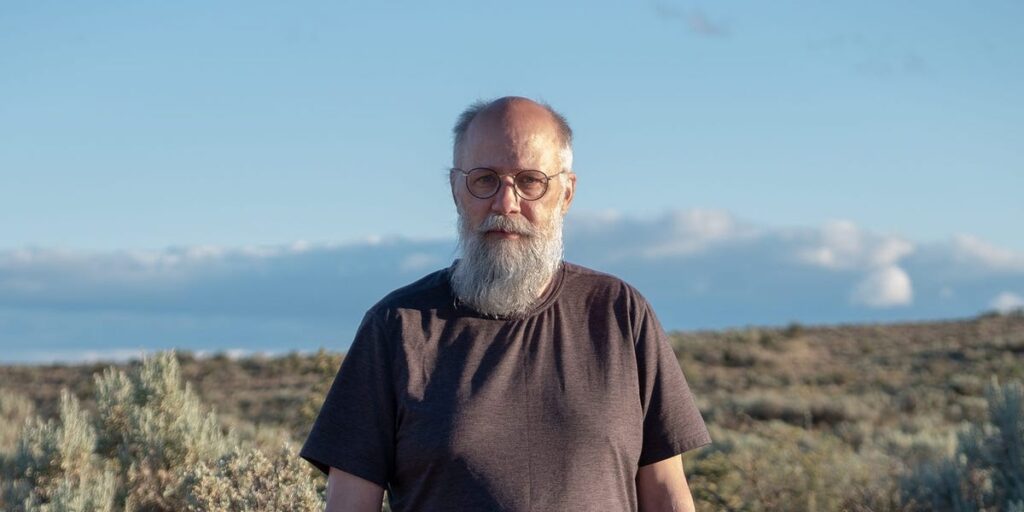

I got my first job at 17 and worked mainly dead-end jobs at restaurants, in construction, and at mini-marts. I was a late bloomer and started college in 1993 at 30.

I graduated with a bachelor’s and a master’s degree in communications and moved to Kansas to take a full-time position teaching at the community college level.

The job offered a state program called KPERs, a retirement program with some matching. I participated and contributed a small amount, which started my retirement journey.

I left the community college and Kansas a year later

My partner and I lost our firstborn child, and it was too hard to stay there. I then went to work for a college in Indiana. They also offered retirement benefits, such as matching, which I participated in. I worked there from 2002 to 2004.

I left Indiana and got a job at a college in Washington, where my daughter was born in 2005. I worked there for the next 20 years and just quit in June.

I bought my first property in Washington in about 2012, which got me into real estate

I then sold it in 2019 for around $70,000 profit — it paid off all my old student loans, credit card debt, and car payments.

I moved to Maine in 2022 and still taught remotely. I bought another property in Washington in 2021, sold it in 2023, and made a nice profit on it.

I bought a third property in Maine. We lived there for two years before deciding to move to Tennessee. I was unable to find full-time academic work in Maine, so I relocated for better job prospects.

I rent the condo in Maine to a family member, so the mortgage is covered while I pay rent in Tennessee.

I’ve never purposefully invested; it’s just been part of my benefits

About five years ago, I started contributing 7% of my income to retirement, which my employer matched. I was making enough money, so I invested an extra $200 a month. As I was consistent, my portfolio grew.

When I was 59 years old, my retirement accounts hit $500,000. I also received a small inheritance of $70,000 from my mom when she died in 2022. Along with my savings, that’s close to another $100,000 for my retirement. I’ve got about $100,000 in equity in my real estate. So, my retirement nest egg is about $650,000 thus far.

In my retirement journey, I’ve held many jobs. I worked for the Postal Service, but I quit because I was working too much for too little pay. Now, I’m working part-time at Cabela’s and part-time teaching.

I don’t feel secure enough, and it’s scary

I’m nervous. My ex-wife and I divorced in 2006. I’m single and building my retirement nest egg alone. Even though $650,000 sounds like a lot, it isn’t. If I’ve lived off $50,000 a year, my retirement savings will only last about 12 years.

I have some medical issues that may make my life a little shorter than the average person’s, but I don’t know about being 71 and still working, and I worry I could run out of money. In my 70s, I don’t want to rely on Social Security and public housing.

I’m working on securing another job in Tennessee. I’ll put in another four years to get to 65 and probably retire, unless I love my job. Then, I could start taking Social Security.

The one thing I would’ve done differently is I would’ve bought real estate earlier

I’ve made a lot of money off the real estate I’ve owned and sold. Real estate boosted me financially in my mid-to-late fifties.

I’m frustrated because I’m a creative person. I’d like to spend my life doing creative work, whether I make money or not, such as writing, music, songwriting, or photography.

Now, I’m stuck working 50 to 60 hours a week at various jobs, and it’s exhausting. I don’t like any of the jobs that I’ve had; they’re means to an end.

I wish I had started putting money away earlier, and that’s the advice I would give young people.

Of course, working dead-end jobs is hard, and you barely make it paycheck to paycheck. I probably would’ve started adding a little extra once I got a job with matching programs because that’s where it adds up.

Read the full article here