Was Buffett’s Apple Sell-Off And The Investment In Dominos A Good Shift In Strategy?

By Horse Poor Investor

Summary

- Warren Buffett’s Berkshire Hathaway has sold over 615 million Apple shares.

- Proceeds from the Apple sales have been partially reinvested in Domino’s Pizza.

- While Apple is overvalued, Dominos may offer a balanced investment possibility with growth potential.

Over 26% of Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway portfolio is invested in Apple stock, which he has owned since 2016 and is still his largest holding; however, he has sold over 615 million shares of Apple in the past four quarters.

Overvalued and Tax Concerns

Apple has traditionally been a high-flying quality stock with a vast moat, an exemplary capital allocation strategy, and a tactical product rollout. Still, the stock has been heavily overvalued since late 2023, with a current value hovering around 20% over GuruFocus’ calculated fair market value of $189.29. Furthermore, Buffett’s nearly 25% share reduction during September was more likely due to tax considerations. During the Berkshire Hathaway annual meeting in May, Buffett stated that he expected future tax rates to rise.

Tentative with Technology

Another reason for selling may be that Buffett is less comfortable with technology companies than his late partner, Charlie Munger, as Berkshire started offloading shares shortly after Charlie passed away in November 2023. Before his passing, Munger emphasized the importance of owning stocks like Apple and Alphabet, acknowledging their dominance and consistent outperformance in the market.

Dominos Investment

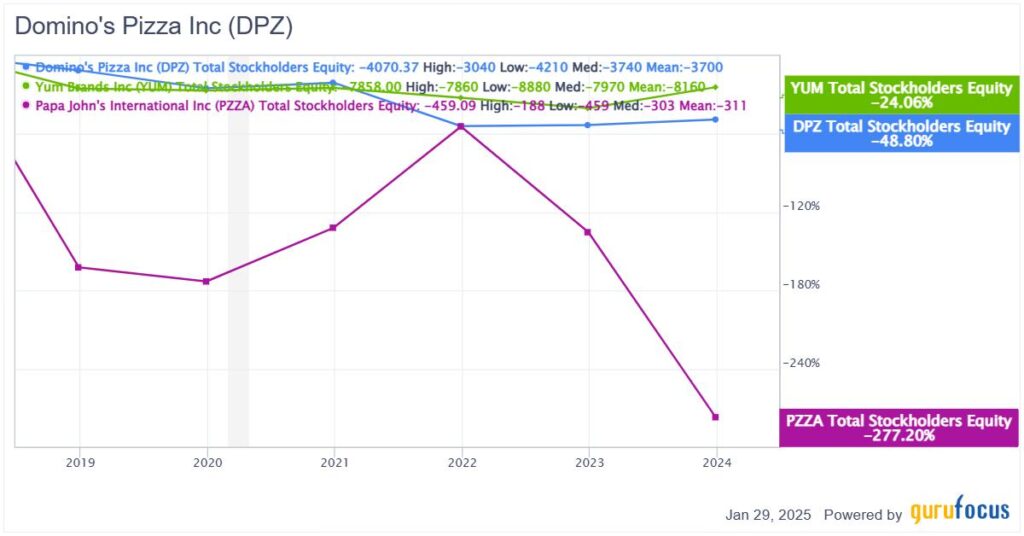

Buffett’s Apple sales have generated nearly $25 billion, giving Berkshire Hathaway a large cash pile for other investments. Fifty-five million of that cash has been invested in high-quality Domino’s Pizza, representing approximately 3.7% of company shares. This solid-value, non-technology franchise business may appeal more to Buffett than his existing overinflated Apple stock. The stock is trading slightly below Guru Focus’s fair market value estimate of $428.28, with an overall score of 92 and a profitability rank of 10 out of 10. Domino’s share price is expected to rise approximately 10% in the next 12 months versus Apple’s, which is predicted to increase by less than 1%. Domino’s fortressing strategy, global master franchise agreements, Pulse POS system, and recently upgraded customer loyalty program have helped the company expand globally and drive domestic carryout traffic. The company is the prominent market leader in the quick-service restaurant (QSR) pizza business and outperformed Papa John’s and Pizza Hut (owned by Yum Brands) in 2024. The company has an impressive 56% ROIC, contrasting sharply with a meager 9.95% WACC, suggesting the company is effectively allocating capital and accreting value despite a heavy debt burden.

Domino’s debt burden is reflected in the company’s long history of negative debt-to-equity and equity-to-asset ratios. However, these metrics align with Papa John’s and Yum Brands in this competitive, capital-intensive industry. With its huge cash pile, Berkshire Hathaway’s interest in the company may help alleviate investor concerns. Domino’s paid investors a $1.51 per share dividend in September and has had a 20% dividend growth rate over the last 10 years. That policy may be questionable, given their negative equity history.

