The investment landscape in 2025 offers several promising opportunities in high-growth sectors. While market volatility continues to be a challenge, certain areas stand out for their strong growth potential, technological innovation, and ability to address critical global issues. This analysis, supported by comprehensive market research and economic indicators, highlights five sectors worth investors’ attention.

Criteria for Identifying Growth Sectors

Successful investing in specific sectors requires analyzing several factors that indicate sustainable growth potential. These criteria are essential for making informed investment decisions based on solid fundamentals rather than market sentiment.

Market Trends

Market trends involve both cyclical patterns and long-term changes in the economy. Key factors include trading volumes, price movements and sector rotation patterns. Economic indicators such as GDP growth, inflation, and interest rates are vital in understanding market movements.

For instance, the U.S. economy grew by 2.1% in 2024, but inflation rates stabilized around 3.4%, affecting sectors differently. Shifts in global trade dynamics, such as increased trade agreements in Asia and the continued impact of supply chain disruptions, are shaping investment opportunities.

Innovation

Innovation remains a critical driver of growth. Metrics such as R&D spending, patent applications, and the pace of new product development highlight sectors leading in technological advancements.

According to recent reports, global R&D spending reached $2.5 trillion in 2024, with industries like artificial intelligence and clean energy receiving a significant share of this investment. Companies that innovate consistently are better positioned for sustained growth and market leadership.

Global Demand

Analyzing global demand patterns helps identify growth trajectories. Demographic trends, such as aging populations in developed markets and growing middle classes in emerging markets, shape consumption patterns.

For example, India’s GDP growth is projected to exceed 6.3% in 2025, driven by increased domestic consumption and infrastructure spending. These factors create opportunities for sectors like healthcare, advanced manufacturing and clean energy.

Sustainability

Environmental, Social and Governance (ESG) considerations are now central to evaluating sector performance. Sectors aligned with sustainability goals often benefit from supportive regulations and growing consumer demand for responsible business practices.

In 2024, global ESG-focused assets under management surpassed $40 trillion, demonstrating the increasing investor focus on sustainability metrics such as carbon footprints, resource efficiency and governance standards.

Methodology Used For These Picks

The sectors identified here were selected using a combination of quantitative and qualitative metrics. Financial indicators such as revenue growth, profit margins and return on invested capital (ROIC) were paired with assessments of market positioning, competitive dynamics and regulatory environments.

The 5 Best Sectors to Invest In for 2025

As we head into 2025, identifying the right sectors to invest in is more important than ever. With shifting economic trends, emerging technologies and evolving consumer habits, certain industries are positioned to outperform others. In this section, we’ll explore five sectors that offer strong potential for growth and resilience in the year ahead, backed by market trends and data-driven insights. Whether you’re looking for stability or high-growth opportunities, these sectors deserve a closer look

1. Artificial Intelligence And Machine Learning

Sector Overview

The Artificial Intelligence (AI) and Machine Learning (ML) sector is growing rapidly, with applications spreading across healthcare, finance and logistics industries. Major players are consolidating their market positions through acquisitions of innovative startups.

Why AI/ML Is A Top Pick

AI adoption is accelerating, supported by technological advancements and increased investment. According to PwC, AI-driven technologies will contribute $15.7 trillion to the global economy by 2030. Regulatory frameworks are also evolving to ensure ethical AI usage, further boosting the sector’s credibility.

Key AI/ML Investment Picks

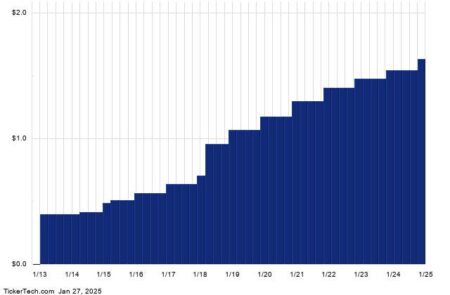

- NVIDIA (NVDA): The company’s H100 GPUs dominate AI infrastructure, with a forward P/E of around 30x. Revenue for Q4 2024 grew 36% YoY.

- Palantir (PLTR): Demonstrates strong market penetration with 45% YoY revenue growth and an expanding commercial client base.

