Gold (XAU/USD) kicks off the week with a negative tone, as improved risk appetite curbed demand for safe-haven assets. At the time of writing, XAU/USD is trading around $4,020, down over 2.0%, extending its retreat from last week’s record high of $4,381 after a wave of profit-taking spurred by progress in trade talks.

Positive trade headlines have boosted market sentiment, with equities extending gains across the globe. Over the weekend, US and Chinese negotiators reportedly reached a preliminary trade framework, setting the stage for further progress ahead of President Donald Trump’s meeting with his Chinese counterpart, Xi Jinping, on Thursday. Trump also signed separate trade framework pacts with Malaysia, Thailand, Vietnam, and Cambodia.

Although markets are in a buoyant mood, a degree of caution prevails as focus shifts squarely to monetary policy. Investors face an event-packed week with key central-bank meetings from the Federal Reserve (Fed), Bank of Canada (BoC), Bank of Japan (BoJ) and the European Central Bank (ECB).

While easing trade tensions has provided some short-term relief, Gold’s downside appears limited as traders remain wary of President Trump’s unpredictable trade stance. Meanwhile, the prolonged United States (US) government shutdown and lingering geopolitical and economic uncertainties continue to keep investors cautious.

Market movers: Markets buoyed by US-China framework, focus turns to Fed

- Top trade negotiators from the United States and China said on Sunday they had reached a framework agreement for a potential trade deal. China’s Ministry of Commerce confirmed that both sides achieved an initial consensus on several key issues, including a possible extension of the current tariff truce, cooperation on fentanyl control, as well as agreements covering agricultural trade, export controls, and shipping levies.

- US Treasury Secretary Scott Bessent said on Sunday that China will defer its new rare-earth export controls for one year and make “substantial” purchases of US soybeans, while the US threat of 100% tariffs on Chinese goods is now “effectively off the table.” Bessent added that the agreed trade “framework” sets the stage for a “very productive meeting” between Presidents Donald Trump and Xi Jinping when they meet later this week on the sidelines of the APEC summit in South Korea.

- The US federal government shutdown entered its twenty-seventh day on Monday with no resolution in sight, extending one of the longest funding standoffs in history. The Senate has failed multiple times to advance a temporary funding bill, while the House remains out of session amid deep divisions over spending priorities. The prolonged impasse is already taking a toll, with over 700,000 federal workers furloughed and many others working without pay. The US Department of Agriculture warned that federal food aid programs, including SNAP and WIC, will halt from November 1 if funding isn’t restored.

- On the monetary policy front, traders are almost certain the Fed will lower interest rates again this week, following September’s ‘risk-management’ cut. Expectations for easing strengthened further after softer-than-expected US inflation data last week.

- According to the CME FedWatch Tool, markets now assign a 96.7% probability of a 25-basis-point (bps) rate cut at the October 29-30 monetary policy meeting, while the odds of another cut in December stand at 95.8%. Lower borrowing costs typically enhance the appeal of non-yielding assets like Gold, as they reduce the opportunity cost of holding the metal.

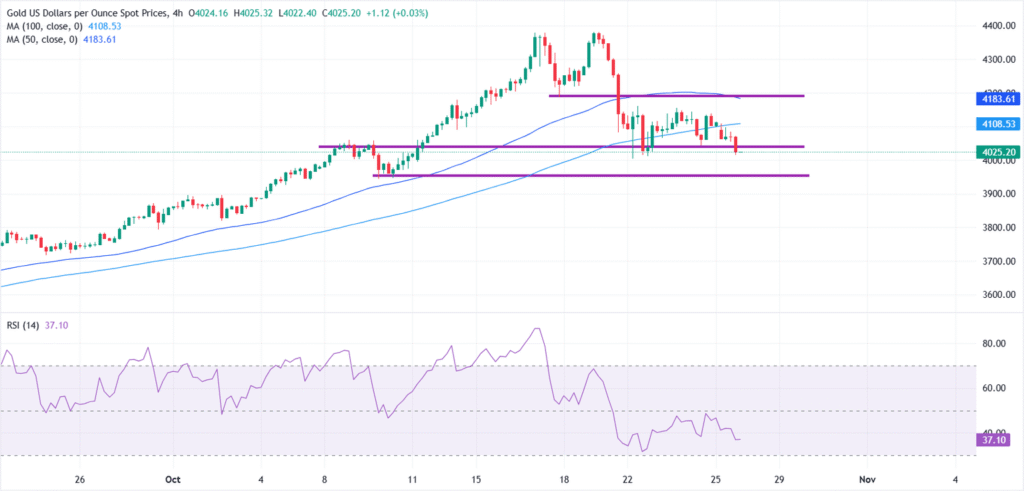

Technical analysis: XAU/USD vulnerable below $4,100 as bearish pressure builds

Gold bears remain in control as prices struggle to hold above the $4,000 psychological mark. The metal continues to trade below the 50- and 100-period Simple Moving Averages (SMAs) near $4,187 and $4,107, showing that sellers have the upper hand.

Immediate support sits near the $4,000 mark, where bulls may attempt to defend the level, though momentum remains fragile. A decisive break below $4,000 would likely embolden bears, paving the way for further downside toward $3,950 and even $3,900.

On the upside, immediate resistance is seen in the $4,100-$4,150 zone, where sellers have repeatedly capped recoveries. A stronger barrier sits near $4,200, the previous breakout region where bulls are likely to face renewed selling pressure.

The Relative Strength Index (RSI) hovers around 37, staying close to the oversold region and signaling that bearish momentum remains in play.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.

Next release:

Wed Oct 29, 2025 18:00

Frequency:

Irregular

Consensus:

4%

Previous:

4.25%

Source:

Federal Reserve

Read the full article here