Despite the highly anticipated 25 basis point (0.25 percentage point) reduction in the Fed Funds Rate announced by the Fed on Wednesday, financial markets tanked.[1] The reason: the “dot plot,” the graph of the individual Federal Open Market Committee members’ (there are 19 of them) anticipated future rate levels showed only a half-percentage point (50 basis point) drop in the Fed Funds Rate (to 4.00%-4.25%) by the end of next year (2025).[1] At the September meeting, that “dot plot” showed a full percentage point drop (to 3.50%-3.75%). As a result, on Wednesday, stock prices tanked (the Dow off -1123 points (a -2.6% drop in one day), the S&P 500 fell -2.9%, the Nasdaq -3.6%, and the small cap Russell 2000, -4.4%). On Friday, the PCE (Personal Consumption Expenditure) Index, the Fed’s preferred inflation gauge, rose only +0.1% at both the headline and core levels.[6] That eased market angst and sent equity markets up by 1.4%.

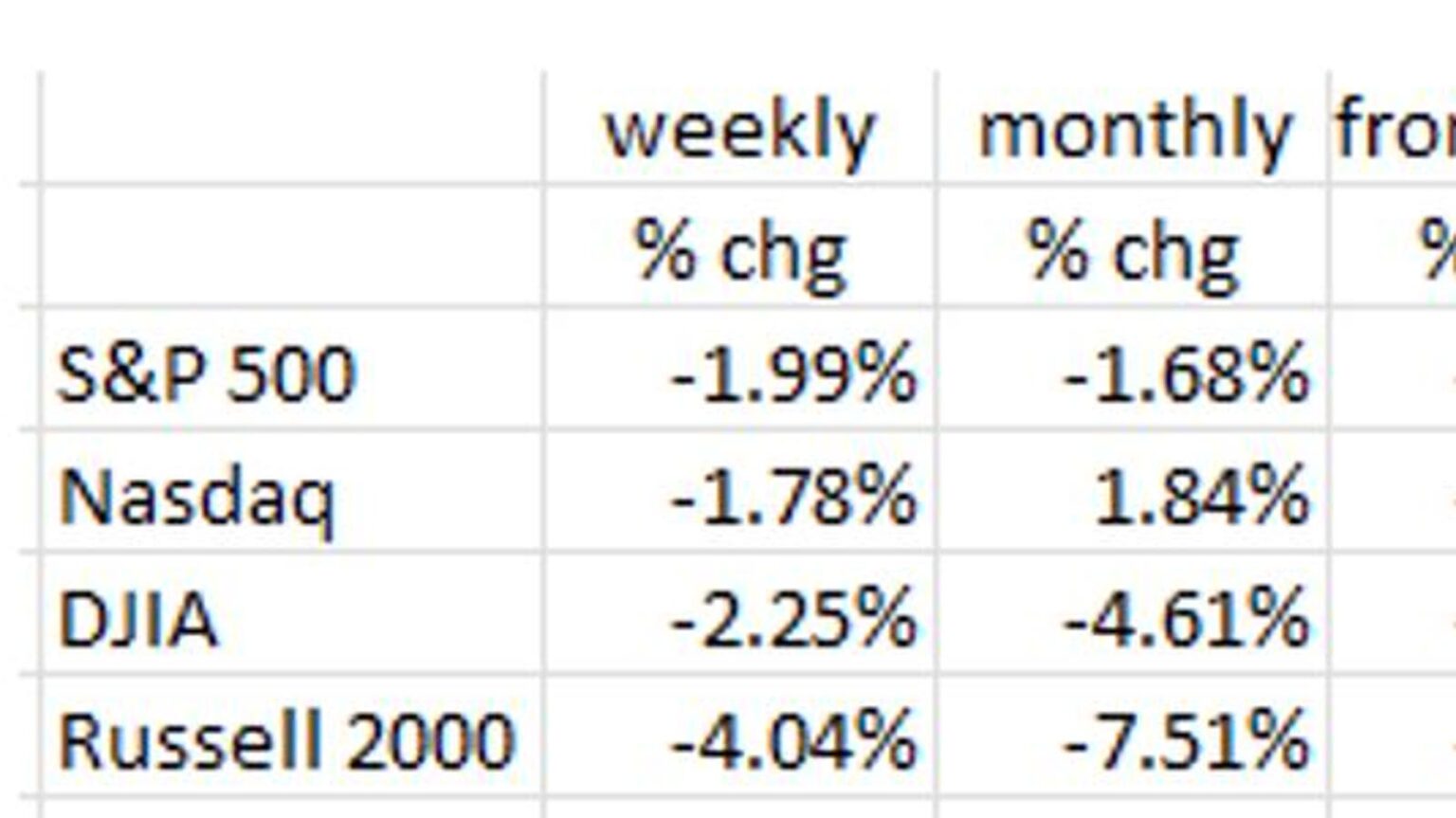

For the week, the major indexes were down about -2.0%, with the small-cap Russell 2000 off more than -4%. For the month of December, the Dow was off -4.6%, the S&P 500 –1.7%, the Russell 2000 -7.5%. Only Nasdaq had a positive reading (+1.8%).[7]

On the bond side, rates rose swiftly on Wednesday. They had been rising since late September when the 10-Year Treasury was flirting with 3.6%.