- Microsoft (MSFT): Strategic partnerships with OpenAI and robust Azure AI services position the company for sustained growth, with a forward P/E of 32x.

2. Clean Energy And Storage Technologies

Sector Overview

Clean energy has transitioned from an alternative option to a mainstream necessity. Advancements in battery technology and storage solutions have addressed previous challenges in adopting renewable energy.

Why Clean Energy Is A Top Pick

Governments worldwide are committing to net-zero emissions targets. The U.S. Inflation Reduction Act of 2022 continues to funnel billions into clean energy projects, and declining costs of renewable installations make this sector highly attractive.

Key Clean Energy. Investment Picks

- First Solar (FSLR): The company’s industry-leading efficiency rates and a P/E ratio of 28x make it a solid pick for solar market expansion.

- Enphase Energy (ENPH): Dominates residential solar installations, supported by a 30% profit margin and steady market share growth.

- Tesla (TSLA): While known for EVs, Tesla’s energy storage segment is growing rapidly, with revenue increasing 40% YoY in 2024.

3. Healthcare Technology

Sector Overview

The healthcare technology sector encompasses digital health platforms, advanced diagnostics, and personalized medicine. The pandemic accelerated the adoption of digital health solutions while biotechnology continues to innovate.

Why Healthcare Technology Is A Top Pick

An aging population and rising healthcare costs are driving demand for innovative solutions. According to the WHO, global healthcare spending reached $10.3 trillion in 2024, highlighting the importance of this sector.

Key Healthcare Technology Investment Picks

- UnitedHealth Group (UNH): The company’s digital health capabilities through Optum are growing steadily, with a P/E of 21x.

- Veeva Systems (VEEV): Its 35% operating margin reflects the effectiveness of its pharmaceutical industry cloud platform.

- Intuitive Surgical (ISRG): With a P/E of around 70x, its dominance in robotic surgery justifies its premium valuation.

4. Cybersecurity

Sector Overview

As cyber threats grow in complexity, the cybersecurity sector is evolving rapidly. Comprehensive security platforms now incorporate AI-driven tools, zero-trust architectures and cloud-native solutions.

Why Cybersecurity Is A Top Pick

Regulatory requirements, such as GDPR in Europe and increased focus on data privacy in the U.S., drive demand for robust cybersecurity solutions. Gartner predicts that worldwide spending on cybersecurity will exceed $200 billion by 2025.

Key Cybersecurity Investment Picks

- Palo Alto Networks (PANW): A market leader with consistent 25%+ revenue growth and a forward P/E of 45.2.

- CrowdStrike (CRWD): Maintains a 90%+ gross margin, reflecting strong operational efficiency.

- Fortinet (FTNT): Offers a balance of growth and stability, with a P/E of 40x and robust free cash flow.

5. Advanced Manufacturing And Robotics

Sector Overview

Technologies like industrial robotics, 3-D printing, and smart factories are revolutionizing traditional manufacturing processes. Supply chain disruptions in recent years have accelerated the adoption of automated solutions.

Why Advanced Manufacturing Is A Top Pick

Rising labor costs and the need for supply chain resilience have made automation a priority. According to McKinsey, automation could add $1.2 trillion to the global economy by 2030.

Key Advanced Manufacturing Investment Picks

- Rockwell Automation (ROK): Consistently leads in industrial automation, with a P/E of 28x.

- Deere & Co (DE): Precision agriculture technology positions it for growth, with an attractive P/E of 12x.

- ABB Ltd (ABB): Offers a reasonable valuation (P/E of 18x) as a robotics and automation solutions leader.

Bottom Line

These five sectors offer substantial opportunities for investors looking to align with innovation and market demand. While the potential for high returns exists, diversification and risk management are critical to navigating market volatility.

Before investing, assess company fundamentals, valuation metrics, and broader economic conditions. Staying informed and monitoring trends within these sectors will be key to long-term success in 2025.

Read Next

Whether it’s mastering cutting-edge strategies, uncovering actionable investment opportunities from influential leaders, or breaking down complex topics, our in-depth journalism has you covered. Become a Forbes member and gain unlimited access to bold ideas shaking up industries, expert guides and practical investment advice that keeps you ahead of the market. Unlock Premium Access — Free For 25 Days.

Read the full article here