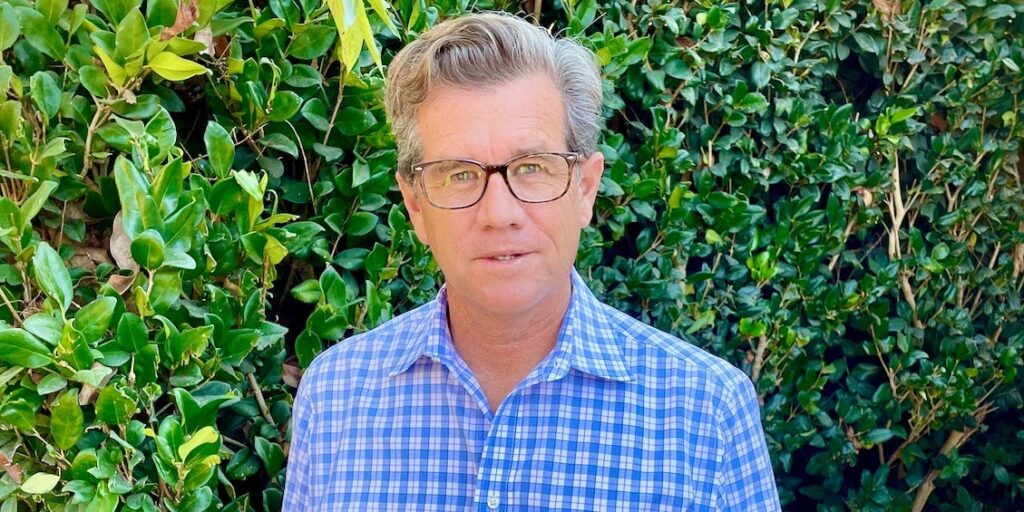

- Alvaro Munevar Jr. credits middle management jobs for his early retirement.

- The jobs gave him enough free time to maintain a side business to cover his retirement expenses.

- Meanwhile, senior management positions would have required longer hours.

The career model you typically hear about in the US is to work for a company until age 65 and then retire and enjoy your latter years as best you can.

I’ve worked in tech since the 1990s, and I’ve always known I wanted to retire early to enjoy my more active years.

I realized I could expedite my retirement date by working smarter. By sticking to middle management positions, I made sure I had enough time to build out a side business in real estate rental properties.

With this income, plus my savings from my IT salary, I retired in September 2024 at the age of 59.

Middle management positions always included reasonable work hours compared to colleagues above and below me

After four years working as a clerk for corporate law firms, I pivoted to an IT career in 1994, working as a software support engineer in Seattle. I enjoyed working on a new operating system as part of the job. It felt more like a fun hobby than actual work.

I was promoted to middle management after performing well in identifying and resolving system defects. My core responsibilities were to assist and train junior support engineers and track their ability to solve problems for customers.

I left that job after almost two years and went on to hold several other middle management roles, including as a project manager and applications engineer at startups and larger companies.

Middle management positions always came with reasonable work hours relative to my IT colleagues above and below me.

Software developers typically had to put in extra hours to complete coding tasks. As far I could tell, the management teams above me worked 50 to 65 hours a week to oversee team members and carry out executive charters and responsibilities, while I only worked 40 hours a week.

Planning, policy, and budgeting discussions mostly took place in senior management roles, so I didn’t have to spend hours attending these meetings.

In the management teams above me, people worked more and received more pay. In the developer teams below me, people worked more to receive slightly less pay. The sweet spot was middle management.

Out of interest and boredom, I did apply for a few senior management roles at different points in my career, but I was never offered the job.

Ultimately, I felt I’d be more successful by being the CEO of my own money and businesses outside work than by being a senior manager.

The extra time enabled me to start my own businesses while keeping my day job

Colleagues occasionally asked me how I planned to retire one day. Did I have a lot in my bitcoin wallet, Apple stock, or would I receive a big inheritance? The answer was no.

What I did have was a work strategy that focused on staying in middle management while building out my own business outside of work. I had always viewed doing side hustles as a fun way to learn new skills and build my savings faster than by having just one paycheck with a company.

My 40-hour work schedule gave me enough free time to create several side businesses, including building websites for other businesses and developing a rental property portfolio that now pays me my current retirement salary.

I’d bought a house with savings from my salary in 2001. In 2014, I started renting out my own residence, after purchasing a second home, which then became my primary residence. Once rent started coming in regularly, I added another rental property to my portfolio which also provided passive income.

Having a solid W-2 software position made this side business possible. Lenders are always looking for borrowers with high credit scores and a predictable income. I was able to show bankers I could pay back my loans, making the process of obtaining home loans relatively seamless.

My wife, who’s a neuroscientist, retired at the same time as me. We planned for this by mapping out our family’s expected future expenses every year from the present day until we turned 99.

We used the 4% rule, a retirement planning method that involves withdrawing less than 4% of your savings annually. We worked backward using the rule to calculate annual withdrawal scenarios of one, two, three, and four percent.

After factoring in the rental property income, we realized we had enough income from our savings and rent to retire. It was on this day in August 2024 that I gave my notice of retirement.

Having a job and your own business is my key to retirement success

The real estate income helped me build up my savings, but my early retirement wouldn’t have been fully possible without my IT salary.

Throughout my tech career, I made a six-figure salary. Over the years, my wife and I both put savings from our salaries into our post-tax investments and our pre-tax retirement savings accounts. We were even able to save the US maximum 401(k) contribution amounts throughout the last 10 years.

I strongly believe that to succeed financially and retire early, you must build out your own business while simultaneously remaining employed.

I don’t regret the way I played my career. Salaries get higher if you work up to C-Suite positions, but I enjoyed working in middle management while also having my own business where I made all the decisions and received all the benefits.

Now that I’m fully retired, I’m living the life I dreamed of when I sat in daily team meetings. I exercise nearly every day and can consume the books and podcasts I didn’t have time for during my working years.

Several retirees have told me I’m simply experiencing the “honeymoon” euphoria of retirement, which they say will fade, but I’m glad I can enjoy my life while I’m still relatively young.

Do you have a story about retiring early that you’d like to share with Business Insider? Email ccheong@businessinsider.com

Read the full article here