Retirement may seem light years away, especially when you’re juggling with student loans, rent and the cost of living. But there’s one discreet move that can pay off: start planning for retirement as early as possible, with an Individual Retirement Account (IRA), for example.

Why now? Because in the world of personal finance and investing, time isn’t just money, it’s also exponential growth, tax advantages and future freedom. And the earlier you start saving, the greater these benefits become.

Let’s take a look at why starting to save early on an IRA could be one of the smartest financial moves you can make, even if you only contribute a little at first.

Compound interest: Your best ally in retirement planning

The greatest advantage of opening an early retirement account (IRA) is the power of compound interest. When you invest money, it produces returns, and those returns, in turn, produce more returns.

Over time, this snowball effect can turn modest contributions into substantial retirement savings.

Investing $1,000 today with an annual interest rate of 8% would earn you more than $10,000 in 30 years, thanks to compound interest.

Source: Nationwide Retirement Plans

Time multiplies your money. By starting early, your money works harder, so you don’t have to do it later.

Let’s say you invest $7,000 per year, the limit for an IRA, starting at age 25. By the time you’re 67, assuming a 7% average annual return, you could have over $900,000. Wait just 10 years to start, and you’d need to contribute nearly twice as much annually to reach the same goal (and the maximum yearly limits set by the IRS wouldn’t let you do it).

Start an IRA early to avoid catching up later

It’s tempting to put off saving for retirement until your twenties or thirties. But the longer you wait, the harder – and more expensive – it becomes to catch up.

For example:

- Starting to save $250/month at age 25 will give you about $750,000 by age 65.

- Starting at 35 with the same amount will give you about $375,000.

- Starting at age 45 would save you only $175,000.

The longer you delay, the more you’ll have to save each month to compensate. And it gets more complicated as family burdens or expenses increase with age.

Starting an IRA early means saving less for the same amount in retirement

Here’s a counter-intuitive truth: saving early often means saving less in total, while accumulating more money in the end, thanks in particular to compound interest.

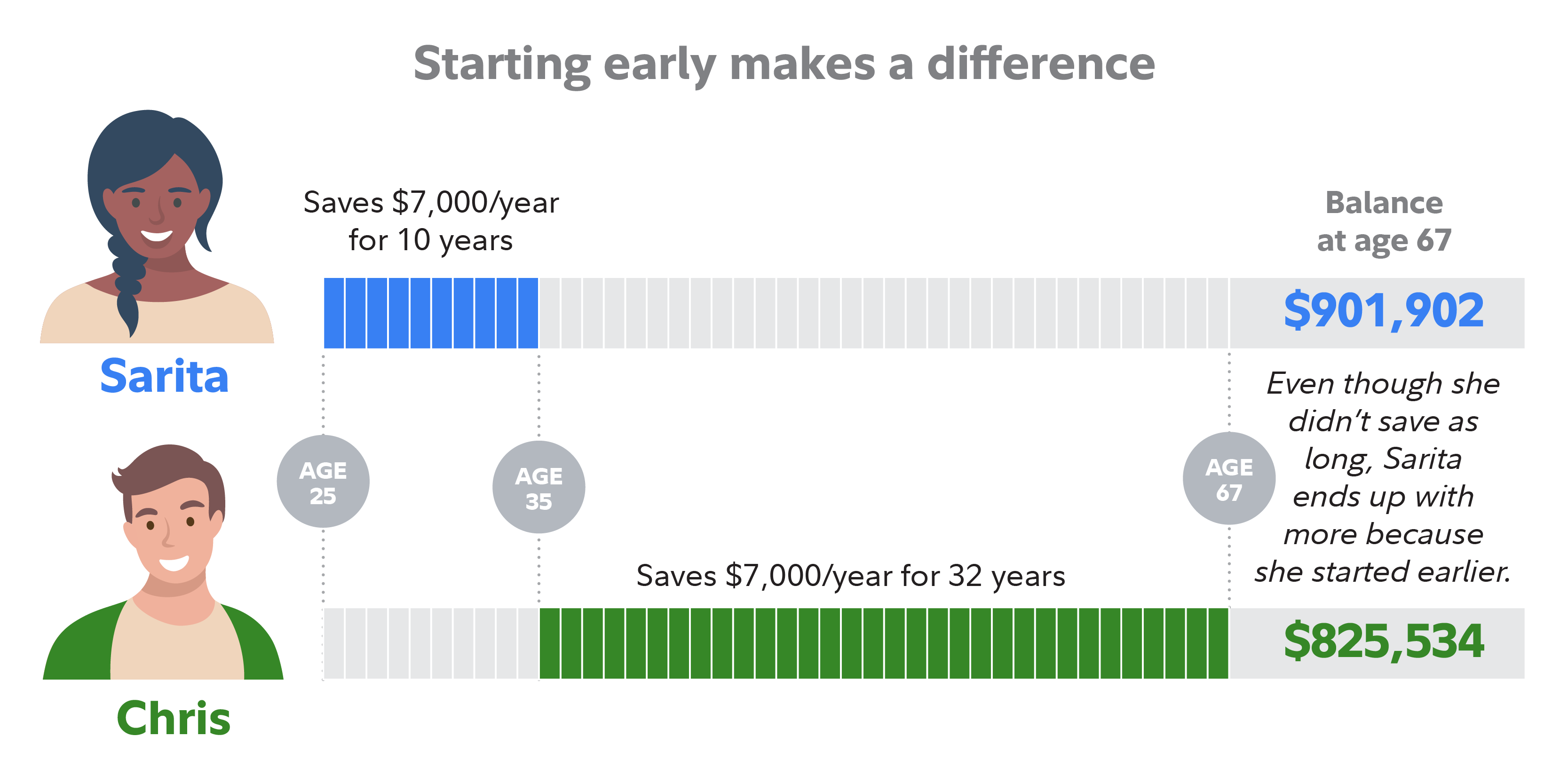

Let’s imagine two people:

- Person A starts saving at age 25 and contributes $7,000 a year for 10 years, then adds nothing between age 35 and 67.

