By Nabeel Bukhari

Summary

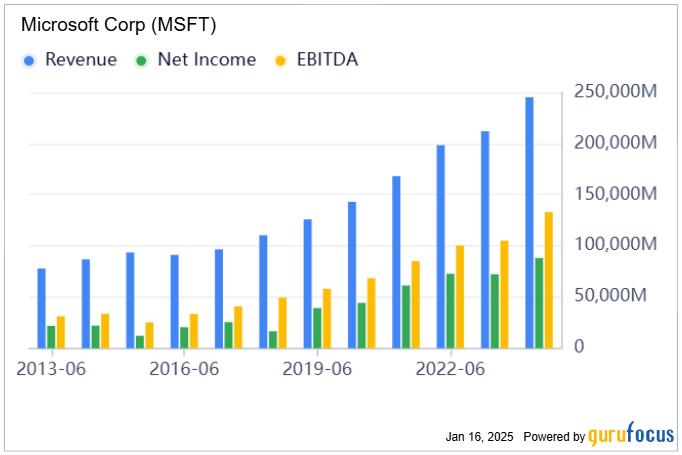

- Microsoft reported Q1 FY25 revenues of $65.6 billion, up 16% YOY, fueled by strong performance across key segments and strategic investments in artificial intelligence and innovation.

- Azure’s AI-driven growth positions it as Microsoft’s key profit engine, with management forecasting sustained high growth as AI infrastructure scales and adoption accelerates.

- Despite trading at premium valuations (33x earnings), Microsoft’s strong balance sheet, high margins, and AI-focused growth strategies justify its long-term investment appeal.

- While risks like competition and regulatory challenges exist, Microsoft’s leadership in AI and cloud positions it well for continued growth, making it a compelling long-term buy.

Microsoft Corporation (MSFT, Financial) is a brand familiar to many, with its system integration being a part of life for millions of people globally. However, in an unusual irony, the stock has not risen to the extent expected, given the phenomenal growth of the technology industry in recent years. Nevertheless, Microsoft is still a giant and one of the biggest winners in the generative AI race. Its partnership with OpenAI is not only helpful to Azure’s revenue growth but also bestows the company with a powerful role in the field of AI driven innovation.

While Microsoft is not screaming value at present, its ability to generate robust double-digit growth with unmatched cash flow generation is almost impossible to ignore. While I’ve been pulling back on some of my biggest growth winners, Microsoft remains a standout stock with great long-term potential and with the ability to provide great returns.

Q1 growth and AI investments paving the way

Microsoft’s Q1 2025 earnings report shows the company is fully charged, with healthy growth rates coupled with progressive investments.

Total revenues of the company were up 16% year-over-year (YOY) to $65.6 billion, accelerating from the preceding quarter’s growth rate of 15.2% and the 12.8% rate in the same period last year. Earnings per share were not far behind, rising at a 10% rate to $3.30 in part due to smart investments in artificial intelligence (AI) and the dilution from Activision Blizzard. Both factors, though modestly impacting the near-term profits, are in fact strategic actions taken for the purpose of securing the company’s long-term control.

Let’s break down the Microsoft’s key segments to better understand what drives this growth and where might the company be going next.

The essence of Microsoft is in its Productivity and Business Processes segment, which is still the biggest source of both revenues and profits for the company at the time being. This segment generated a revenue of $28.3 billion which was up 12% and was ahead of the company’s guidance of 10% primarily driven by strong uptake of enterprise products such as Microsoft 365 Copilot that incorporate AI. Management guidance of up to 11% growth next quarter supports the view that businesses will sustain efficiency through advanced AI capabilities.

Yet, all the focus is on Azure, the crown jewel in the Intelligent Cloud segment (up 20% and generated a revenue of $24.1 billion) for Microsoft. Azure itself is up a monstrous 33%. Such acceleration proves the company’s strength and its close connection with OpenAI which not only improves Azure but also brings in new clients eager for the best AI solutions. While management has forecasted up to a mind-boggling 32% growth next quarter, this is expected to increase in the second half of the year as more AI capacities come online. Azure’s growth path may outpace the Productivity segment to become the new cash cow for Microsoft.

Last but not least, the More Personal Computing segment’s revenue of $13.2 billion, up 17%, is still more cyclical than the rest of the segments. Management anticipates that revenues in this segment will be slightly lower compared to the prior year due to lapping tougher comparables. However, the inclusion of Activision Blizzard as part of this segment points to long-run growth. The acquisition had a dilutive impact of $440 million on operating income this quarter, but synergies and cost discipline should help flip it into a growth driver.

Furthermore, Microsoft is a fortress, with $116.2 billion in cash at the end of the quarter against $45 billion in debt.

As we look at the graph above, it’s evident that the buffer has shrunk significantly compared to previous years. Well, that’s due to increased capital expenditures to heavy investments. In 2023, the ratio dropped below 1.5 but the good news is that it has since recovered, back up to 1.28. This dip doesn’t take away from the fact that Microsoft is in a great financial position and is well set up for a steady growth trajectory as its AI-driven investments mature.

