ChatGPT and Claude, be warned! DAL-IO could be next. Legendary investor Ray Dalio asked LinkedIn and X users for questions he could train his AI clone on. (I made up the name, but Dalio’s welcome to use it for a small licensing fee.)

By the way, have you signed up for our new markets newsletter, First Trade? It launches Monday, so be sure to subscribe.

In today’s big story, tonight marks the first debate in the NYC mayoral race. We examined where Wall Street workers are putting their money.

What’s on deck:

Markets: Jamie Dimon weighs in on everyone’s favorite debate: Is AI a bubble?

Tech: How a handful of young startup founders we’re dubbing “Young Geniuses” pitched themselves to investors and raised millions.

Business: The price for using superstar attorney Alex Spiro keeps going up.

But first, Wall Street on the campaign trail.

If this was forwarded to you, sign up here.

The big story

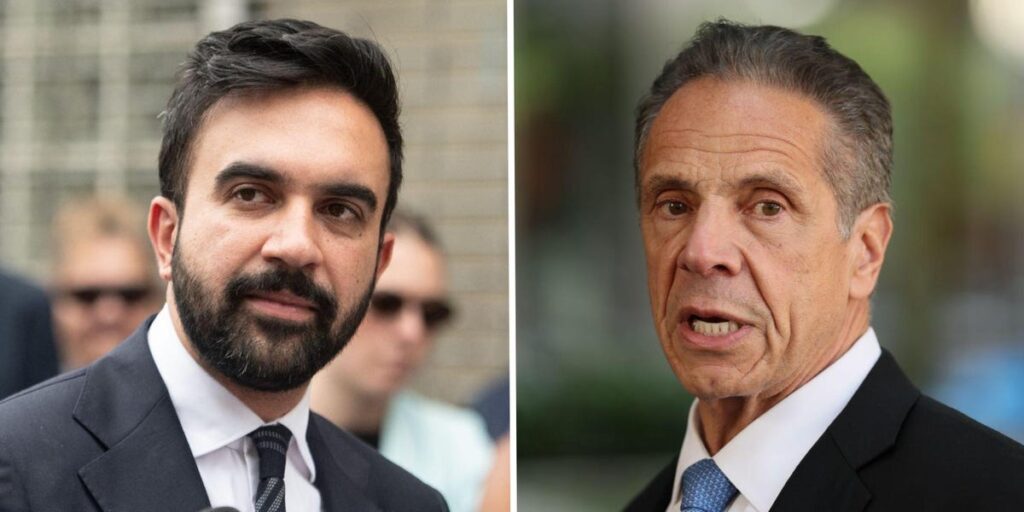

Mamdani vs. Cuomo

Wall Street’s stance on New York’s mayoral race might surprise you.

At first glance, you might think the choice between Andrew Cuomo and Zohran Mamdani is clear-cut for finance workers. Mamdani, a democratic socialist, appears to represent the antithesis of everything Wall Street is about.

But a Business Insider analysis of donation data shows a much more even split between the two candidates — at least when it comes to the number of people donating to their campaigns.

Across 400 financial companies, 401 workers donated to Mamdani’s campaign compared to 397 backing Cuomo. The gap, however, is much larger when considering the amount of money spent.

Cuomo received 88% of the money donated, with the average amount sent to Cuomo ($1,006) dwarfing what Mamdani received ($131). When including PAC spending, Cuomo holds an even bigger edge, with 95% of the more than $9 million donated from the financial industry going to pro-Cuomo or anti-Mamdani efforts.

That differential is representative of the type of finance workers backing both candidates. Front-office employees (think dealmakers and investors) are largely team Cuomo, while back-office workers (administrative-type roles or those in tech) lean toward Mamdani.

Still, there’s no guarantee the status quo will remain until Election Day.

Tonight marks the first debate between Mamdani and Cuomo. (I suppose I should mention Republican nominee Curtis Silwa is also on the ticket, so here’s me saying that.)

And as much as finance executives don’t like Mamdani and his politics (and some of them really don’t like him), they’re likely not fans of pouring money into a losing effort.

