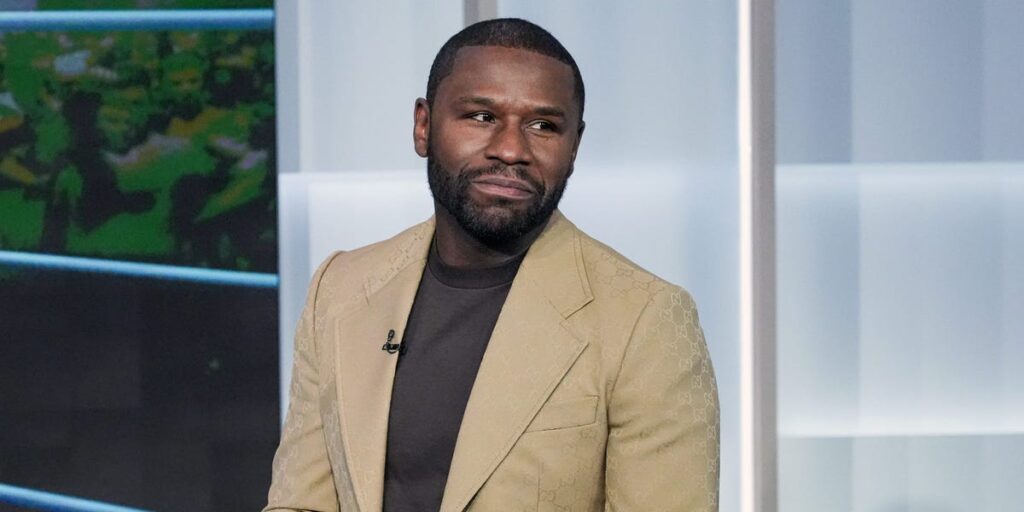

Floyd “Money” Mayweather Jr. earned his nickname by reaping more than a billion dollars during an illustrious boxing career and spending big on designer clothing, palatial homes, and ultra-exotic sportscars.

More recently, the 48-year-old retired champion has sought to refashion himself as a budding business mogul, with interests in liquor, nutritional supplements, apparel, and, increasingly, commercial real estate.

In late February, Mayweather announced his biggest single deal to date, the purchase of a sprawling portfolio of 62 rental apartment buildings in upper Manhattan.

“All the buildings belong to me, I don’t have no partners,” Mayweather proclaimed in a video posted on his Instagram account that also included a slideshow of him touring some of the buildings. “And all the retail down below, on my buildings, all belong to me. Guess what? You can do the same. It’s all about making power moves.”

Mayweather posted that his real estate investment firm, Vada Properties, paid $402 million for the properties.

Yet the boxer’s bold claims do not appear to match reality. A month after Mayweather’s announcement, none of the buildings have changed hands, according to New York City property records, which are usually updated within days of a sale, several experts said. A deal to sell the properties outright to Mayweather does not seem imminent.

The NYC Housing Partnership, a non-profit group that is a partner in the majority of the properties to help them qualify for tax breaks and grants and preserve the affordability of the portfolio’s apartments, said through a spokesman that it has not been alerted of a pending sale.

“The Housing Partnership has not been advised of any sale, pending sale, or change in ownership,” the spokesman said. “Generally, the partnership would be advised of the transfer and would be party to the transfer. That has not occurred.”

A person directly involved in the deal with Mayweather said that Mayweather had purchased a small minority ownership interest in the portfolio, with options to expand that stake over time or acquire the buildings in their entirety. It is not clear if Mayweather will exercise those options. The person asked to remain anonymous to speak about a confidential arrangement with Mayweather.

“Floyd Mayweather continues to be a reliable partner and a great ambassador for affordable housing,” a spokesman for Black Spruce Management, the real estate company that owns the majority of the buildings in the portfolio, said in a statement. “To date, Mayweather has performed on all of his obligations.”

Meyer Orbach, the chief executive of the Orbach Group, a firm that owns the remaining handful of buildings in the portfolio, according to public records, did not respond to multiple calls and emails.

Asked about acquisition, Ayal Frist, the CEO of Vada Properties, Mayweather’s property firm, patched in a man during a telephone call who introduced himself as James McNair, an executive involved in Mayweather’s business ventures.

