- GBP/USD rises 0.31%, boosted by weaker USD after Trump announces 25% metal tariffs.

- Risk aversion spikes with Wall Street braced for negative open; focus on Powell’s upcoming testimony.

- BoE’s Catherine Mann supports a significant rate cut yet upholds a long-term higher rate outlook.

The British Pound (GBP) resumed its uptrend early on Tuesday morning following the latest United States (US) President Donald Trump tariff round, which included base metals like aluminum and steel. The Greenback weakened, as seen by the GBP/USD pair trading above 1.2400, gaining 0.31%.

British Pound ascends amid new US tariffs and cautious central bank rhetoric

Wall Street is set to open in the red, with traders turning risk-averse after Trump signed a proclamation to reimpose a 25% tariff on steel and aluminum imports, effective March 12. In the meantime, a slight economic docket, mainly driven by Federal Reserve (Fed) speakers, leaves traders awaiting Fed Chair Jerome Powell’s testimony at the US Congress.

In the meantime, Cleveland’s Fed President Beth Hammack commented that she favors holding rates steady for some time so the Fed can assess the economy. She added that policy is ‘modestly restrictive’ and emphasized that it is still unclear whether inflation will keep moving towards the Fed’s 2% goal.

Across the Pond, Bank of England (BoE) member Catherine Mann voted for a 50 basis points (bps) interest rate cut last week, joining Swati Dhingra. Mann was a well-known uber-hawk in the BoE.

Mann said that she still views restrictive monetary policy as necessary and sees the long-term neutral rate (R-star) at the higher end of the 3.0% – 3.5% range, given by BoE’s latest survey of investors. She added: “I choose 50 basis points now, along with continued restrictiveness in the future and a higher long-term Bank Rate to ‘cut through the noise.’”

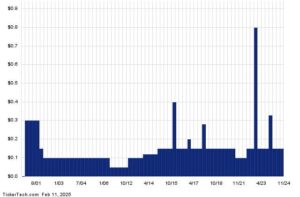

GBP/USD Price Forecast: Technical outlook

Given the fundamental backdrop, the GBP/USD pair extended its gains after printing an ‘inverted hammer’ preceded by a downtrend. Nevertheless, downward pressure will persist unless buyers clear the 50-day Simple Moving Average (SMA) at 1.2479, which could expose the latest cycle high at 1.2549, February’s 5 peak.

In that outcome, GBP/USD would extend its rally and challenge the 100-day SMA at 1.2718. Conversely, if the pair drops below 1.2400, sellers could drive the exchange rate towards the February 3 daily low of 1.2248.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.22% | -0.29% | 0.21% | 0.06% | -0.10% | -0.16% | 0.22% | |

| EUR | 0.22% | -0.09% | 0.42% | 0.28% | 0.12% | 0.06% | 0.45% | |

| GBP | 0.29% | 0.09% | 0.51% | 0.36% | 0.19% | 0.13% | 0.52% | |

| JPY | -0.21% | -0.42% | -0.51% | -0.14% | -0.31% | -0.37% | 0.02% | |

| CAD | -0.06% | -0.28% | -0.36% | 0.14% | -0.16% | -0.22% | 0.16% | |

| AUD | 0.10% | -0.12% | -0.19% | 0.31% | 0.16% | -0.07% | 0.32% | |

| NZD | 0.16% | -0.06% | -0.13% | 0.37% | 0.22% | 0.07% | 0.38% | |

| CHF | -0.22% | -0.45% | -0.52% | -0.02% | -0.16% | -0.32% | -0.38% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Read the full article here