Jain Global launched last July with great fanfare and even greater expectations. It landed with a thud — at first — before gathering momentum toward the end of its first year.

While Jain Global didn’t end up being the largest hedge fund launch ever, as founder Bobby Jain had once envisioned, it nonetheless holds a claim to being the most complex and ambitious.

Jain raised $5.3 billion in commitments from the Abu Dhabi Investment Authority, a sovereign wealth fund, and wealth management platforms from Goldman Sachs and Morgan Stanley, among others. Jain Global didn’t start trading that full amount right away. Instead, it received and put the money to work in stages, the last $700 million arriving in July.

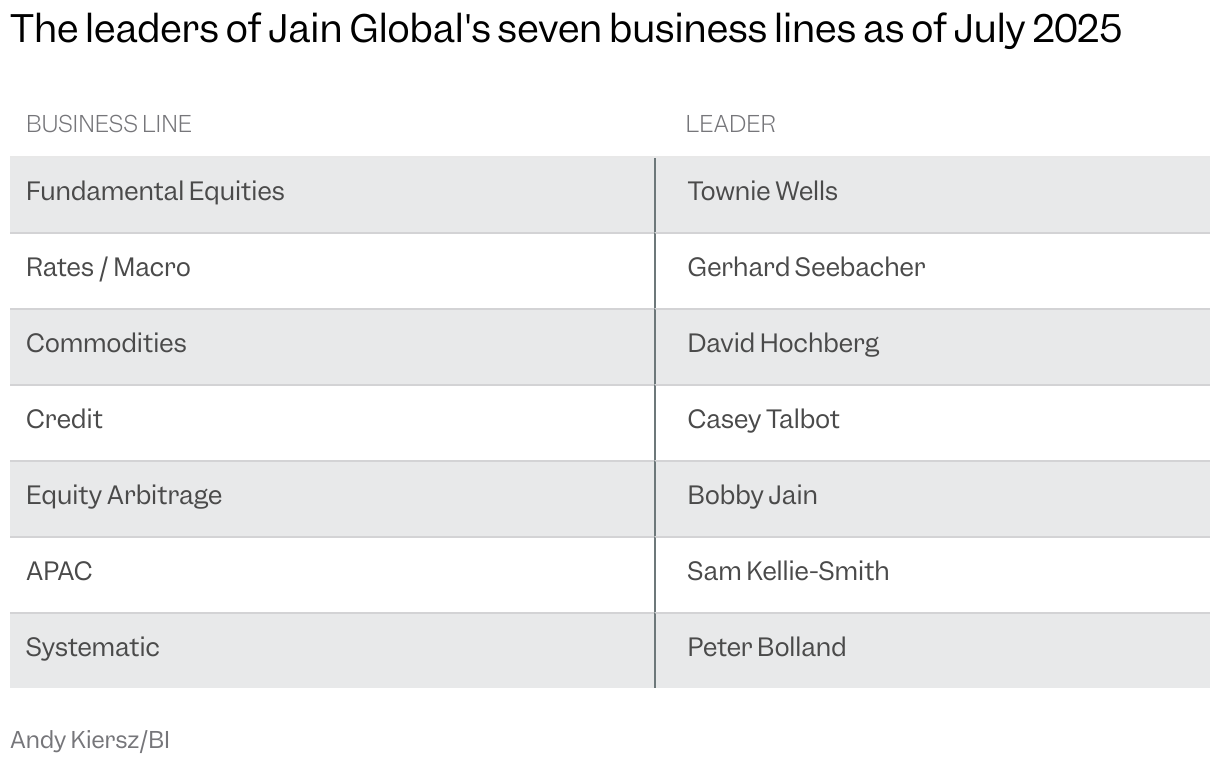

The firm started trading with 215 employees and six overarching investment strategies, as well as a seventh Asia-specific business line that trades in each strategy — an unprecedented and expensive rollout intended to lay the foundation for future growth. In its first year, the firm traded about 50 products — everything from convertible bonds to significant risk transfers, Delta 1 options, and natural gas — across 45 countries.

Fair or not, the heft of Jain’s undertaking immediately thrust it into competition with the world’s largest multistrategy hedge funds, drawing comparisons to Millennium, Citadel, and Exoduspoint, which holds the crown as the largest ever hedge fund launch.

Business Insider dug into more of the numbers and charts that explain Jain Global’s first year. Charts are based on BI conversations with people familiar with the firm as well as public media reports.

A Jain Global spokesman declined to comment.

Jain’s headcount has kept growing

Jain Global’s roster has expanded significantly since launch, growing nearly 80% to more than 380, about half of which are investment professionals, a person close to the firm said. PMs are still joining as their noncompete provisions and garden leaves expire.

One upshot of launching seven businesses at once, according to people familiar with the firm’s strategy, is minimizing technology headaches from bolting on businesses years later.

Each of the seven business lines has a dedicated CIO overseeing the operation, apart from equity arbitrage. That business, which includes strategies like index rebalance and volatility trading, is overseen by founder and firm-wide CIO Jain, who spent decades at Millennium and Credit Suisse deeply involved in such trades.

How Jain Global has put money to work

How exactly a fund deploys its capital fluctuates depending on market conditions and personnel, among other factors. When Jain was pitching investors in late 2023, he included details on how he expected to allocate investor capital once at full strength, BI reported at the time.

Here’s how those estimates compare with its capital allocation as it hit the one-year mark (The Asia business wasn’t included in the strategy breakdown early on):

Having received its last tranche of capital this month, the firm expects to have its $5.3 billion fully deployed by year-end, a person familiar with the matter said.

Jain Global got off to an inauspicious start, losing money in its first two months but clawing into the black by the end of 2024, finishing up 0.5%.

But it started to hit its stride in the second quarter of 2025, posting three straight months of gains and ending its first 12 months of trading up 2.7%.

Here’s a breakdown of Jain’s performance in each of the first 12 months:

Investors don’t gush over returns that lag the Treasury yield. But they also don’t sign up for a three-year commitment to a new fund — as Jain’s backers did — without some inherent patience.

“Setting up and effectively competing with the other Multi-Strats, which is already an extremely competitive backdrop, is an uphill battle,” Brian Payne, chief private markets and alternatives strategist at BCA Research, said in an email to BI. “Getting the proper talent, infrastructure, technology, etc. on top of making sure the portfolio is properly balanced and meeting objectives is not one that can be done overnight.”

It’s taken ExodusPoint, which launched with a record $8.5 billion, seven years, including plenty of fits and starts, to begin hitting its stride, BI previously reported.

Jain envisioned a fund that could one day scale to as much as $12 billion. The initial investors get first crack at future Jain Global capital raises, and one telling sign will be who signs up for more and what external investors decide to pile in.

Read the full article here