Mamdani holds a double-digit lead in almost every major poll. If prediction markets are more your speed, Mamdani’s got an 88% chance of winning according to Polymarket.

Outside a major slip-up in tonight’s debate, or some other unforeseen event, Mamdani has a really good chance at being Gotham City’s next mayor. And if that’s the case, some on Wall Street could change their tune.

I’m not suggesting you’ll start seeing managing directors wearing Mamdani swag. But some might soften their stance to gain favor with the potential new top politician in town. If the past year has taught us anything, it’s that businesses can be flexible when it comes to politics.

(Case in point: JPMorgan’s Jamie Dimon said he’d help Mamdani, who he once described as “more of a Marxist than a socialist,” if he wins.)

Still, there are those who aren’t prepared to give up their fight against Mamdani. Billionaire hedge funder Bill Ackman made a seven-figure donation to an anti-Mamdani super PAC as recently as Wednesday.

If Mamdani ultimately wins, that could also mean another financial exodus, perhaps to Florida, like we saw during the pandemic or maybe it’ll be the big push “Y’all Street” has been preparing for.

Either way, the rest of the country will be watching. If Mamdani wins, businesses and their leaders will be eager to see how the world’s financial epicenter reacts to the arrival of a democratic socialist at the helm.

3 things in markets

1. The White House doesn’t want to TACO about it. If you’re banking on the “Trump Always Chickens Out” trade, Treasury Secretary Scott Bessent recently told investors don’t. He said the White House won’t back down from tough trade talk just to boost stocks. Those comments come a day after Trump reignited the TACO trade, though.

2. Wall Street’s dealmaking drought might be over. Big banks like Goldman Sachs and Morgan Stanley reported blockbuster earnings this week just as CEOs revived mergers and financing plans. Goldman Sachs’s advisory revenue, for example, jumped 60% from a year earlier. It’s the latest sign that the dealmaking wave could be here to stay.

3. Where Jamie Dimon stands on the great AI bubble debate. So, are we in a bubble or not? The JPMorgan boss said he doesn’t think so at a conference on Tuesday, although he added that some AI projects won’t pan out.

3 things in tech

1. It’s not just your job. AI is coming for your side hustle, too. The tech does wonders for productivity, making it easier to take on various side gigs. At the same time, it’s stifling creativity and driving down wages. It’s making the future of side hustles very murky.

2. Another team bites the dust at Scale AI. The startup just cut a generalist task-focused contractor team in its Dallas office. The move comes amid a wider pivot toward more specialized AI tasks. It offered the workers four weeks of severance and invitations to its gig-work platform, according to an email from a staffing agency used by the startup.

3. The young tech founders raising millions in the AI era. From teenagers to 20-somethings, young startup founders are having a moment in the AI era. For BI’s Young Geniuses series, these youthful founders who have raised millions in funding shared the pitch decks they used to impress investors.

3 things in business

1. Inside the Manhattan building that used to be JPMorgan’s stomping grounds. Once home to the bank’s back offices, 25 Water Street is now bustling with residents moving into its 1,320 units. It’s the largest completed office-to-residential project in the country. Take a look inside.

2. Palmer Luckey’s crypto bank gets a green light (for now). Luckey’s crypto- and tech-focused Erebor Bank cleared an important regulatory hurdle by securing preliminary approval from federal regulators. It still needs FDIC approval to open, though, plus a final sign off from the feds.

3. For $3,000 an hour, Alex Spiro will give you legal advice. In the last four years, Spiro, whose clientele range from Kim Kardashian to Elon Musk, has nearly doubled his hourly rate, according to records. That’s a more than 16% increase on average each year, outpacing inflation and other lawyers’ rates at top firms. The elite fee also puts him in a very small club.

In other news

What’s happening today

- New York mayoral race debate.

- Nestle reports earnings.

Dan DeFrancesco, deputy executive editor and anchor, in New York. Hallam Bullock, senior editor, in London. Akin Oyedele, deputy editor, in New York. Grace Lett, editor, in New York. Amanda Yen, associate editor, in New York.

Read the full article here