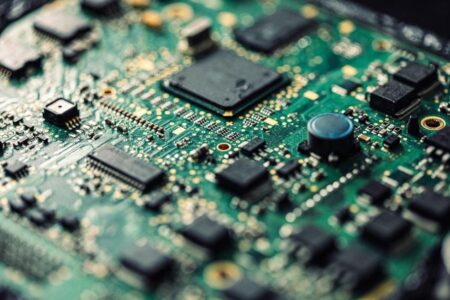

Many investors might recognize blockchain as the technology behind popular cryptocurrencies such as Bitcoin and Ethereum. But its application extends across industries and services, too.

Blockchain is essentially a string of information or “blocks” recorded on independent computers connected through a shared network. Each data block is frozen in time on an open ledger for all participants to access. This feature makes blockchain technology especially useful in industries where security is paramount, such as banking.

As a retail investor, there are multiple ways to participate in this emerging technology. But first, let’s review the basics of blockchain and how it’s the bedrock of digital investments.

What is blockchain technology?

To understand blockchain, it helps to first understand its purpose.

At its core, blockchain reduces the risk of fraud, corruption or the tarnishing of data by a central authority by democratizing access to information on an open ledger that everyone can see. This type of technology makes it nearly impossible for users to manipulate facts.

By linking verified data and making it accessible to everyone, the blockchain also simplifies and automates processes that might have previously been inefficient, such as manually recording transaction information.

For instance, Walmart (WMT) uses blockchain to ensure food safety, tracing products back to the farm. So in the case of an E. coli or salmonella outbreak, the retailer can quickly pinpoint the source, preventing contaminated food from spreading.

Large corporations such as Microsoft (MSFT), PayPal (PYPL), Starbucks (SBUX), Salesforce (CRM) and IBM (IBM) use blockchain for digital security, infrastructure and automation, among other uses.

How to invest in blockchain

Outside of crypto trading and individual stocks, investors can gain exposure to blockchain technology through exchange-traded funds (ETFs). A blockchain ETF holds a basket of publicly traded companies exposed to blockchain technology in some way or form.

It’s important to note that blockchain ETFs don’t directly hold cryptocurrency assets, though there are some funds that are pegged to futures of major cryptos like Bitcoin, Ethereum and others. Instead, these funds are designed to invest in global companies, of which many are blue-chip technology names.

Top blockchain ETFs

Since there are no pure-play blockchain companies, most of the holdings in these funds tend to overlap with other broad-based ETFs.

Below, we highlight the names with the most assets under management that are focused on the broader blockchain ecosystem. (Data as of Feb. 6, 2025.)

| ETF name | Expense ratio | Assets under management | 3-month performance |

|---|---|---|---|

| Amplify Transformational Data Sharing ETF (BLOK) | 0.76% | $932 million | 29.2% |

| Siren Nasdaq NexGen Economy ETF (BLCN) | 0.68% | $60 million | 6.3% |

| First Trust Indxx Innovative Transaction & Process ETF (LEGR) | 0.65% | $90 million | 6.0% |

| Global X Blockchain ETF (BKCH) | 0.50% | $191 million | 18.1% |

| VanEck Digital Transformation ETF (DAPP) | 0.51% | $210 million | 22.5% |

Source: etfdb.com, data as of Feb. 6, 2025

Amplify Transformational Data Sharing ETF (BLOK)

Amplify Transformational is the most prominent blockchain ETF on the market. This actively managed fund selects global companies that develop and apply blockchain technologies. It aims to invest at least 80 percent of its net assets in companies actively involved in “transformational data sharing technologies”.

- Top holdings: Robinhood Markets (HOOD), Metaplanet (MTPLF) and Galaxy Digital Holdings (GLXY)

- Expense ratio: 0.76 percent

- Assets under management: $932 million

Siren Nasdaq NexGen Economy ETF (BLCN)

Siren NextGen owns global companies that are committing resources to developing, researching and supporting blockchain technology for use by others.

- Top holdings: Accenture (ACN), Robinhood and Qualcomm (QCOM)

- Expense ratio: 0.68 percent

- Assets under management: $60 million

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

First Trust Indxx offers exposure to a global portfolio of companies that benefit from blockchain technology or the potential of increased efficiency that comes with it.

- Top holdings: JD.com (JD), Salesforce (CRM) and Industrial and Commercial Bank of China Ltd (IDCBY)

- Expense ratio: 0.65 percent

- Assets under management: $90 million

Global X Blockchain ETF (BKCH)

Global X invests in global companies participating in blockchain activities like digital asset mining and integration.

- Top holdings: Coinbase Global (COIN), MARA Holdings (MARA) and Core Scientific (CORZ)

- Expense ratio: 0.50 percent

- Assets under management: $191 million

VanEck Digital Transformation ETF (DAPP)

VanEck Digital invests 80 percent of its total assets in securities of digital transformation companies and seeks to track the Global Digital Assets Equity Index.

- Top holdings: Coinbase Global, Strategy (MSTR) and Block (XYZ)

- Expense ratio: 0.51 percent

- Assets under management: $210 million

Cryptocurrency vs. Blockchain ETFs: How these investments differ

For those interested in digital currencies, Bitcoin and Ethereum ETFs offer the key way to invest through a traditional exchange, so you don’t have a lot of options there yet. And you do also have other ways to own cryptos directly or through futures contracts.

If you want to trade digital currencies such as Bitcoin, you can access specialized crypto exchanges such as Coinbase or Binance.

Alternatively, some of the best traditional brokers to buy and sell crypto include Charles Schwab and Interactive Brokers, which offer Bitcoin futures contracts, too.

Risks associated with emerging technologies

Similar to other thematic investments such as electric vehicles or artificial intelligence, blockchain ETFs tend to come with additional sources of volatility. These risks can be market-related, such as pricing valuations or sudden changes in investors’ sentiment. Or they can be macro risks, such as a constantly evolving regulatory landscape.

Consider Bitcoin, which uses blockchain technology to store every transaction ever made. The digital currency has been in existence since 2009, but the popular crypto is not without its share of skepticism from some authorities and investors. That uncertainty translates into greater volatility.

For sophisticated and retail investors alike, assessing the value of Bitcoin and other cryptocurrencies such as Ethereum, XRP and Cardano remains a challenge. Most traders appear unsure of what these cryptocurrencies might be worth now or in the future.

Nevertheless, it seems the trend in cryptocurrency trading is not going anywhere. If anything, it appears to have gained steam in recent years — and so has the adoption of blockchain.

— Bankrate’s Logan Jacoby contributed to an update of this article.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Read the full article here