Few things in modern life are built to last. But one area where longevity really matters is in your investment portfolio.

A “forever portfolio” is designed to generate wealth consistently, so you can live comfortably without running out of money later in life. It takes the stress and guesswork out of investing by focusing on long-term growth and time-tested strategies.

And unlike your last iPhone or beat-up pair of running shoes, it’s built to last — so you won’t have to worry about coming up short once retirement arrives.

Whether your goal is early retirement or lifelong financial freedom, here are six steps to help you create your forever portfolio, including choosing the right investment account, hiring a financial advisor and developing the right mindset for long-term investing.

1. Pick your investment account

Building a forever portfolio starts with choosing the right investment account. Certain accounts stand out for long-term wealth-building thanks to their favorable tax treatment.

A Roth IRA is at the top of the list. It lets your investments grow tax-free, and you won’t owe taxes on withdrawals in retirement. That’s huge. The less you pay in taxes down the road, the more money you get to keep.

“Plus, for investors who expect to be in a higher tax bracket down the road, a Roth can be a powerful tool,” says Daniel Goodman, a certified financial planner and founder of Good Better Best Financial Planning.

Another major benefit is that Roth IRAs have no required minimum distributions (RMDs). Traditional IRAs and 401(k)s force you to start withdrawing funds at age 73, whether you need the money or not, which can create a tax burden. With a Roth IRA, your investments can grow indefinitely — a true forever portfolio.

Roth IRAs also offer flexibility in withdrawals. You can withdraw your contributions (but not earnings) at any time, tax- and penalty-free, so long as the account has been opened for at least five years. This flexibility is great if you plan to retire early because traditional IRAs and 401(k)s levy a 10 percent penalty for withdrawals made before age 59 ½.

However, while a Roth IRA is a powerful account, it does have a few drawbacks. First, contribution limits are relatively low — in 2025, the maximum contribution is $7,000 ($8,000 if you’re 50 or older). Compare that to a 401(k), where you can contribute up to $23,500 in 2025 if you’re under 50. If you’re 50 or older, you can contribute up to $31,000 in 2025, and those age 60, 61, 62 and 63 can contribute up to $34,750.

If you’re a high earner, you may also face income limits that reduce or eliminate your ability to contribute directly. In that case, you might need to use a backdoor Roth IRA, a legal strategy that allows people with high income to convert traditional IRA funds into a Roth.

Goodman notes that traditional brokerage accounts can also be a great alternative, due to their flexibility, namely no income caps or contribution limits.

“So you can add or withdraw funds without many restrictions,” says Goodman.

Ultimately, the best account depends on your goals, time horizon and tax situation. Goodman says the perfect fit might involve multiple account types, so you can optimize for both liquidity and taxes.

2. Develop the right mindset

A forever portfolio isn’t about chasing quick profits or timing the market — it’s about creating a well-diversified investment strategy that can sustain you through turbulent markets. To do so, you’ll need to focus on two core principles: investing for the long term and resisting the impulse to sell.

Invest for the long-term

Instead of reacting to daily market movements, adopt a buy-and-hold strategy of strong stocks or funds, reinvesting dividends and letting compounding returns work magic in your favor.

“You want companies with strong fundamentals — stable earnings, reliable cash flow and competitive advantages — so you’re not chasing trends that could collapse,” says Goodman.

A prime example of this strategy is legendary investor Warren Buffett’s investment philosophy.

“Buffett emphasizes buying businesses you’d be comfortable owning for a decade or longer,” says Goodman.

If you want longevity in your portfolio, you need companies that are uniquely positioned in their industry.

“Look for what Buffet calls a moat — a durable competitive edge that sets the company apart,” says Goodman.

By mirroring this approach, you can bypass costly trading fees and taxation on short-term gains while giving your wealth room to snowball over time.

Resist the urge to sell

Selling out of fear or in reaction to breaking news can derail your financial plan. Market downturns are inevitable, but history shows that markets recover quickly.

There’s an old saying on Wall Street: “The market never lets you back in.” The adage points to the fact that once you sell a stock during a downturn, it often rapidly rebounds and continues to climb, leaving you unable to re-enter at a good price.

If you panic-sell, you’ll likely miss out on the recovery. For example, during the 2008 financial crisis, many investors liquidated their holdings at a loss. But those who stayed invested saw significant gains throughout the 2010s.

Instead, only sell when you have a legitimate reason — like the company’s business outlook has profoundly changed or you need to rebalance your portfolio. Otherwise, staying the course is the best strategy.

Need an advisor?

Need expert guidance when it comes to managing your investments or planning for retirement?

Bankrate’s AdvisorMatch can connect you to a CFP® professional to help you achieve your financial goals.

3. Explore low-cost index funds

Investing in an index fund is the simplest way to build your forever portfolio without the hassle of analyzing individual stocks or timing the market.

