Asset allocation in a retirement account like an IRA is much more than a technicality. It’s a decisive strategy that can make the difference between a serene retirement and late regrets.

Neglecting to allocate assets in an Individual Retirement Account (IRA) can be particularly costly.

All too often, savers are content to invest their money for retirement without any real strategy, or even to let it lie dormant in cash. Poor allocation or lack of diversification can considerably slow down the growth of savings over the long term.

A misallocation, a silent loss

Investing in an IRA, whether Traditional or Roth, does not by itself guarantee a bright financial future. The key lies in how that money is invested.

Delays in investment, or keeping cash uninvested, can significantly reduce performance.

By deferring contributions and leaving the money in cash, an investor could lose up to $16,000 in potential gains over 30 years with a modest return of 4% per year, according to a Vanguard study.

Understanding asset allocation: A pillar of retirement planning

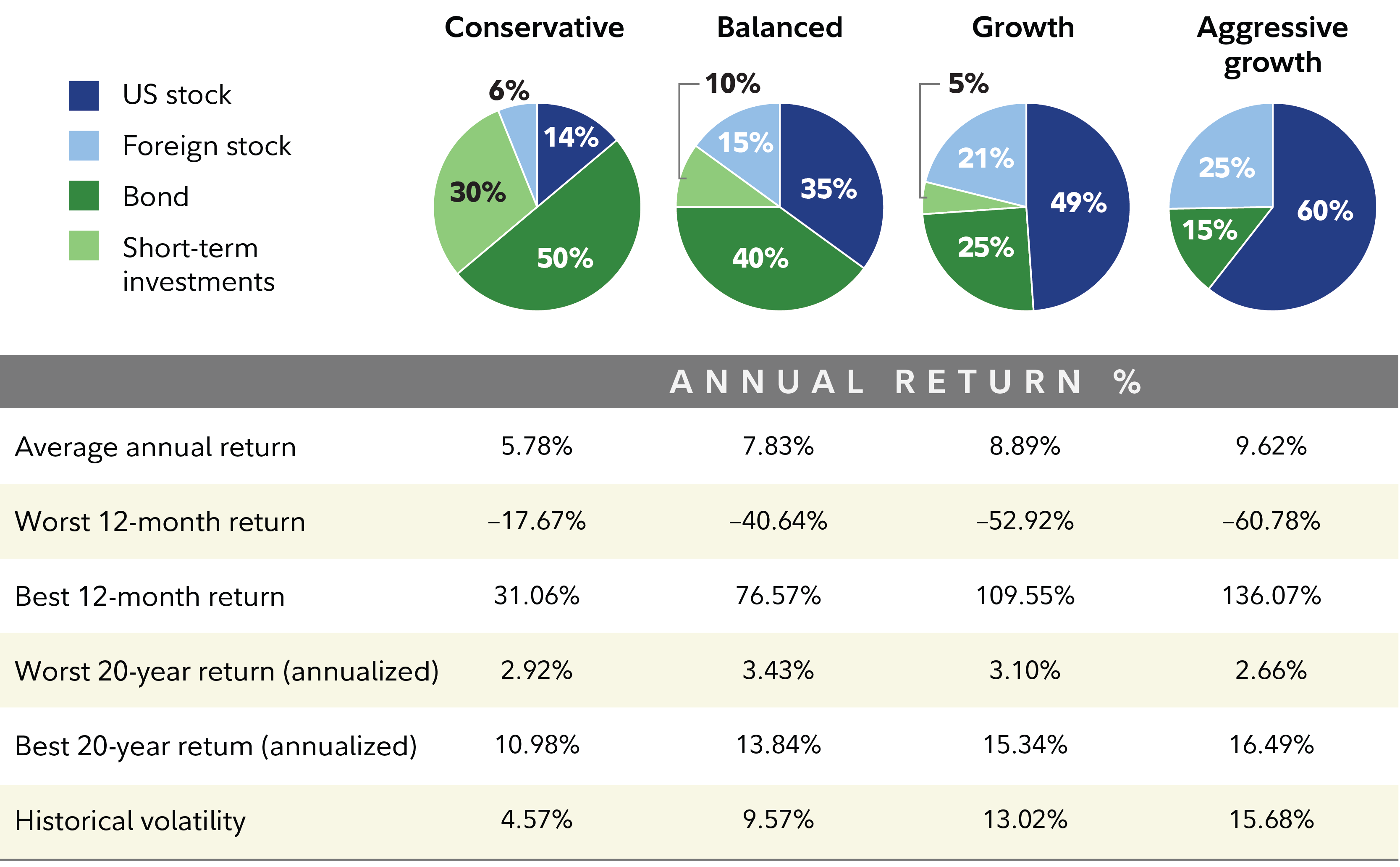

Asset allocation involves dividing your portfolio among several asset classes: Equities, Bonds, Cash, even Real Estate or Commodities.

Each of these asset classes reacts differently to economic cycles. A well-thought-out allocation reduces overall volatility, smoothes returns and maximizes long-term growth potential.

Age, investment horizon, risk profile and financial objectives are the main criteria to be taken into account when deciding where to allocate your funds.

For example, a young investor could favour a high exposure to Equities to benefit from long-term stock market returns. A retired investor, on the other hand, should look for greater stability, with a higher proportion in Bonds.

Too much cash in an IRA: A risky choice

Many savers make the mistake of leaving a large part of their IRA in cash, thinking they can avoid risk by doing so.

In reality, cash is the safest asset, but also the least profitable, and offers no protection against inflation.

In a long-horizon account like an IRA, leaving money idle is an expensive passive choice. It deprives the saver of the power of compound interest.

The importance of regular rebalancing your IRA

Your ideal allocation is not set in stone. With time and market movements, weightings change.

A typical portfolio initially balanced 60% equities and 40% bonds may become unbalanced if equities rise sharply.

You therefore need to periodically rebalance your IRA to stay true to your risk profile. This discipline makes it possible to sell what has risen (at the right time) and strengthen what is undervalued, without exposing yourself to emotional decisions.

Source: Fidelity

Adapting your allocation to each stage of retirement

The right asset mix evolves throughout the retirement planning cycle. In the early years of saving, a dynamic allocation builds capital.

As you approach retirement, you need to secure part of your gains. And once retired, the aim is to combine residual growth with income stability to cope with expenses and longevity.

The “glide path” approach allows a gradual transition from a growth-oriented portfolio to a more conservative one.

In practical terms, this means that you deduct your age from 100 to obtain the recommended share of equities in your portfolio, with the remainder invested in bonds or cash. For example, at age 40, you could aim for an allocation of 60% equities and 40% bonds.

A strategy to build, not improvise

Investing in an IRA is not enough. You also need to adopt a rigorous asset allocation strategy, tailored to your objectives and regularly adjusted.

Neglecting this lever means under-exploiting one of the best tools for preparing for retirement.

And in a world where people are living longer and markets are more volatile, a poorly thought-out allocation can be costly.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Read the full article here