On January 6, Nvidia CEO Jensen Huang made a series of what looked to me like relatively small announcements — including products for industries such as robotics, cars, and gaming — at the Consumer Electronics Show in Las Vegas, according to the Wall Street Journal.

Are these mini-announcements a diversion? One analyst thinks the biggest news could be Nvidia’s strategy to compete with cloud services customers — Amazon, Microsoft, and Alphabet — by building its own AI cloud, noted Investor’s Business Daily.

Nvidia — whose shares rose almost 4% in pre-market trading — is excited about the opportunity to provide software for robotics developers. “The ChatGPT moment for robotics is coming,” Huang told CES attendees according to IBD.

“Like large language models, world foundation models are fundamental to advancing robot and AV development, yet not all developers have the expertise and resources to train their own. We created Cosmos to democratize physical AI and put general robotics in reach of every developer,” he added.

An Nvidia spokesperson I contacted declined to comment.

Nvidia’s CES Product Announcements

If there is one thing I learned in writing my latest book, Brain Rush, it is this: Nvidia’s future depends heavily on collaboration with companies closer to technology end-users.

That’s because Nvidia — which designs chips and builds software for developers — can only enjoy rapid growth by motivating companies closer to end-users — such as chip fabricators, cloud services providers, enterprise software companies, and management consultants — to make Nvidia’s products part of a system that businesses and consumers find valuable.

Nvidia’s CES product announcements are aimed at strengthening such partnerships. Here are the industries these announcements aim to enhance:

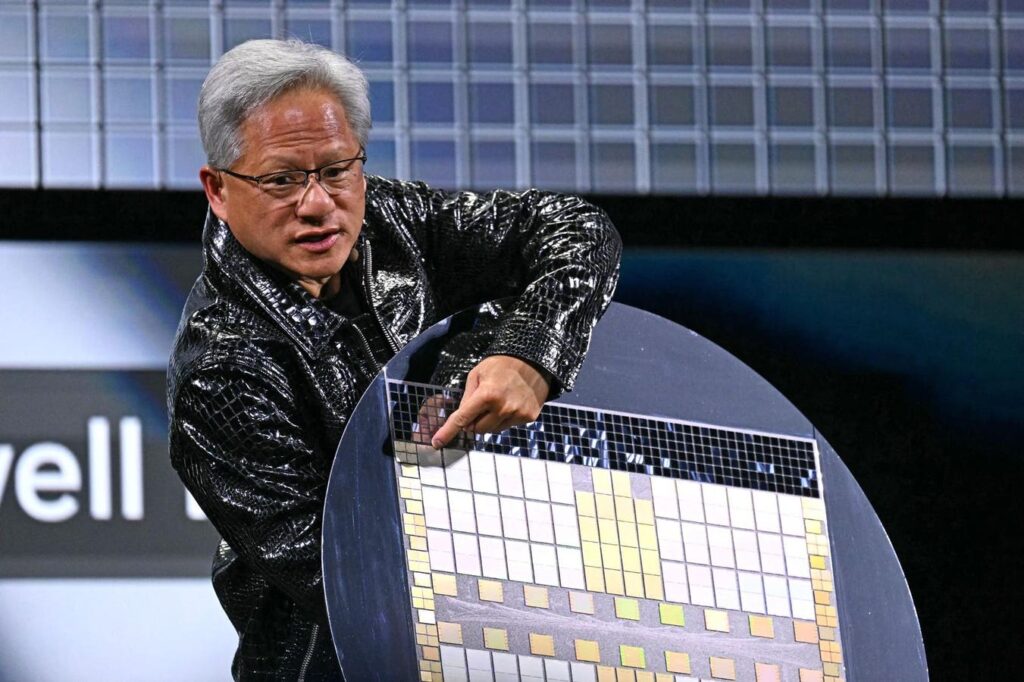

- Robotics. At CES, Huang demonstrated “physical AI” simulation tools for helping robots learn. These Cosmos foundation models “generate photo-realistic video” to train robots and self-driving cars — Uber is a Cosmos customer — more efficiently than does conventional data, according to Reuters. Nvidia sees a $38 billion market opportunity in the “next couple of decades” for bringing robots to warehouses and factories, noted the Journal.