Apple’s Short and Long-Term Prospects

Apple’s stock rose more than 30% in 2024 and is trading at all-time highs. Many fear the stock may lose momentum, as reflected in Guru Focus’s flat share price target for the next 12 months. However, Apple investors might not want to unload their stock just yet.

Near-term prospects are mixed due to geopolitical risks related to Apple’s supply chain in China and Taiwan. With Trump’s return to office, we might see a continuation of his previous trade policies, which previously have included tariffs on Chinese products and stricter enforcement of trade agreements.

Apple also has antitrust concerns. Since Google is the default search engine on Safari, Apple has taken an interest in the Department of Justice versus Google case, which may negatively impact Apple’s ability to provide premium products to users. Weakened consumer spending may exacerbate these problems.

However, the release of the new iPhone 16, the Apple Watch Series 10, and AirPods 4 holds some promise that the stock may maintain a similar 2024 trajectory, including record revenues of 9.4 billion, a 6% year-over-year increase, and a 12% earnings increase. Apple is also developing a proprietary cellular modem, expected to roll out in 2025, starting with the iPhone SE and even eventually moving to premium models by 2027. This vertical integration strategy is expected to drive margin expansion.

With the adoption of Apple Intelligence, Apple’s latest artificial intelligence system, introduced at the company’s tradeshow, Worldwide Developers Conference 2024, dedicated Apple users are expected to upgrade their current iPhone models in 2026. The company is also expected to have an 11.4% compounded annual growth rate in service revenue through fiscal year 2027. For these reasons, Morgan Stanley forecasts a 12.3% revenue growth and earnings per share of $8.52 for 2026.

The Stalwart Parent

Cautious investors can’t go wrong with Buffett’s company, Berkshire Hathaway. Berkshire Hathaway shows moderate short-term gain potential with strong financial health and profitability metrics. Net margin, return on assets, return on equity, and return on invested capital indicate strong financial health compared to the S&P 500. The company had a record $325.2 billion in cash and cash equivalents at the end of Q3 2024, up from $276.9 billion at the end of June 2024. Berkshire Hathaway A and B shares are priced slightly above Guru Focus’s calculated values. Investment income trends for the company remain strong due to increased bond reinvestment rates and Berkshire also exhibits attractive long-term prospects due to consistent revenue and net income growth, improved financial health, and a diversified business model. Berkshire Hathaway is expected to earn over $23.00 per share by 2027 through 2029 and may also continue to benefit from strategic acquisitions.

However, there are a few cracks in the armor. Operating earnings were $4.68 per share in the third quarter of 2024, a decline due to decreased underwriting income from industrywide catastrophes. The company has a history of rising debt and inconsistent per-share cash flow within the last 5 years.

In November 2024, CFRA downgraded its rating on Berkshire Hathaway’s Class B shares from ‘Buy’ to ‘Hold,’ attributing the decision to lower EPS estimates and revenue forecasts caused by widespread declines in operating revenues and insurance premiums.

Morningstar lowered Berkshire Hathaway’s moat rating from wide to narrow due to several factors. They observed signs of slippage in the railroad business and increased litigation exposure for the utilities/energy business, which have put downward pressure on excess returns for the noninsurance operations. Moreover, following Buffett’s inevitable departure, the company will likely find it challenging to replicate the historic advantages he provided, making it harder for Berkshire to achieve superior returns consistently over the next decade.

Berkshire Hathaway is the clear winner for more risk-averse investors. The company has low PE and EV/EBITDA ratios and a nearly 70% margin of safety based on GuruFocus’ discounted cash flow model. Still, these calculations may be highly unpredictable due to the company’s narrowing moat, challenges in capital allocation, and inevitable leadership transition.

Take-Aways

Buffett’s Berkshire Hathaway significantly reduced its Apple holdings, selling over 615 million shares due to concerns about Apple’s overvaluation and future tax rates. This shift reflects Buffett’s cautious stance on technology stocks following the passing of his partner, Charlie Munger.

The proceeds from these sales have been partially reinvested in Domino’s Pizza, a high-quality, non-technology franchise that aligns more closely with Buffett’s investment philosophy.

Despite Apple’s strong performance and promising product rollouts, its overvaluation and geopolitical risks present challenges. Meanwhile, Berkshire Hathaway faces headwinds such as decreased underwriting income, rising debt, and a narrowing moat, compounded by the impending leadership transition post-Buffett. Domino’s Pizza emerges as a compelling value investment, offering a balance of growth potential and dividend yield despite its high debt levels.

Read the full article here