The EV winter is going global — and even Tesla isn’t immune.

Electric vehicle sales across the auto industry fell 3% worldwide in January compared to the same period last year, according to data from Benchmark Intelligence published Friday, as policy changes in the US and China threaten to throw the industry into a deep freeze.

In North America and China, sales fell 33% and 20% respectively last month.

EV sales in the US have plummeted since the removal of the $7,500 tax credit for new electric vehicles in September, and CEOs and industry experts have warned of a bumpy few years ahead.

In China, EVs accounted for around half of all vehicles sold last year — but companies are facing their own challenges after the government moved to end a key tax exemption for EV purchases and adjusted its trade-in scheme to make it less generous for battery-powered vehicles.

Tesla’s troubles deepen

China’s EV wobble has also hit its most successful foreign import — Tesla.

Elon Musk’s automaker sold fewer than 20,000 vehicles in China in January, according to data from the China Passenger Car Association, its lowest figure since late 2022.

Unlike many other Western carmakers in China, Tesla has largely managed to fend off a wave of local rivals and protect its market share in the world’s largest auto market.

However, a slowing EV market and a lack of new products — barring refreshes and variants, Tesla hasn’t launched a new vehicle in China since the Model Y in 2021 — has left the US automaker vulnerable.

Industry data published last week suggests that Tesla’s Model Y was outsold in January by more than two to one by Xiaomi’s YU7, which was widely hailed as a serious rival to Tesla’s bestselling EV when the smartphone maker launched it last June.

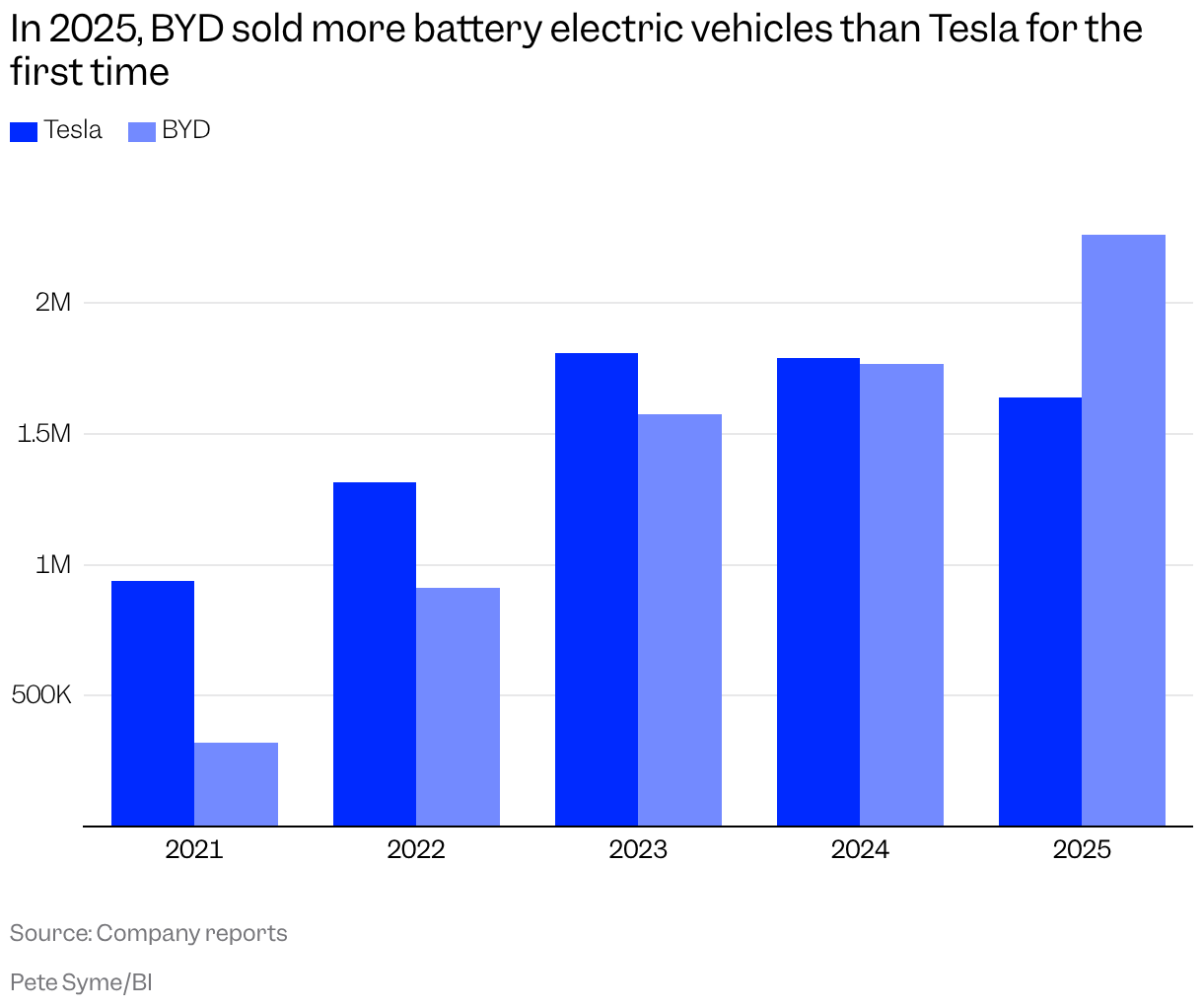

And last year, BYD took Tesla’s crown as the world’s largest seller of battery-powered vehicles — although the Chinese company also saw its January sales fall 30% year over year, signaling a difficult start to 2026.

Outside of China, things aren’t looking much better for Tesla.

The company continues to struggle in Europe, after facing major backlash last year over CEO Musk’s interventions into local politics and endorsement of the German far-right party AfD.

Despite staging a recovery in some markets, such as Spain and Italy in January, Tesla’s registrations also collapsed by 42% in France and fell to just 82 cars in EV-friendly Norway.

In the UK, where Tesla’s Chinese rivals do not face tariffs, BYD sold four times as many cars as Tesla last month, after the Austin-based automaker’s registrations fell by half.

The ongoing slump comes despite Europe being one of the few regions to see a bump in EV demand so far this year. Electric vehicle sales grew by nearly 25% year-over-year in January, per Benchmark figures.

Tesla’s struggles in China and Europe mean its attempt to return to growth after two years of annual sales declines is off to a rough start.

The company has also faced a difficult spell in the US following the end of the tax credit, with sales in the final three months of 2025 falling 15% year over year, per figures from Cox Automotive — although the brand’s January sales were only 2% lower than last year.

Tesla is by no means the only US automaker taking a hit in the EV market. The Detroit “big three” of Ford, GM, and Stellantis have collectively announced over $50 billion in charges related to their EV businesses in recent months, as they switch gears to sell more gas-powered and hybrid vehicles. Just 90,000 electric vehicles were sold in North America in January, according to Benchmark’s figures.

Getting caught in the EV winter might not bother Tesla’s management, though, with the company rapidly shifting its focus away from the traditional auto industry.

Musk told investors last month that Tesla will sunset its pioneering Model X and S models to build a new production line for its Optimus humanoid robot, and predicted that the company’s upcoming Cybercab robotaxi will make current transportation methods obsolete.

“We’re literally saying what we’re going to do and have said what we’re going to do for a while,” Musk said

“I think long-term, really the only vehicles that we’ll make will be autonomous vehicles, with the exception of the next-generation Roadster,” he added.

Read the full article here