Every summer, the mountains of Wyoming become the center of the economic world. The Jackson Hole Symposium, organized by the Federal Reserve Bank of Kansas City, is more than just an academic gathering: it’s the stage on which the major orientations of global monetary policy are sometimes shaped.

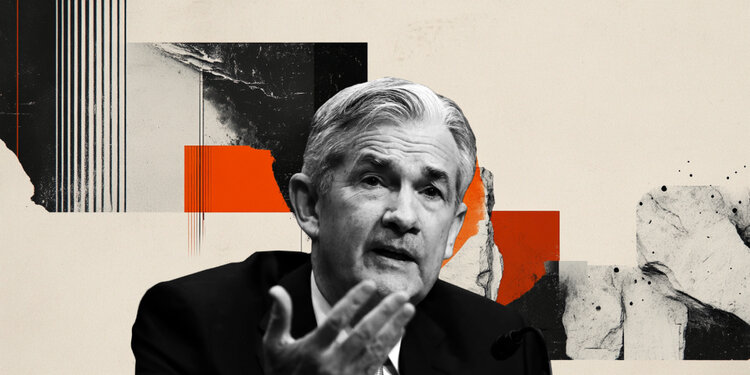

This year, the spotlight is even more intense. On Friday, Federal Reserve (Fed) Chair Jerome Powell is scheduled to deliver what will probably be his last speech in Jackson Hole as President of the US central bank.

A key event for the markets

For several decades now, Jackson Hole has been the event where central bankers reveal the changes in their strategy.

It was here where Ben Bernanke outlined his quantitative easing (QE) policy after the 2008 financial crisis, and Powell himself introduced a new framework of tolerance for higher inflation in 2020.

In other words, the words spoken here count, sometimes more than the formal decisions taken at Federal Open Market Committee (FOMC) meetings.

In 2025, the context makes this meeting even more crucial. The markets want to know whether the Fed is ready to cut its key interest rates as early as September, as the US economy teeters between a slowdown in employment and a resurgence of inflation linked to US President Donald Trump’s new tariff hikes.

Three scenarios for Powell’s speech

Investors are considering three main options for Jerome Powell’s speech.

- First possibility: Prepare for a rate cut. After several months of stagnation in the labor market, some Fed officials fear that further deterioration could lead to a full-blown wave of unemployment. Powell could then signal that easing is imminent to support the economy.

- Second scenario: Cooling expectations. Inflation remains above the 2% target, and new import taxes are already fuelling a rise in wholesale prices. Powell could insist on vigilance in the face of inflationary risk and delay any announcement of a rate cut.

- Third option: Remain evasive. True to the “data-dependent” approach, Powell could simply emphasize that the Fed is waiting for the next indicators before making a decision, thus maintaining the suspense until the September meeting.

Between economics and politics

Technical considerations aside, the Jackson Hole speech takes place in an electric political climate. Donald Trump is multiplying his attacks on the Fed, going so far as to demand Powell’s resignation.

Never has the independence of the central bank been so much in question. On Friday, Powell could seize the opportunity to defend the institution’s neutrality and point out that its decisions are based on economic analysis, not political pressure.

Why Jackson Hole matters beyond the US

What is said at Jackson Hole goes far beyond American borders. The Fed’s choices influence global financial markets, currencies and the cost of credit.

An announcement of monetary easing would boost Stock markets, but could also weaken the US Dollar (USD). Conversely, a firm stance on inflation would keep pressure on Bond yields and on emerging economies heavily indebted in dollars.

A legacy to defend

For Powell, this speech also has a personal dimension. After more than seven years at the helm of the Fed, he wants to leave behind the image of a pragmatic chair, concerned with the balance between growth and price stability.

His final stint at Jackson Hole could seal his place in the history of the central bank: that of a leader who, despite unprecedented political pressure, tried to preserve the institution’s independence and credibility with the markets.

Read the full article here