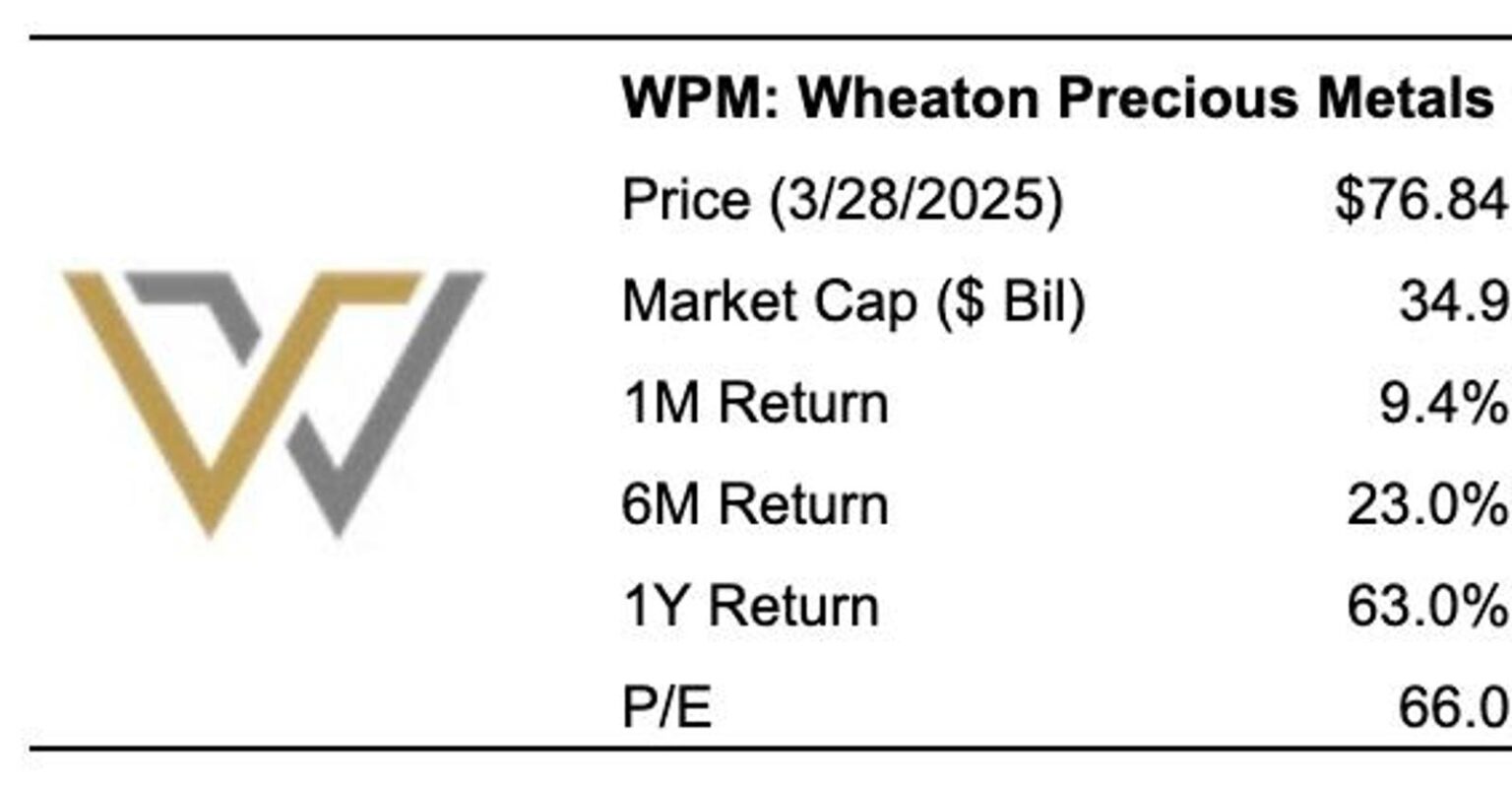

Wheaton Precious Metals stock has jumped more than 60% over the past year, while the S&P 500 index has only seen a 9% increase. This performance exceeds that of its competitors, such as Barrick Gold stock (NYSE: GOLD), which rose 19%, and Newmont Corporation (NYSE: NEM), which gained 34% over the same period.

The strong rise in Wheaton’s stock over the past year can be attributed mainly to increasing precious metals prices. Gold and silver prices climbed in 2024 due to factors such as slowing inflation, geopolitical conflicts like the Russia-Ukraine war, and uncertain policy signals from the U.S. Federal Reserve. Wheaton also expanded its output through new streaming agreements, including the Fenix and Kone projects, and gained from better-than-expected gold grades at its existing sites. Additionally, the company boosted its quarterly dividend for 2025, signaling its confidence in continued strong profitability. For investors seeking growth with less volatility than individual stocks, the High Quality portfolio, which has consistently outpaced the S&P, may be worth a look, with returns exceeding 91% since launch.

Factors behind Wheaton’s stock performance over the past year

Part of the stock’s rise can be credited to a 26% increase in annual revenue in 2024 to $1.3 billion and the maintenance of a robust gross profit margin. The company posted record quarterly operating cash flows of $1.028 billion.

While Wheaton experienced strong top-line growth in 2024, its price-to-sales (PS) ratio also climbed from 22x in 2023 to 28x now. This increase aligns with its solid stock gains, likely fueled by higher metal prices, better revenues, or improved investor sentiment toward streaming companies.

WPM stock performance over the last four years has not been linear, although it has shown less volatility compared to the S&P 500. Annual returns stood at 4% in 2021, -8% in 2022, 28% in 2023, and 15% in 2024. The Trefis High Quality Portfolio, comprising 30 stocks, has delivered better consistency and has significantly outperformed the S&P 500 over the same period.

Why is that? Stocks in the HQ Portfolio have delivered superior returns with reduced risk compared to the broader market; offering a more stable experience, as reflected in HQ Portfolio performance metrics. Considering today’s uncertain macro environment—including rate cut speculation and ongoing geopolitical tensions—WPM may either follow past underperformance seen in 2021 and 2024 or deliver another strong year.

What’s ahead for Wheaton’s stock?

Wheaton Precious Metals delivered a strong Q4 2024, with record revenue and impressive earnings growth. It reported $381 million in Q4 revenue, marking a notable year-over-year gain. Adjusted earnings per share came in at $0.44. Looking ahead, Wheaton expects annual production to rise by 40% to 870,000 gold equivalent ounces (GEOs) by 2029, with 2025 output projected between 600,000 and 670,000 GEOs. In summary, WPM’s strategic initiatives, favorable market dynamics, and solid operational performance have propelled its stock upward over the past year. We currently value the Wheaton Precious Metals valuation at $77 per share, which is in line with the current market price.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here