Gold (XAU/USD) retains its negative bias heading into the European session on Monday, though it lacks follow-through selling and remains confined in a multi-day-old range amid mixed fundamental cues. Signs of easing trade tensions between the US and China boosted investors’ appetite for riskier assets, which, in turn, is seen undermining demand for the safe-haven precious metal. However, dovish Federal Reserve (Fed) expectations act as a tailwind for the non-yielding yellow metal amid subdued US Dollar (USD) price action.

Traders now seem convinced that the US central bank will lower borrowing costs two more times by the year-end, and the bets were reaffirmed by softer US consumer inflation figures released on Friday. This, in turn, keeps the US Dollar (USD) bulls on the defensive, which, along with persistent geopolitical risks stemming from the protracted Russia-Ukraine war, offers some support to the Gold. Traders also seem reluctant and opt to wait for the FOMC decision on Wednesday before placing fresh directional bets around the XAU/USD pair.

Daily Digest Market Movers: Gold bulls remain on the defensive amid US-China trade optimism

- Top Chinese and US economic officials on Sunday agreed on the framework of a potential trade deal that will be discussed when US President Donald Trump and Chinese President Xi Jinping meet later this week. US Treasury Secretary Scott Bessent said that discussions on the sidelines of the ASEAN Summit in Kuala Lumpur had eliminated the threat of 100% tariffs on Chinese imports starting November 1.

- This helps soothe investor nerves and eases concerns about a further escalation of trade tensions between the world’s two largest economies. Moreover, the optimism sends stocks sharply higher at the start of a new week and exerts some downward pressure on the safe-haven Gold during the Asian session. However, bets for more interest rate cuts by the US Federal Reserve warrant some caution for bears.

- The US Bureau of Labor Statistics reported on Friday that the headline Consumer Price Index rose by 0.3% in September, putting the annual inflation rate at 3%. Excluding food and energy, the gauge showed a 0.2% monthly gain and an annual rate stood at 3%. The reading fell short of consensus estimates and reaffirmed market bets that the US central bank will lower borrowing costs later this week.

- Moreover, the CME Group’s FedWatch Tool indicated that traders have nearly fully priced in another 25-basis-point Fed rate cut move in December. This, in turn, fails to assist the US Dollar to capitalize on Friday’s goodish bounce from a one-week low. This, along with geopolitical risks stemming from the protracted Russia-Ukraine war, turns out to be a key factor acting as a tailwind for the non-yielding yellow metal.

- Russia launched a drone attack on the Ukrainian capital, Kyiv, in the early hours of Sunday. Ukraine’s Air Force said that it downed four of nine missiles and 90 of 101 drones launched in the Russian attacks across the country. Furthermore, Russian President Vladimir Putin also announced a successful final test of a new nuclear-powered cruise missile. This could support the safe-haven commodity.

- Traders might also opt to move to the sidelines ahead of this week’s central bank event risks. Meanwhile, the focus will remain glued to the crucial FOMC policy decision on Wednesday, which will play a key role in influencing the near-term USD price dynamics and determining the next leg of a directional move for the XAU/USD pair.

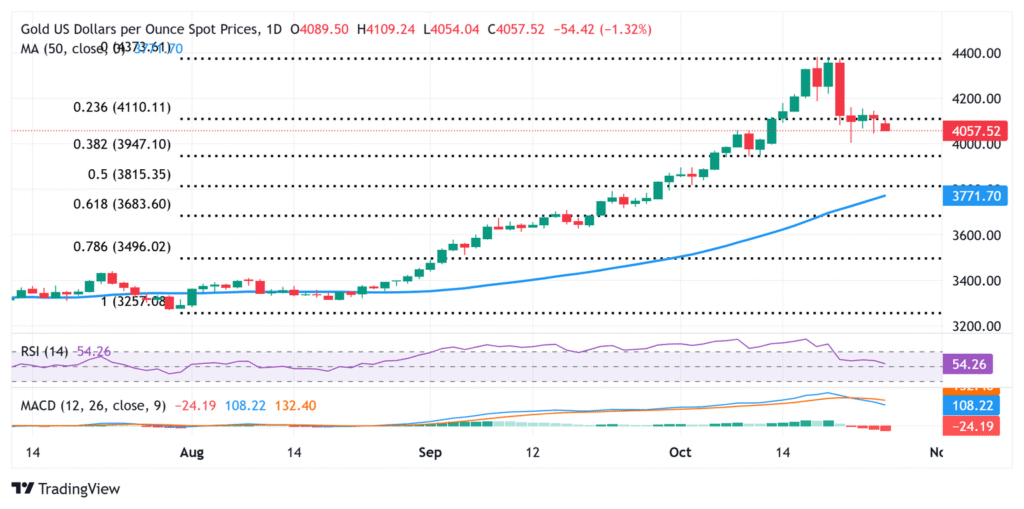

Gold seems vulnerable; the $4,200 psychological mark holds the key for bulls

From a technical perspective, the commodity now seems to have found acceptance below the 23.6% Fibonacci retracement level of the July-October blowout rally. However, last week’s bounce from the vicinity of the $4,000 psychological mark and mixed oscillators on the daily chart warrant caution for the XAU/USD bears. This, in turn, suggests that any subsequent slide below Friday’s swing low, around the $4,044 area, might continue to attract some buyers near the said handle. This is followed by the 38.2% Fibo. retracement level, around the $3,948 region, which, if broken decisively, could drag the Gold price to sub-$3,900 levels. Some follow-through selling should pave the way for a fall towards the 50% retracement level, around the $3,810-$3,800 region, en route to the 50-day Simple Moving Average (SMA), currently pegged near the $3,775 area.

On the flip side, the Asian session high, around the $4,109-4,110 region, which coincides with the 23.6% Fibo. retracement level support break point might continue to act as an immediate hurdle. A sustained strength beyond could lift the Gold price to the $4,155-4,160 supply zone, which, if cleared, could trigger a short-covering rally. The XAU/USD pair might then accelerate the positive move towards reclaiming the $4,200 mark and climb further towards the next relevant hurdle near the $4,252-4,255 region.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Read the full article here