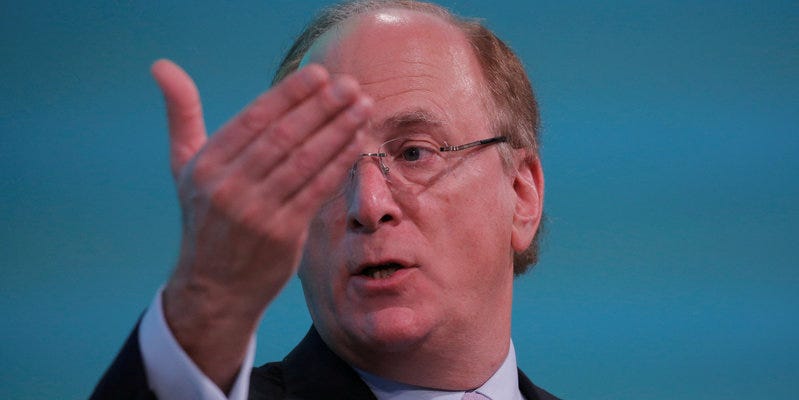

The CEO of the world’s largest asset manager was asked whether he thinks a recession is coming. Larry Fink’s response: We’re in it.

Most CEOs the BlackRock chief has been talking to “would say we are probably in a recession right now,” he said Monday in an interview at the Economic Club of New York.

“One CEO specifically said the airline industry is a proverbial bird in a coal mine — canary in the coal mine — and I was told that the canary is sick already,” he said, adding that travel demand had declined.

Last week, President Donald Trump made a tariff announcement that prompted trillions of dollars in value to be wiped from the stock market. He has made no indication that he will reverse his plans despite investors’ pain.

Fink raised concerns about inflation if all the proposed tariffs were put into effect simultaneously. He said this would make it difficult for the Federal Reserve to cut interest rates, adding that there was “zero chance” of multiple rate cuts.

“I’m much more worried that elevated inflation — that’s going to bring rates up,” he said.

While Fink said he believed the markets could still fall by another 20%, he suggested that the conditions were “more of a buying opportunity than a selling opportunity” in the long run as there are no systemic risks in the financial system.

Longer term, Fink thinks Trump will focus on a growth agenda, like deregulation and tax cuts, he said: “The market is not focusing on these areas.”

Fink said the need to build up infrastructure in the US, especially for AI, is still a major investment theme that needs to play out.

“If you spent time right now with the CEOs of the hyperscalers, Nvidia, and other players, they would say the need is just as great today as it was three months ago, and I believe some of the big macro trends are still in place,” he said.

Read the full article here