period.

Why is this the case? HQ Portfolio stocks, as a group, have provided better returns with lower risk, avoiding the dramatic fluctuations seen in individual stocks. This is evident in HQ Portfolio performance metrics. With an uncertain economic outlook, including potential interest rate cuts and global conflicts, will INTC continue underperforming as it did in 2021, 2022, and 2024, or could a recovery be on the horizon?

Intel stock currently trades at around $21 per share, or just over 20 times the projected 2025 earnings—an arguably reasonable valuation. Trefis estimates Intel’s fair value at approximately $27 per share, significantly above its current market price. Despite challenges over the last few years, Intel’s strategic investments in foundry operations, improved CPUs, and a potential slowdown in AI-driven GPU spending could all work in its favor. See how China’s Breakthrough AI Model DeepSeek actually benefits Intel Stock.

For a detailed breakdown, see our analysis of Intel’s valuation. Also, explore our upside scenario in How Intel Stock Can Surge 3x To $60. Conversely, examine the downside case in Intel Stock Could Dive To $10.

Invest with Trefis Market Beating Portfolios

See all Trefis Price Estimates

Read the full article here