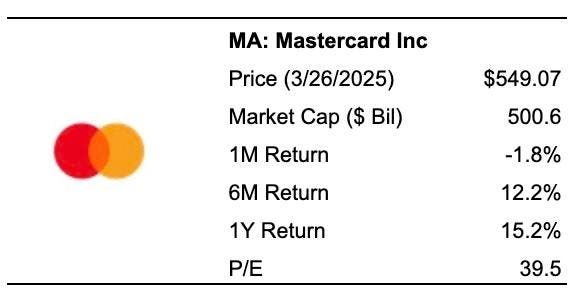

Question: How would you respond if you owned Mastercard stock (NYSE: MA) and it dropped by 40% or more in the next few months? While this might sound dramatic, it’s not unprecedented—and it could happen again. Mastercard stock has actually outperformed the broader market in 2025, gaining around 4% since January, whereas the S&P 500 has slipped by 2% during the same period. This strong showing was fueled by better-than-expected Q4 2024 results, driven by increased payment and cross-border volumes. That said, potential headwinds are looming. Overall market sentiment has turned cautious amid rising fears of a U.S. recession triggered by tariffs enacted by President Donald Trump. This could significantly affect Mastercard, given its reliance on consumer spending and international travel trends.

Here’s the point: Mastercard stock could face substantial losses in a downturn. In 2020, MA stock dropped by roughly 41% in just a few quarters, and during the inflation-driven sell-off in 2022, it fell around 29%—performing slightly worse than the S&P 500. This raises a key question: Could the stock tumble to $320 in a similar scenario? Individual stocks typically exhibit greater volatility than diversified portfolios. If you’re looking for growth with less risk, consider the High-Quality portfolio, which has beaten the S&P 500 and delivered returns of over 91% since inception.

Why Is It Relevant Now?

President Donald Trump’s aggressive trade policies—including a 20% tariff on Chinese goods and 25% on imports from Canada and Mexico, along with tighter immigration rules—have sparked fears that inflation could make a comeback. These developments suggest that the U.S. economy may face serious challenges, even tipping into recession, as discussed in our analysis here on the macro picture. Earlier this month, the President didn’t dismiss the idea that these tariffs could prompt a recession. Given the rising uncertainty tied to these policies, the risks are worth watching. Add in global instability like the Ukraine–Russia conflict and ongoing trade disputes, and the economic outlook remains murky. Tariffs raise import costs, push prices higher, cut into consumer purchasing power, and reduce spending.

These conditions could negatively affect Mastercard. If rising prices cause consumers to trim discretionary spending, Mastercard may see reduced transaction volumes. A potential recession—bringing job cuts and lower incomes—could worsen the decline in consumer payments. Additionally, companies managing tighter budgets might reduce spending, including on business travel and transactions. If travel slows due to global instability, Mastercard’s high-margin cross-border revenues—which have been growing rapidly—could take a hit, squeezing overall revenue and profitability.

How resilient is MA stock during a downturn?

MA stock has held up slightly better than the S&P 500 during some past downturns. Concerned about what a market crash could mean for MA stock? Our dashboard How Low Can Mastercard Stock Go In A Market Crash? includes detailed performance analysis across previous market crashes.

Inflation Shock (2022)

• MA stock declined 28.6% from a high of $396.75 on February 2, 2022 to $283.38 on October 12, 2022, compared to a 25.4% drop for the S&P 500

• The stock fully recovered by July 11, 2023

• As of March 2, 2025, it hit a high of $576.31 and is now trading around $550

Covid Pandemic (2020)

• MA stock fell 41.0% from $344.56 on February 19, 2020 to $203.30 on March 23, 2020, while the S&P 500 declined 33.9%

• The stock fully recovered by August 25, 2020

Global Financial Crisis (2008)

• MA stock plunged 62.8% from $32.00 on June 2, 2008 to $11.92 on January 20, 2009, compared to a 56.8% drop for the S&P 500

• The stock fully rebounded by August 3, 2011

Premium Valuation

At a current share price of around $545, Mastercard trades at nearly 34x projected 2025 earnings, which appears somewhat expensive. Although the company’s growth is solid, it isn’t exceptional—consensus estimates suggest annual revenue growth of about 11% for FY’25 and FY’26. Operating expenses have also been on the rise in recent years. On top of that, regulatory risks remain. The proposed Credit Card Competition Act, which aims to reduce merchant fees and increase competition in the payments sector, could challenge the market dominance of Mastercard and its main competitor Visa in the U.S.

Considering the possible slowdown in growth and macroeconomic risks, ask yourself: will you continue to hold MA stock, or will you sell if it slides to $320 or below? Holding a stock in decline is always tough. Trefis, in collaboration with Empirical Asset Management—a Boston-based wealth advisory firm—has developed asset allocation strategies that posted gains during 2008-09 while the S&P fell over 40%. Empirical integrates the Trefis HQ Portfolio into its strategies to offer improved returns and reduced volatility versus the benchmark—a smoother investing experience, as seen in the HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here