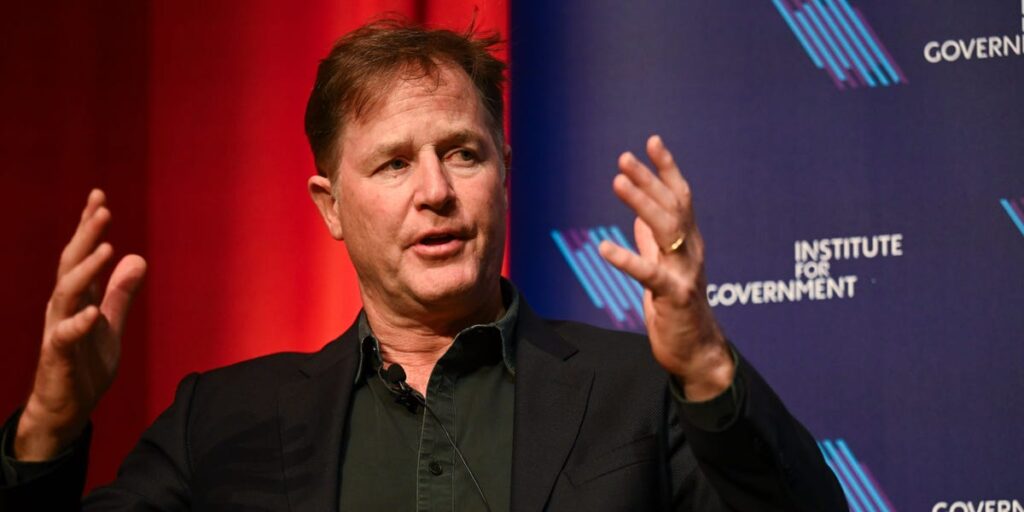

Former Meta executive Nick Clegg said on Wednesday that companies investing in AI may see a correction in the industry down the line.

“It’s certainly got some pretty prominent features of what looks like a bubble,” Clegg, Meta’s former president of global affairs, told CNBC.

Clegg, 58, was the UK’s deputy prime minister from 2010 to 2015. After leaving politics, he joined Meta in 2018 as its vice president for global affairs and communications.

In 2022, Meta promoted Clegg to president of global affairs. He left the company in January.

Clegg told CNBC the race among companies to dominate in AI has resulted in “unbelievable, crazy valuations” in the market.

“There’s just an absolute sort of spasm of almost daily, hourly, dealmaking. Of course, you have got to kind of think, ‘Oh wow, this could be headed for a correction,” he added.

Representatives for Clegg did not respond to a request for comment from Business Insider.

Clegg said in his interview on Wednesday that “the chance of a correction is pretty high” because of the large amounts of capital needed for AI and its technical limitations.

Companies investing billions into building data centers will need to “prove that they have got a sustainable business model to recoup that money,” Clegg said.

Clegg added that “certain limits to that probabilistic AI technology” could make it difficult for AI to truly “deliver the holy grail of super intelligence.”

“It doesn’t mean that the technology itself is not going to persist, and is not going to flourish, and is not going to have a huge effect,” Clegg continued, adding that the infrastructure being built for AI could be repurposed for other uses.

Companies looking to gain a foothold in AI have been rushing to secure investments. ChatGPT maker OpenAI has inked $1 trillion worth of computing deals this year, announcing deals with AMD, Nvidia, Oracle, and CoreWeave to power its AI infrastructure.

Business leaders have different views on whether there is an AI bubble.

Former Google CEO Eric Schmidt told attendees at the RAISE Summit in Paris in July that “it’s unlikely, based on my experience, that this is a bubble.”

“It’s much more likely that you’re seeing a whole new industrial structure,” he added.

JPMorgan CEO Jamie Dimon said at the Fortune Most Powerful Women Summit on Tuesday that he had a more nuanced view on the industry.

“You can’t look at AI as a bubble. Though some of these things may be in a bubble, in total, it’ll probably pay off,” Dimon said.

“You’ve got to go one by one to say, ‘Is it pushing a bubble, or is it real?’ Are they really going to develop stuff that will have productive capability that will pay off on the investment?” he added.

Read the full article here