JPMorgan reported higher-than-anticipated fees in investment banking in the second quarter of the year, signaling a more resilient market for dealmaking than many expected.

The bank said the fees it earned from providing dealmaking advice and capital raising rose 7% year over year and 12% quarter over quarter. Wall Street analysts had been expecting a 14% decline in investment banking fees.

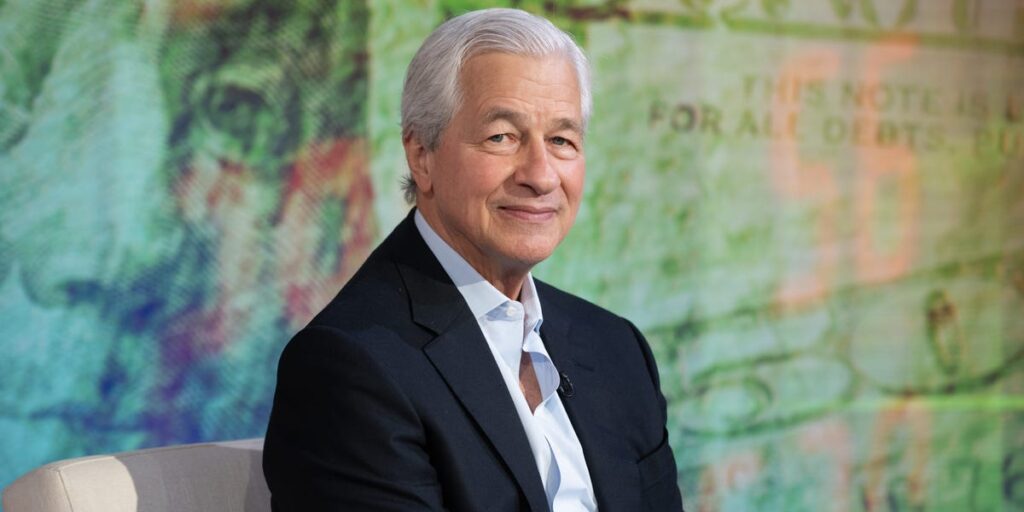

“IB activity started slow but gained momentum as market sentiment improved,” Jamie Dimon, the firm’s CEO, wrote in an announcement accompanying the earnings release.

“The US economy remained resilient in the quarter,” he added, but warned of “significant risks” including tariffs, trade concerns, and a fraying political landscape.

Dealmaking stalled going into the second quarter due to uncertainty around Trump’s tariff agenda. Industry insiders have expressed concern that dealmaking could remain muted indefinitely due to Washington’s policy whiplash.

Revenue in the combined commercial and investment bank division was more than $19 billion for the quarter, driven by higher debt underwriting and advisory fees. Revenue from helping large investors trade rose nearly $9 billion, up 15% year over year, likely a reflection of choppy trading activity.

The bank posted net revenue of $45.7 billion, down 10% over last year, and net income of $15.0 billion, down 17%, driven in part by a one-time gain tied to shares of Visa that it recognized in the second-quarter of 2024.

Dimon also touted the success of the Chase Sapphire Reserve card franchise, saying the company’s relaunch of two Reserve card products had garnered “positive early reactions and strong new card acquisitions.” But the relaunch of the Sapphire Reserve card for everyday consumers was met with some blowback this year, particularly over its $795 annual fee.

JPMorgan is the first of the large investment banks to report earnings and often acts as a bellwether. Citigroup will also report second-quarter results on Tuesday, followed on Wednesday by Goldman Sachs, Morgan Stanley, and Bank of America.

Read the full article here