- Person B starts at age 35 and contributes $7,000 each year until age 67, for a total of 32 years of contributions.

Assume an average annual return of 7%, excluding taxes and inflation.

At age 67, both individuals will have accumulated:

- Person A: $901,902

- Person B: $825,534

So, at age 67, Person A, who saved only $70,000 over 10 years, but started early, could have more money in retirement than Person B, who saved $224,000 over 32 years, but started later.

Source: Fidelity

This is the power of time and compound interest. Money invested early benefits from decades of growth on itself. And that can offset, even outweigh, larger contributions started later.

Of course, this is a theoretical example, which doesn’t take into account fees, taxes or market fluctuations. But the message is clear: the earlier you start, the less you’ll need to save to reach your goals.

Small amounts can make a big difference

Can’t put aside $7,000 a year? That’s not a problem. The key is to start with what you can – even $50 or $100 a month – and build up gradually.

With an IRA, you’re flexible: you can contribute at your own pace, and even automate your monthly payments.

When it comes to retirement savings, regularity is more powerful than amount.

Starting an IRA early means taking advantage of tax benefits for longer

Another important advantage of an IRA is its tax benefits. Depending on the type of account you choose, Traditional or Roth IRA.

- Your contributions can reduce your taxable income today (Traditional IRA).

- Or your withdrawals will be entirely tax-free in retirement (Roth IRA).

In both cases, investments benefit from tax-sheltered growth, accelerating their development over the long term.

And the earlier you start, the longer you’ll benefit from these tax advantages.

Don’t rely solely on Social Security

Many Americans think that Social Security will be enough to live on in retirement. But it’s only a safety net, replacing an average of 40% of earned income, according to a Social Security Administration report, rarely enough to live comfortably.

Worse still, according to the latest report from the Social Security Board of Trustees, without reform, the fund’s exhaustion date is now estimated at 2034. At that point, only 81% of projected benefits could be paid out, a reduction of around 19% for beneficiaries.

Opening an IRA means taking matters into your own hands and not relying exclusively on an uncertain public system.

Starting retirement planning early also means greater freedom

Saving young doesn’t just mean having more money. It means having more options, such as retiring earlier, changing career, taking a sabbatical year, starting your own business… With well-built savings, these choices become possible.

Conversely, the longer you delay saving, the more you’re tied to your salary and your obligations.

Don’t wait for the “right moment”

There will always be a good excuse not to start saving for retirement now. But waiting is expensive. And it’s often an invisible cost until it’s too late.

Opening an Individual Retirement Account (IRA) early, even with small amounts, gives you an advantage that most people don’t have.

You benefit from compound interest, tax advantages, reduce your dependence on Social Security, and develop a retirement savings discipline now.

IRAs FAQs

An IRA (Individual Retirement Account) allows you to make tax-deferred investments to save money and provide financial security when you retire. There are different types of IRAs, the most common being a traditional one – in which contributions may be tax-deductible – and a Roth IRA, a personal savings plan where contributions are not tax deductible but earnings and withdrawals may be tax-free. When you add money to your IRA, this can be invested in a wide range of financial products, usually a portfolio based on bonds, stocks and mutual funds.

Yes. For conventional IRAs, one can get exposure to Gold by investing in Gold-focused securities, such as ETFs. In the case of a self-directed IRA (SDIRA), which offers the possibility of investing in alternative assets, Gold and precious metals are available. In such cases, the investment is based on holding physical Gold (or any other precious metals like Silver, Platinum or Palladium). When investing in a Gold IRA, you don’t keep the physical metal, but a custodian entity does.

They are different products, both designed to help individuals save for retirement. The 401(k) is sponsored by employers and is built by deducting contributions directly from the paycheck, which are usually matched by the employer. Decisions on investment are very limited. An IRA, meanwhile, is a plan that an individual opens with a financial institution and offers more investment options. Both systems are quite similar in terms of taxation as contributions are either made pre-tax or are tax-deductible. You don’t have to choose one or the other: even if you have a 401(k) plan, you may be able to put extra money aside in an IRA

The US Internal Revenue Service (IRS) doesn’t specifically give any requirements regarding minimum contributions to start and deposit in an IRA (it does, however, for conversions and withdrawals). Still, some brokers may require a minimum amount depending on the funds you would like to invest in. On the other hand, the IRS establishes a maximum amount that an individual can contribute to their IRA each year.

Investment volatility is an inherent risk to any portfolio, including an IRA. The more traditional IRAs – based on a portfolio made of stocks, bonds, or mutual funds – is subject to market fluctuations and can lead to potential losses over time. Having said that, IRAs are long-term investments (even over decades), and markets tend to rise beyond short-term corrections. Still, every investor should consider their risk tolerance and choose a portfolio that suits it. Stocks tend to be more volatile than bonds, and assets available in certain self-directed IRAs, such as precious metals or cryptocurrencies, can face extremely high volatility. Diversifying your IRA investments across asset classes, sectors and geographic regions is one way to protect it against market fluctuations that could threaten its health.

Read the full article here