Nonfarm Payrolls (NFP) in the US rose by 256,000 in December, the US Bureau of Labor Statistics (BLS) reported on Friday. This reading followed the 212,000 increase (revised from 227,000) recorded in November and surpassed the market expectation of 160,000 by a wide margin.

Other details of the report showed that the Unemployment Rate edged lower to 4.1% from 4.2%, while the Labor Force Participation remained steady at 62.5%. Finally, annual wage inflation, as measured by the change in the Average Hourly Earnings, declined to 3.9% from 4%.

Join the NFP Live Coverage here

“The change in total nonfarm payroll employment for October was revised up by 7,000, from +36,000 to +43,000, and the change for November was revised down by 15,000, from +227,000 to +212,000. With these revisions, employment in October and November combined is 8,000 lower than previously reported,” the BLS noted in its press release.

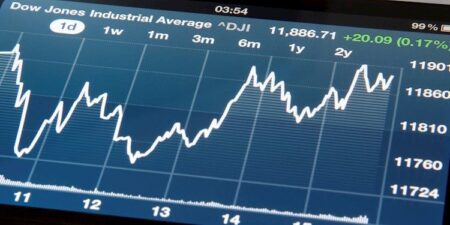

Market reaction to US Nonfarm Payrolls

The US Dollar (USD) gathered strength with the immediate reaction to the upbeat Nonfarm Payrolls data. At the time of press, the USD Index was trading at its highest level since November 2022 at 109.90, rising 0.7% on the day.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.79% | 0.93% | 0.38% | 0.31% | 0.92% | 1.00% | 0.75% | |

| EUR | -0.79% | 0.12% | -0.36% | -0.48% | 0.11% | 0.20% | -0.04% | |

| GBP | -0.93% | -0.12% | -0.48% | -0.61% | -0.02% | 0.07% | -0.22% | |

| JPY | -0.38% | 0.36% | 0.48% | -0.15% | 0.45% | 0.52% | 0.24% | |

| CAD | -0.31% | 0.48% | 0.61% | 0.15% | 0.60% | 0.69% | 0.39% | |

| AUD | -0.92% | -0.11% | 0.02% | -0.45% | -0.60% | 0.09% | -0.21% | |

| NZD | -1.00% | -0.20% | -0.07% | -0.52% | -0.69% | -0.09% | -0.30% | |

| CHF | -0.75% | 0.04% | 0.22% | -0.24% | -0.39% | 0.21% | 0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

This section below was published as a preview of the December Nonfarm Payrolls data at 05:00 GMT.

- US Nonfarm Payrolls are expected to rise by 160K in December after jumping by 227K in November.

- The United States Bureau of Labor Statistics will release the labor data on Friday at 13:30 GMT.

- US jobs data is set to rock the US Dollar after hawkish Fed Minutes published on Wednesday.

The highly anticipated United States (US) Nonfarm Payrolls (NFP) data for December will be published by the Bureau of Labor Statistics (BLS) on Friday at 13:30 GMT.

The December jobs report is critical to the US Dollar’s (USD) next directional move as it will help the markets gauge future interest rate cuts by the US Federal Reserve (Fed) amid the incoming administration of President-elect Donald Trump.

What to expect from the next Nonfarm Payrolls report?

Economists expect the Nonfarm Payrolls report to show that the US economy added 160,000 jobs in December after witnessing a stellar 227K job gain in November as distortions caused by two hurricanes and the Boeing strike faded.

The Unemployment Rate (UE) is expected to remain at 4.2% in the same period.

Meanwhile, Average Hourly Earnings (AHE), a closely-watched measure of wage inflation, are expected to rise by 4% year-over-year (YoY) in December, at the same pace as seen in November.

Investors will assess the December jobs data for fresh signs on the health of the US labor market, as they remain wary about the inflation and monetary policy outlook under Trump’s presidency. Incoming Trump’s immigration and trade policies are expected to stoke up inflation, calling for higher interest rates.

The Minutes of the Fed’s December meeting released on Wednesday showed policymakers’ concerns about inflation and the potential impact of Trump’s policies, suggesting that they will move more slowly and cautiously on interest rate cuts because of the uncertainty.

Previewing the December employment situation report, TD Securities analysts said: “We expect payroll growth to cool down closer to trend in December following the October-November gyrations that were triggered by one-off shocks.”

“The UE rate likely stabilized at 4.2% despite our expectation for a meaningful rebound in the household survey’s employment series. Separately, we look for wage growth to mean-revert to 0.1% m/m following a string of hot monthly prints,” they added.

How will US December Nonfarm Payrolls affect EUR/USD?

Speculations around Trump’s potential tariff plans continued to offset any impact from the recent US economic data releases. However, that failed to alter the market’s pricing of a no-rate change decision at the Fed meeting later this month, according to the CME Group’s FedWatch tool.

Earlier in the week, the BLS reported that the JOLTS Job Openings climbed to 8.09 million, outpacing forecasts for a 7.7 million growth and higher than October’s 7.83 million print.

The Automatic Data Processing (ADP) announced on Wednesday that employment in the US private sector grew by 122,000 jobs last month, lower than the estimated 140,000 and November’s 146,000 job gain.

The disappointing ADP jobs report ramped up expectations of a weak payrolls data on Friday. However, the US ADP data is generally not correlated with the official NFP data.

If the headline NFP figure shows a payroll growth below 100,000, the US Dollar could witness a massive selling wave in a knee-jerk reaction to the data, as it would create a dilemma for the Fed and could revive dovish Fed expectations. In such a scenario, EUR/USD could stage a solid comeback toward the 1.0450 level.

On the other hand, an upside surprise to the NFP and wage inflation data could double down on the Fed’s hawkish shift, sending the USD back to multi-year highs while knocking off the EUR/USD pair to the lowest level in over two years to below 1.0250.

Dhwani Mehta, Asian Session Lead Analyst at FXStreet, offers a brief technical outlook for EUR/USD:

“EUR/USD remains below all major daily Simple Moving Averages (SMA) in the lead-up to the NFP showdown. Meanwhile, the 14-day Relative Strength Index (RSI) points south below the 50 level. These technical indicators suggest that the pair remains exposed to downside risks in the near term.”

“Buyers needs a decisive break above the 21-day Simple Moving Average (SMA) at 1.0391 to initiate a meaningful recovery toward the January 7 high of 1.0437. The next relevant topside target aligns at the 50-day SMA at 1.0510. Fresh buying opportunities will rise above that level, calling for a test of the December 6 high of 1.0630. Conversely, if EUR/USD yields a sustained break of the two-year low at 1.0224, additional declines will aim for the 1.0150 psychological barrier.”

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Read the full article here