Microsoft stock valuation and growth potential

As of recent prices, MSFT found itself trading at around 33x earnings.

Consensus estimates depict the stock to clock higher double-digit growth rates in the years to come. I consider these estimates reasonable based on the stellar momentum of Azure.

The stock may not even appear as an obvious bargain at around 12x sales, as this multiple ranks highly compared to other software companies. However, I would like to stress that some premium is deserved given that MSFT is already earning such high profit margins, and, therefore, its high earnings yield would contribute to the continuous return prospects. In the longer term, I still expect net margins under GAAP to reach towards 45%-50% as operating leverage starts to kick in, up from 37.7% in the latest quarter. This actually put the current valuation at 25x long-term earnings, which could be considered reasonable with the strong balance sheet and long-term secular growth. Between the consensus estimate of double-digit revenue growth and the roughly 3% earnings yield, I think this stock can deliver between 15% to 17% annual compounded returns for the next five years or more. To get a return less than that projected by the above formula, either the company has to underperform the consensus growth estimates or the stock’s valuation would need to compress. Even if we assume that the stock is trading at 21x long-term earnings in five years, the stock will return between 12% to 14% per year and will therefore outperform the average 8% return of the market.

MSFT does trade at a slight premium to its 5-year average but is still not as greatly overvalued as one might think given the current tech euphoria and the company’s position in it.

Over the last five years, Microsoft’s stock skyrocketed 160.58% as showed in the graph below, which demonstrates that the company has good opportunities in fast growth sectors like cloud computing, AI and enterprise software. But this performance also speaks about a market that is willing to pay a premium for steady and consistent growth.

Currently, the stock’s valuation multiples which I discussed previously are both considerably higher than Microsoft’s historical ratios and its sector ‘s median.

What’s next for the stock?

For the past year, Microsoft posted a 12.40% return, but this does not compare to the kind of growth witnessed previously due to market fluctuations. The stock rose to $450 in mid-2024 but has since corrected to trade in the $410-$425 range. This correction may have come from valuation concerns and other market factors rather than company-specific issues. However, it is important to note that the $400 level is the critical support zone as investors consider any price dip close to this range to be a good buying opportunity.

Nonetheless, the current trading price of the stock reflects that the investors lack the enthusiasm to drive the valuations even higher. The $468.35 as a 52-week high is a significant resistance point while $450 has acted as the ceiling over the past year. Penetrating this barrier would require Microsoft to post stellar earnings or for the market sentiment to change. On the other hand, missing the high expectations may lead the stock to retest the $400 support level.

In the short term, Microsoft shares are unlikely to move much beyond the $400-$450 range as the investors assess its valuation relative to growth potential. The longer-term stable scenario of maintaining double-digit top-line growth rates, along with GAAP net margin growth towards 45%, can justify further price increases.

Investors should be careful of market risk and ensure that the stock’s valuation is correct with regard to their investment horizon and risk tolerance. Microsoft fundamentals are good, however, short-term gains are expected to be dependent on its ability to beat high forecasts.

Risks to my thesis

The prospects appear favorable for Microsoft, however, there are some risks that may affect the thesis I’ve described above. First, lower-than-expected AI adoption is a big concern. The growth story heavily draws on Azure performance, depending on AI-powered tools like Microsoft 365 Copilot. However, delays in the adoption of these tools or issues related to the implementation of the same can slow down the overall AI and Cloud service revenues as anticipated. This might also slow down the total growth of the company.

Another significant risk is the competitiveness threat that Microsoft experiences most in the cloud as well as the AI segments. Azure has been a good performer but in front of Microsoft are giant competitors like Amazon Web Services (AWS) and Google Cloud both of whom are actively using similar technologies. If these competitors advance further or if Azure’s expansion is thrown off by more competition, then the rate of revenue expansion, which is core to the thesis could be impacted.

Last but not least, regulatory challenges can not be ignored. Microsoft is under increasing pressure from regulators, notably due to the Activision Blizzard acquisition. If regulatory bodies enter or place restrictions on the company, there might be unhealthy hindrances or complicities in the company’s expansion strategies. New regulations for Big Tech may also become a problem, which, together with existing problems, can cause additional risks to the company’s future. These risks are noteworthy, considering they can influence both growth and valuation assumptions.

Your takeaway

All in all, Microsoft remains a great stock for the long-term investment. This is being achieved under the stewardship of Azure, which is driving impressive growth and with the company now placing more emphasis on AI, gives the impression that it is poised to benefit from some of the most promising trends in technology. Sure the stock is a little bit on the expensive side, but when you look at the cash flow, healthy margins and growth possibility that is being offered, the premium that is commanded for the stock seems well deserved.

Of course, there are a few risks, but Microsoft has proved its abilities to overcome obstacles and to remain ahead of innovations. So as long as it keeps delivering in the AI and cloud sectors as it has done before, I believe the stock will keep on giving good returns. I would recommend Microsoft to anyone seeking solid, market-beating growth in tech, as the company possesses healthy financials and leads in high-growth areas. It’s a stock you can hold onto and expect it to pay off in many years to come.

Read the full article here