- Cars. Nvidia — which currently partners with Mercedes and Volvo — announced a deal for Toyota to purchase driver-assistance chips and software for future vehicles. Huang said automotive revenue could increase 25% to $5 billion in the next fiscal year beginning later this month, the Journal reported.

- Gaming. Nvidia announced chips for desktop and laptop PCs based on the Blackwell architecture used for AI — to give gamers better graphics and higher resolution. The RTX 50-series chips — which will be available in March — will support a feature called DLSS 4 that uses AI to boost gaming frame rates, reported CNBC. In the company’s October-ending quarter, Nvidia’s gaming sales were relatively small — accounting “for under 10% of total revenue, compared to 88% from data center chips,” CNBC noted.

- AI reearchers and data scientists. Nvidia announced Project DIGITS — a desktop AI supercomputer with the company’s latest Blackwell AI chip starting at $3,000 — to enable AI researchers and data scientists to work on AI models without tapping “Nvidia’s cutting-edge AI chips housed in data centers,” the Journal reported.

- Agentic AI. Nvidia released software to automate work in enterprises — called agentic AI blueprints. Agentic AI completes a series of tasks — for example, planning a vacation, comparing flights, hotels, and excursions, and booking and paying for the best ones available, noted Brain Rush. Nvidia’s AI blueprints — such as PDF to Podcast — help researchers quickly understand key takeaways in long PDFs, noted IBD.

Nvidia’s AI Cloud Strategy

While Nvidia did not make an announcement about this at CES, the biggest news from the company could be a strategy to compete with its cloud services customers who account for most of the company’s growth.

Indeed one analyst detected Nvidia’s growing appetite for leased data center capacity equipped for AI processing. Such AI data centers would “rent out servers powered by its own chips as well as host its AI software development platform,” noted Investor’s Business Daily.

The analyst sees Nvidia’s push into cloud computing as a New Year’s surprise. “We see the potential for Nvidia to accelerate its data center leasing in 2025 as it looks to procure more capacity that can be used for its ‘AI cloud,’ with the potential for Nvidia to outpace its hyperscale peers in data center leasing in 2025,” noted TD Cowen analyst Michael Elias in a report featured by IBD.

In addition to looking for more data center capacity in other deals, Elias noted an “apparent large leasing deal between Nvidia and Digital Realty for data center capacity in Northern Virginia,” IBD reported.

Nvidia’s AI Cloud would compete with so-called Neoclouds — AI processing cloud services from the likes of CoreWeave, Lambda, Crusoe, Vultr and Together AI, noted IBD — as well as Nvidia’s biggest AI chip customers Amazon and Microsoft, wrote Elias.

By building its own Neocloud, Nvidia could take more profit from a fast-growing industry sector. Nvidia — which now distributes its AI software by leasing it through AWS — could boost its profits by operating its own cloud. AI neoclouds are expected to grow at a 100% compound annual rate from $4 billion last year to $32 billion by 2027, according to Pitchbook.

Meanwhile, Nvidia’s cloud customers are trying to buy more AI chips from rivals and build their own custom chips. For example, in addition to buying Blackwell chips from Nvidia, hyperscalers are buying AI processors from Broadcom and Marvell Technologies as well as designing their own custom AI accelerators and trying to sell them to OpenAI, Apple and Meta Platforms, IBD reported.

Where Will Nvidia Stock Go?

Nvidia stock may be heading up. Based on 40 Wall Street analysts offering 12-month price targets, Nvidia stock would need to rise 18.5% to reach the average forecast of $135, noted TipRanks.

Here are comments from less- and more-bullish analysts:

- Robotics is a niche opportunity. “The challenge in our view is … making the products reliable enough, cheap enough and pervasive enough to spawn credible business models,” Bank of America analyst Vivek Arya said in a note to clients featured by Reuters. “From that perspective robotics could remain another cool but niche opportunity such as metaverse or autonomous cars,” Arya added.

- Nvidia’s market capitalization could hit $5 trillion by mid-2026. Wedbush analyst Dan Ives says “he is more bullish than ever,” noted MarketBeat. Nvidia is opening the door to “a $5 trillion valuation that could be reached within 18 months” by building on the company’s technological lead and expanding into new vertical markets.

To me the key questions for investors are: How much revenue could Nvidia’s AI cloud generate? Will Nvidia’s hyperscaler clients buy less from Nvidia? My guess is Huang expects Nvidia’s AI cloud service will make the company better off.

Read the full article here