On Thursday (December 19th) that 10-Year T-Note closed at 4.57%, the highest yield since late May. After today’s PCE report, it has retreated slightly to 4.53%.

The Nasdaq has been the market leader all year, mainly because of the performance of the Magnificent 7 stocks.[8]

On Wednesday, December 11th, META hit a record high; as of the close of business on Friday, it is down -7.5% from that record high. This past Monday (December 16th), AMZN, and GOOG both hit record highs. APPL closed at a new record high on Friday, but AMZN and GOOG are off their peaks by -3.4% and -2.6% respectively.

We are often asked if a market correction is near. No one knows when such an event might occur. What we do know is that, based on market history, a correction is long overdue. All the historical market metrics, like the PE ratio (at 23x) are two standard deviations above their historical norms. For the PE ratio, the historical norm is closer to 17x. Based on that, a -25% correction would just take the markets back to its historic norm.[3]

The Fed

The Fed revised its interest rate view significantly at its December meeting. The reason: stubborn inflation. That view likely changed again on Friday with the PCE number being so light. In the last couple of months, the disinflation that we had been seeing looked like it had stopped. The Fed, which had switched its focus from its inflation mandate to its full employment mandate, became worried that it was no longer on the path to its 2% inflation goal. On the other hand, we see a lot of market data that says the Fed has already achieved that 2% goal. Apparently, the FOMC doesn’t want to prematurely declare victory at the risk of another inflation flare-up. After all, they were burned several year ago when they said the inflation was “transitory.”

The Fed’s work is actually done by the bond market. Since the CPI and PPI releases on December 11th and 12th, the 10-Year Treasury Note yield, which was 4.15% in early December, rose to 4.57% on Thursday (December 19th) with the last 20 basis points coming since the Fed meeting on Wednesday (December 18th). As of Friday (December 20th), the 10-Year Treasury closed at a yield of 4.53%.[4]

Macro-Micro Data Discrepancies

The first data point here is the BLS’s benchmark revision to the employment data for the year ended March 31st. It was a staggering downward revision of -818K jobs, that’s -68K per month. That means that all those job market “beats” that has kept the equity market buoyant were actually “misses.” And it means that the labor market is much more fragile than the Fed currently thinks and is a major reason why our view is that there will be more rate cuts in 2025 than is currently embodied in the “dot plots.” If that is the case, bond yields will be much lower (bond prices much higher) than the market has currently priced in.[5]

It is also quite likely that in next year’s benchmark revisions, we will see negative numbers emerge in Q2, Q3, and Q4 of 2024. The Fed was correct to have placed emphasis on their full-employment mandate in September; why they switched back to their inflation mandate is truly puzzling. Perhaps they felt that the pause in September and October’s disinflation readings was something they had to address.

CPI and PPI

The Consumer Price Index (CPI) was released a week ago Wednesday (December 11th) and the PPI the next day. The headline CPI rose +0.3% in November from October’s level and is up +2.7% from a year earlier. This was a disappointment because the year/year inflation rate rose to +2.7% from +2.6% in October. While the Fed doesn’t use the CPI, per se, it does have an influence. The “core” rate of inflation (ex-food and energy) also rose +0.3% in November, and its year/year rate disappointingly held steady at a too high +3.3%.

The headline Producer Price Index (PPI) also disappointed, coming in at a +0.4% in November, mostly due to a large rise in wholesale food prices. (Note that these rising food prices get translated pretty quickly to the consumer level and will likely show up in the CPI in the next month.) Markets expected only +0.2%, so the rise was double the expectation. If we take out the food prices, the rise was a tamer +0.2%, i.e., what the market expected. Note that Services prices, which has been driving the inflation lately, rose only +0.2%, the smallest gain since July. So that’s a positive. Another such positive is that Core PPI (the headline ex-food, energy, and trade services) did print +0.1% (market expected +0.2%).

