- 25% tariffs on goods imported from Canada will take Tuesday.

- The US reached a deal with Mexico to delay similar tariffs for one month.

- The automotive industry could be especially affected by import taxes.

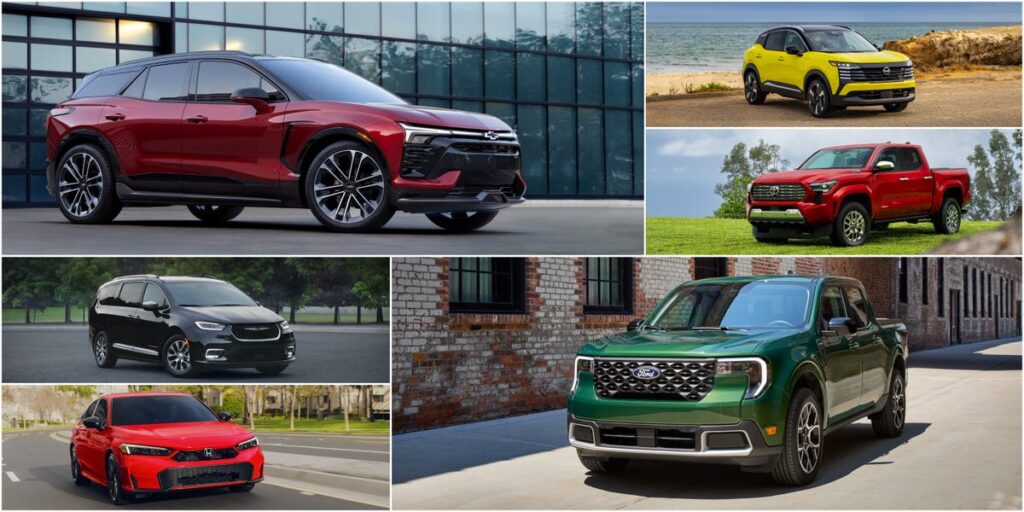

Tariffs on imports from Canada and Mexico would have broad implications for the auto industry, which relies on a complex supply chain that crisscrosses North America, potentially impacting some of the most popular models for sale in the United States.

Potential price increases as auto manufacturers pass along added costs could come at a rough time for consumers, who have seen the average cost of a new car skyrocket more than $10,000 since 2019 to more than $48,000.

Foreign and domestic carmakers like Ford, GM, and Nissan have invested decades of time and billions of dollars to establish a well-oiled, cross-border manufacturing and supply chain operations to make vehicles destined for US dealerships. Many automakers, meanwhile, are already planning layoffs and plant closures amid a slowdown in EV demand.

Mexico is the largest trade partner for the US, accounting for nearly 16% of total trade over the first three quarters of 2024. The country exports more than 2.3 million cars a year to the US, according to Commerce Department data.

President Trump on Monday said an agreement had been reached with Mexico to pause the planned tariffs, which were set to begin at midnight Tuesday, for one month while the countries negotiate border security issues like migration.

It’s possible a similar deal could be reached with Canada prior to the Tuesday deadline. Automakers may have pulled forward some imports in recent months or may absorb some of the increased costs to limit the impact on consumers.

A 25% tariff would not automatically mean a matching price increase, though it would leave automakers — already struggling with shrinking profit margins — with little room to eat the cost without increasing the sticker price of their vehicles. Some indsutry watchers have estimated increases of up to $3,000.

Large retailers like Walmart and Best Buy have said in recent months that consumer prices will likely rise if businesses pass on cost increases to consumers.

Parts for cars, trucks, and SUVs sold in the US can cross the border several times during their production process, thanks to friendly conditions fueled by various regional trade agreements over the years.

Information from the National Highway Traffic Safety Administration shows that several dozen vehicles made in Canada and Mexico are currently sold in the US.

Here’s a closer look at these models, which range from pickups to luxury SUVs and EVs:

Read the full article here