The U.S. trade deficit widened to approximately $918 billion in 2024, and the national debt figure is well above $36 trillion. Bad news, no doubt. But then, anyone from anywhere in the world – from Argentina to Greece and Japan – can worry about costs and deficit. So, while “What will happen if the U.S. trade deficit continues to widen?” and “How will runaway debt levels hurt the U.S.?” are important questions, they are NOT the scariest questions for the U.S. right now.

“Will my investments take a big hit if there is a recession?” is a scary question. But then, you need to think about your investments over a long horizon instead of worrying about what will happen to them next month, next quarter or even next year. And you can always explore investment options that aim for growth while limiting downside, such as the High Quality portfolio, which has outperformed the S&P and clocked >91% returns since inception.

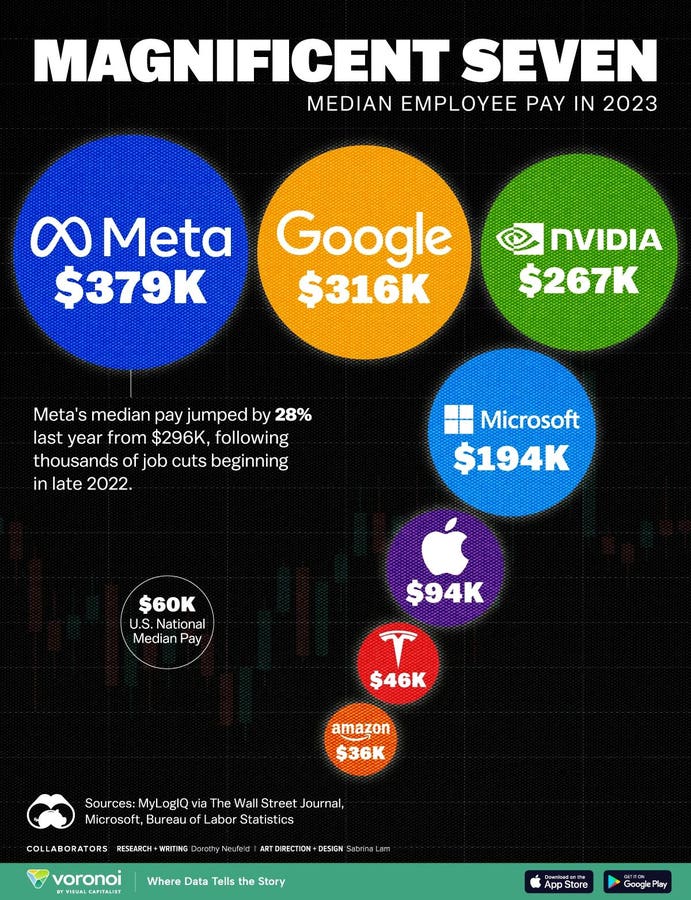

Coming back to scary questions, how about: “Where is the next Nvidia or Amazon going to be born?” or “Where is the next generation of the magnificent 7 being incubated right now?”

Sure, these are interesting questions. But how are these supposed to be scary?

That’s because you just implicitly assumed that it would be a U.S. company. So the real question is, what’s the likelihood that the location or zipcode of the next mag7 company is right here in the U.S? Is it greater than 80%, implying a 4 in 5 chance the next trillion-dollar company will be born here?

This metric – the high likelihood of value creation – is a way, way more powerful one than the measure of the U.S. debt or trade deficit. It is the measure of America’s value creation potential. It is the single biggest reason why investors around the globe overlook the country’s gaping trade deficit and the mountain of debt. And if this metric is headed in the wrong direction, it’s a big reason to be scared.

America’s Innovation Engine

What makes America great is its ability to serve as a melting pot for the best. The best entrepreneurs, chip designers, biologists, statisticians, and visionaries.

But think about this: The next Bezos, Gates, Jobs, and Musk – are they more excited or less about building their business in America than they were 1 year ago?

That’s the only question Trump and his administration, and all future leaders of this country, need to be thinking about. Why is that? It’s simple: the work of these extraordinary doers and thinkers is what has defined American success in the last 50 years.

Focus on value creation is more important than debt.

Would you rather worry about the $50 billion in trade deficit that the next Apple will create by manufacturing 1 billion of those iPhones, iPads, and accessories in China? Or, focus more on the $500 billion in revenue, or the $3 trillion in value that Apple has created in that process. We offer a unique perspective on the trade deficit here.

Revenue and value matter more. The deficit incurred is the cost.

The fuller impact is way more

Close to 35% of the S&P 500’s market cap comes from these magnificent 7 companies. But the significance of each of these companies – from Tesla to Nvidia, Apple, Amazon, or Microsoft – is way beyond the market cap figure.

Each of them has redefined entire industries and ecosystems. Ecosystems in which numerous other companies find prosperity – think Apple suppliers, and innumerable beneficiaries once Amazon’s cloud economy started. They create new cultures and establish new normals. These businesses impact and define all aspects of society and civilization, from education and academia to policies and politics. Think about the role of Twitter/X and Meta and their relevance to elections around the globe

These companies have defined life as we see it today.

What about the lost capability?

Do we still know how to manufacture chips, ball bearings, and guns? Of course we do. And yes, some of these should be brought back in the right dose to preserve strategic leverage. Let’s do it.

But let’s not lose sight of what really matters: ensuring that America remains the place where talent and innovation are rewarded. If we can’t tell the visionaries and dreamers from the charlatans and demagogues, we have no chance of creating the next big ecosystem and the next magnificent 7. The “fabulous 7,” if you will.

Being able to correctly pick companies that can go on to become one of the “fabulous 7” to add to your portfolio sounds exciting. But it is definitely not an easy task. And investing in just a few stocks can be risky. On the other hand, the Trefis High Quality (HQ) Portfolio, with a collection of 30 stocks, has a track record of comfortably outperforming the S&P 500 over the last 4-year period. Why is that? As a group, HQ Portfolio stocks provided better returns with less risk versus the benchmark index – less of a roller-coaster ride as evident in HQ Portfolio performance metrics.

Read the full article here