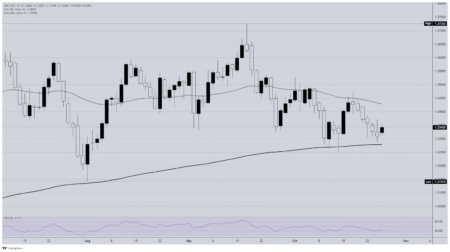

Gold (XAU/USD) attracts some buyers during the Asian session on Tuesday and recovers a part of the previous day’s losses to the $3,972-3,971 region, or an over two-week low. The US Dollar (USD) drifts lower for the second straight day amid the growing acceptance that the US Federal Reserve (Fed) will lower borrowing costs two more times this year, which turns out to be a key factor offering some support to the non-yielding yellow metal. Apart from this, geopolitical risks stemming from the protracted Russia-Ukraine war further underpin the safe-haven commodity.

However, signs of easing trade tensions between the US and China – the world’s two largest economies – act as a headwind for the Gold and keep a lid on further gains. Traders also seem reluctant to place aggressive directional bets ahead of the expected interest rate cut by the US central bank on Wednesday. The real focus will be on guidance for a follow-up rate cut in December or early next year. This makes it prudent to wait for strong follow-through buying before confirming that the XAU/USD pair’s recent corrective slide from the all-time peak has run its course.

Daily Digest Market Movers: Gold draws support from a weaker USD; bulls seem reluctant amid trade optimism

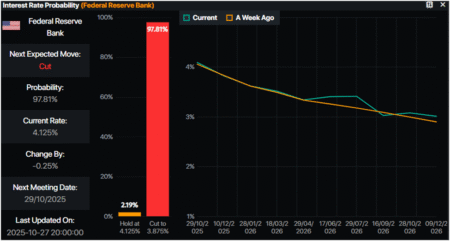

- Expectations of further interest rate cuts by the US Federal Reserve keep the US Dollar depressed for the second straight day on Tuesday and assist the non-yielding Gold to stage a modest recovery from an over two-week low.

- According to the CME Group’s FedWatch Tool, traders have fully priced in that the US central bank will lower borrowing costs by 25-basis-points at the end of a two-day meeting on Wednesday and cut rates again in December.

- The bets were reaffirmed by the latest US inflation figures released on Friday, which showed that the headline Consumer Price Index and the core gauge (excluding food and energy) increased by the 3% YoY rate in September.

- US President Donald Trump, in response to Russian President Vladimir Putin’s announcement of a successful test of a new nuclear-powered cruise missile, warned that the US has a nuclear submarine off the coast of Russia.

- This keeps the risk of a further escalation of geopolitical tensions and turns out to be another factor lending some support to the safe-haven precious metal, though the US-China trade optimism could keep a lid on further gains.

- Top officials from the US and China agreed on Sunday a framework for a potential trade deal that will be discussed when Trump and Chinese President Xi Jinping meet this week, easing concerns about a full-blown trade war.

- This, in turn, remains supportive of the upbeat mood around the equity markets and might hold back traders from placing fresh bullish bets around the XAU/USD pair heading into this week’s key central bank event risks.

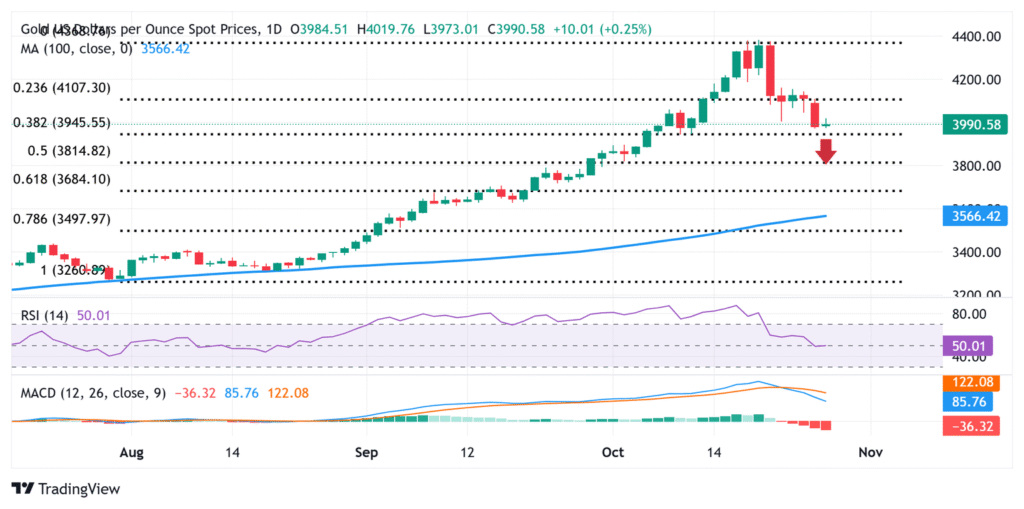

Gold seems vulnerable to slide further as a breakdown below the $4,000 psychological mark remains in play

Acceptance below the $4,000 psychological mark, along with the fact that oscillators on the daily chart have just started gaining negative traction, backs the case for a further depreciating move for the Gold price. The XAU/USD bears, however, might wait for some follow-through selling below the $3,970 area and the $3,945 region, or the 38.2% Fibonacci retracement level of the July-October rally, before placing fresh bets. The commodity might then accelerate the downfall towards testing sub-$3,900 levels en route to the 50% retracement level, around the $3,810-$3,800 region and the 50-day Simple Moving Average (SMA), currently pegged near the $3,775 area.

On the flip side, move beyond the Asian session high, around the $4,019-4,020 region, could be seen as a selling opportunity and remain capped near the $4,050-4,055 zone. A sustained strength beyond might trigger a short-covering rally towards the $4109-4,110 region, which coincides with the 23.6% Fibo. retracement level support break point. Some follow-through buying would negate the near-term negative outlook and lift the Gold price to the $4,155-4,160 supply zone en route to the $4,200 mark and the next relevant hurdle near the $4,252-4,255 region.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Read the full article here