What is so confusing about the Fed’s new attitude is that if we calculated the November CPI the way the Europeans calculate their CPI (the HICP method), November would show up as 0.0% from October, and 2.0% on the nose year/year, dead on the Fed’s inflation goal. Again, we are puzzled as to why the Fed has become so hawkish and is another reason why we believe that 2025 will have more than two rate cuts. We think there will be four to six cuts amounting to 100 to 150 basis points, bringing the Fed Funds Rate to the 3% to 3.5% range. Note that 3% is the Fed’s view of neutral – so if the economy weakens and there is a threat of Recession, the Fed will go to at least “neutral,” and most likely lower.

Other Concerning Data

Housing starts have continued on their downward path, falling -1.8% in November vs. October, and are down -14.6% on a year/year basis. By the way, market expectations were for a +2.6% increase for November, so the -1.8% was a big miss and was another reason for equity market volatility this past week. If we look at more detailed data, we find that while single-family starts rose +6.4% in November, that didn’t make up for the -9.1% fall in October’s starts. For the single-family area, starts are down -10.2% from a year ago.[6]

The real action was in the multi-family space, down -23.2% in November from October’s pace. That’s the second lowest print since April 2020 (Covid).

In addition, the pipeline shows that there were +780K new multi-family units under construction. The vacancy rate is already high, and it is likely going to continue to rise. The end result will be that the lower rents we’ve seen for the past year and a half will continue.

The BLS uses lagged rents when it computes the CPI. We have noted in several blogs that rents have been falling for over a year.[7] So, now that those lagged rents that the BLS uses to compute the CPI have turned negative (such rents have a 35% weighting in the CPI), we expect to see much better inflation numbers going forward, another reason we see more rate cuts by the Fed that are currently priced in.

Wage growth is also slowing. It was 3.8% year/year in November vs. 4.2% in October vs. 4.9% in September. Given that productivity growth is at 2%, that would put inflationary pressure from the wage side at 1.8% (that’s the 3.8% wage growth minus 2.0% productivity). That’s right in the Fed’s wheelhouse, and another reason we see more than two rate cuts in 2025.

Another indicator of a softening economy is Industrial Production. It was off -0.1% in November and is down -0.9% year/year. Industrial Production has flatlined for the past year and a half and it is clear that manufacturing in the U.S. is in Recession. The only components that show any signs of life are in the tech area.

The NY Fed’s Services Index showed up as -5.2 in December after a -0.5 print in November and has been negative for three months in a row.

In the employment arena, initial claims for unemployment insurance are up and the average duration of unemployment (time between jobs) is the highest since Covid. Clearly new hiring has slowed. Yet another reason for rate reductions.

Retail Sales

Retail Sales were up a hefty +0.7% in November. The consumer is being fueled by asset growth, i.e., the stock market. According to Rosenberg Research, asset growth on consumer balance sheets was up $5 trillion in Q3 alone and it is up +10.4% from a year ago. Meanwhile, consumer liabilities have risen by a mere 3.4%. Consumer incomes have been rising too, but not nearly as much, growing at 1/8th the pace of financial assets. It appears that it is the financial asset growth that has been supporting consumption. In fact, we’ve seen a -127 billion annual rate savings drawdown in Q3, and Rosenberg notes that savings growth has been negative in four of the last five quarters.

One other point: Throughout the Q3 earnings reports, the large retailers unanimously reported that the consumer is revolting against high prices. We’re not talking about the current rate of inflation, but about past inflation that has raised prices to their current high level. The consumer is looking for cheaper alternatives or is foregoing consumption altogether. Even in the buoyant Retail Sales numbers, note that November Restaurant Sales were down -0.4% vs. October, sales at the Grocery chains were off -0.2%, sales of apparel fell -0.2% (unusual for the holiday season), and Department Store sales were off -0.1%.

Final Thoughts

The Fed has scared both the bond market (rates rising) and the equity market. The equity downtrend, currently in the -3% range for the week (higher for small caps) – it’s only a couple days old. Whether it becomes a trend is another issue. Markets clearly did not like the Fed’s move back to inflation fighter mode, as it is clear that disinflation will continue.

The CPI and PPI disappointed for November, are the likely cause of the Fed’s return to its inflation mandate, and have contributed to the recent rise in interest rates. The main contributor to higher rates was the Fed itself as it moved away from its employment mandate and back to being the inflation doctor. It now forecasts only two rate cuts of 25 basis points each in 2025, down from four at its November meeting.

Rents have been falling for more than a year and that is now set to put downward pressure on the inflation indexes, especially the CPI where rents have a 35% weight in the index.

The industrial sector continues to slow and is clearly in Recession. And the unemployment data and jobs market in general are starting to cause angst.

The consumer continues to spend, and it appears this has been driven by asset growth (rising stock prices) on consumer balance sheets. A long overdue stock market correction will definitely slow consumption and GDP growth. There are signs that the consumer is revolting against high prices.

(Joshua Barone and Eugene Hoover contributed to this blog.)

Read the full article here