These funds track major stock market indices, such as the S&P 500, and offer broad diversification with a single purchase. By investing in an index fund, you spread your money across dozens or even hundreds of companies, reducing the risk of your portfolio taking a nosedive if one particular stock plunges.

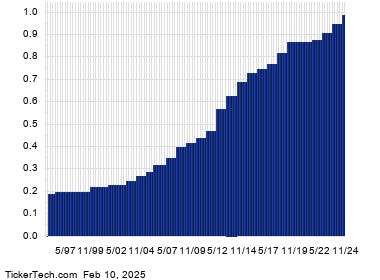

While individual stocks may be volatile, index funds tend to grow steadily over time, following the overall market. For the S&P 500, the average annual return has been about 10 percent over long stretches. It’s hard to get that kind of consistent return with any other investment.

Rather than trying to beat the market, index funds aim to match its performance, providing steady, long-term returns. With low-cost mutual funds and exchange-traded funds (ETFs) widely available, passive investing has never been easier.

And since you aren’t constantly buying and selling, you can defer capital gains taxes until you eventually sell, keeping your tax bill low.

Here is a list of some of the best index funds to get you started.

4. Explore dividend stocks to produce income

Many well-established companies distribute a portion of their profits to shareholders through cash dividends, offering a steady stream of passive income. Investing in dividend-paying stocks or funds lets you earn consistent cash flow while enjoying potential long-term growth.

However, not all high-dividend stocks are worth investing in. When adding dividend stocks, it’s crucial to look beyond the yield, says Goodman.

“You want to see if the company can sustain or grow that dividend over time,” he says. “Check metrics like the dividend payout ratio and free cash flow to ensure that high yields aren’t masking underlying problems.”

You can explore companies with a history of increasing dividends over time, such as the Dividend Aristocrats, which have steadily increased their payout for investors each year for 25 years or more. Examples include Johnson & Johnson, Procter & Gamble and Coca-Cola. These companies provide reliable income and tend to outperform during economic downturns.

Another way to gain dividend exposure while bypassing the stock-picking game is by purchasing a dividend ETF. Like an index fund, a dividend ETF gives you exposure to numerous companies in a single fund.

5. Adjust your portfolio over time

A forever portfolio might sound like a set-it-and-forget-it venture: Pick the right funds, regularly contribute money and watch the balance grow.

The truth is, you’ll need to refine your portfolio over time to ensure its longevity.

When you’re young, you have the advantage of time, allowing you to take on more risk in exchange for higher potential returns.

For investors with a long time horizon — measured in decades rather than years — experts recommend allocating most of your portfolio to stocks. Historically, stocks have delivered the highest long-term returns, and a longer time frame lets you ride out market volatility while benefiting from that growth potential. Avoiding stocks entirely could mean missing out on the returns needed to sustain your wealth — which could put your forever portfolio on life support.

As your investment timeline shortens and the date you’ll need your funds approaches, it’s important to shift your allocation to more conservative investments to protect your capital.

At this stage, experts generally recommend gradually reducing exposure to stocks and increasing holdings in bonds and other low-risk investments. This way, you protect your income for when you need it most.

Target-date funds are one way to automate this transition, and they’re a staple of many workplace 401(k) retirement plans. These funds gradually shift from high-growth assets to more conservative investments like bonds as your planned retirement date approaches.

Another way to simplify the process is with a robo-advisor, which uses algorithms to create and manage a diversified portfolio for you. Platforms like Betterment and Wealthfront can automatically rebalance your holdings and adjust your allocation as retirement approaches.

“Building a forever portfolio is challenging because life isn’t static — family needs, career changes, and financial goals can shift,” says Goodman. “A genuine buy-and-hold strategy can be remarkably effective, but remember to maintain enough liquidity for life’s curveballs so you’re never forced to sell at a bad time.”

6. Speak with a financial advisor

If you want your forever portfolio to last the rest of your life, it’s wise to consult a professional along the way.

A financial advisor can help in two ways:

- Manage your investments: If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a portfolio for you. Most advisors charge a percentage of assets under management, usually 1 to 1.5 percent of your portfolio balance.

- Make sure you’re on track: Want someone to check your work, not do the work for you? Most financial advisors offer a flat fee for a one-hour session, during which you can review your portfolio together and ask any pressing financial questions you might have. Cost can vary for this service, but it’s usually in the range of $200 to $500.

Whether you need help with option one or two, Bankrate’s financial advisor matching tool can connect you with a certified financial planner in minutes.

Bottom line

Building a forever portfolio isn’t about chasing quick gains — it’s about creating a resilient nest egg that lasts a lifetime. The key is choosing the right investments, holding for the long haul and resisting the urge to react to short-term market swings. Stick to these principles, and you’ll build a portfolio that stands the test of time.

Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation.

Read the full article here