The Japanese Yen (JPY) strengthens across the board during the Asian session on Tuesday as comments from Japan’s Economics Minister Minoru Kiuchi fueled speculations about a possible government intervention to stem further falls in the domestic currency. This, along with some repositioning trade ahead of the crucial Federal Reserve (Fed) and the Bank of Japan (BoJ) rate decisions this week, assists the JPY to move away from an over two-week low touched against its American counterpart the previous day.

Meanwhile, data released on Monday showed that Japan’s service-sector inflation rose for the second consecutive month in September and reinforced bets for gradual rate hikes by the BoJ. In contrast, traders have fully priced in that the US central bank will lower borrowing costs two more times by the year-end. This, along with uncertainty over US-China trade talks, underpins the JPY, though expectations of aggressive fiscal spending under Japan’s new Prime Minister Sanae Takaichi might cap further gains.

Japanese Yen is underpinned by Economics Minister Minoru Kiuchi’s verbal intervention

- Japan’s Economics Minister Minoru Kiuchi said this Tuesday that it is important for foreign exchange (FX) moves to be stable and reflect fundamentals, adding that he will scrutinize its impact on Japan’s economy.

- Japan’s Prime Minister Sanae Takaichi said that she wants to realise a new golden age of the Japan-US alliance. Moreover, US President Donald Trump said that we are signing a new deal with Japan, and it is a fair deal.

- Data released on Monday showed that Japan’s Services Producer Price Index accelerated to 3.0% in September, reaffirming bets for further tightening by the Bank of Japan and also lending support to the Japanese Yen.

- This marks a significant divergence in comparison to the growing market acceptance that the US Federal Reserve will lower borrowing costs by 25-basis-points at the end of a two-day policy meeting on Wednesday.

- Moreover, traders have been pricing in a greater possibility of another rate reduction by the US central bank in December. This keeps the US Dollar bulls on the defensive and further exerts pressure on the USD/JPY pair.

- Meanwhile, Takaichi is known for her pro-stimulus stance and could resist early tightening by the BoJ. Hence, the BoJ policy update on Thursday will be looked at for guidance about a rate hike in December or early next year.

- Trump said ahead of his expected meeting with Chinese leader Xi Jinping that the US and China were poised to come away with a trade deal. Trump added that he could sign a final deal on TikTok as early as Thursday.

- The optimism remains supportive of the upbeat market mood and might contribute to capping any meaningful appreciating move for the safe-haven JPY, which, in turn, should help limit losses for the USD/JPY pair.

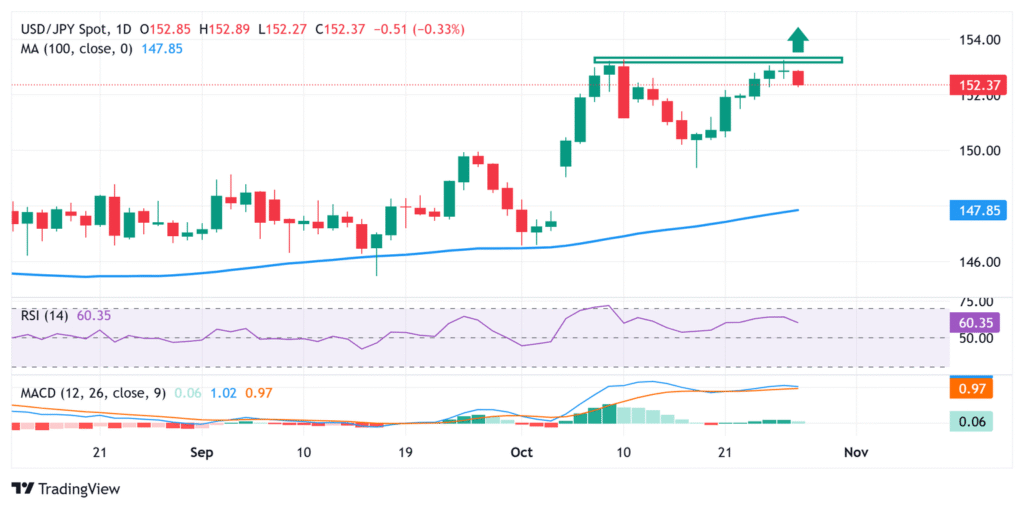

USD/JPY constructive setup backs the case for the emergence of some dip-buying

A failure near the monthly swing high, around the 153.25-153.30 region, and the subsequent fall warrant some caution for the USD/JPY bulls. However, positive oscillators on the daily chart back the case for the emergence of some dip-buyers near the 152.00 round figure. A convincing break below the latter could negate the positive outlook and pave the way for deeper losses towards the 151.10-151.00 zone with some intermediate support near the 151.50-151.45 area.

On the flip side, the 152.90-153.00 region now seems to act as an immediate hurdle ahead of the 153.25-153.30 zone, above which the USD/JPY pair could aim towards reclaiming the 154.00 round figure. The momentum could extend further towards the next relevant resistance near mid-154.00s en route to the 154.75-154.80 region and the 155.00 psychological mark.

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Read the full article here