The man’s voice, however, was starkly different from existing recordings of McNair.

The person insisted that Mayweather had acquired the portfolio, but declined to discuss details of the transaction on the record. He said that Mayweather had lived in affordable housing as a child and had been drawn to the properties, in part, because they include rent-regulated apartments.

“He felt that it’s so cool because: I give back to the community and I make money,” the person said. “And once that clicked in his head, he is like, I want to buy it all.”

McNair did not respond to calls and text messages.

Lawyers for Mayweather did not respond to requests for comment.

From boxing to New York City skyscrapers

The deal is one of several large real estate investments that Mayweather has touted.

A chance encounter more than a decade ago appears to have helped Mayweather make some high-placed connections in commercial real estate.

At a Knicks game, Mayweather happened to sit next to Jeff Sutton, a major owner of Manhattan retail space, and Andrew Mathias, who was then a senior executive at the large commercial landlord SL Green. The men hit it off and developed a friendship, according to two people who were present at that introduction. Both wound up counseling Mayweather on real estate investments.

In a podcast interview in 2022, Mayweather said that, during his boxing career, with the help of his former manager Al Haymon and “my Jewish friends and my white friends,” he initially invested $5 million in commercial real estate and began to net $50,000 a month in proceeds — an impressive 12% return on his money.

He suggested during that interview that he held a stake in One Vanderbilt, a 1,400-foot-tall Manhattan office tower controlled by SL Green.

“I’m a part of that project,” Mayweather said, adding incorrectly that the skyscraper is “the tallest building in New York City.”

The man who spoke to Business Insider claiming to be James McNair said that Mayweather had invested $88 million into roughly 20 loans that SL Green had originated and that were tied to commercial properties in the city. He said the company lent the money out as mezzanine debt, a type of higher interest rate loan sometimes used in real estate investments.

“It was a nice opportunity for them to make money for Floyd, who they have a great deal of respect for,” the person said. “And at the same time, it was also a good marketing opportunity for SL Green to be associated with him.”

Alexendra Zarchy, a spokeswoman for SL Green, said in an email: “We don’t comment on questions regarding individual investors.”

SL Green hasn’t disclosed investments with Mayweather in public filings. The company, which is public, typically announces large deals involving the sale of ownership stakes in its assets.

During an investor call in December 2014, Marc Holliday, SL Green’s CEO, introduced Mayweather as “somebody who’s been a big fan of the company, probably own some shares,” according to a transcript of the call by AlphaSense.

“You’re the right team, SL Green,” Mayweather responded.

Mayweather also recently claimed to have invested an undisclosed sum into 601W Companies, an owner of office assets, according to a report. A call to a senior 601W executive was not returned.

He announced last year that he had purchased a stake in a portfolio of luxury rental apartments owned by Black Spruce Management and the Orbach Group — the owners of the uptown Manhattan portfolio.

On his property website, Mayweather lists 1196 Avenue of the Americas among his holdings. Ownership of the building, a three story property in Manhattan’s Diamond District that is filled with retail tenants in the jewelry business, also has not been sold, according to property records.

“That hasn’t closed yet,” the man who claimed to be McNair said.

A close associate with a checkered past

Mayweather has credited another executive — one with a less reputable past — with propelling his business career.

“A close friend of mine, Jona Rechnitz, a great guy, great person, helped me a lot,” Mayweather said during a recent interview on Fox News to promote a new sports supplement line.

Rechnitz pleaded guilty and served as a government witness in a federal criminal corruption case against Norman Seabrook, then the head of the Correction Officers’ Benevolent Association, a union that represents jail guards in New York City.

Rechnitz admitted to delivering a bribe to Seabrook, who then placed $20 million in correction officers’ pension money he controlled into a hedge fund managed by a friend of Rechnitz’s. Nineteen million dollars in funds were later lost in the investment. Rechnitz was ordered in federal court to pay restitution to the union and has given back about $1.2 million dollars, according to his attorney. Seabrook was convicted in 2019 and sentenced to 58 months in prison. He served less than two years before being released.

Rechnitz’s sentencing was vacated in 2023 when an appeals court found that the judge in the case had had a conflict of interest. He is due to be resentenced in June.

Read the full article here