EUR/USD is heading higher for the fifth consecutive day on Tuesday, trading just above 1.1650 at the time of writing, from 1.1580 lows last week. The first signs of de-escalation in trade tensions between the US and China, a rare earths agreement with Japan, and hopes that the Federal Reserve (Fed) will cut interest rates further on Wednesday, are buoying risk appetite and keeping the safe-haven US Dollar (USD) under pressure.

US President Donald Trump has signed an agreement with Japan to secure the supply of rare earths and has kept a positive tone towards China as he tours Asia, affirming that he is optimistic about signing a good deal with Chinese President Xi Jinping. Earlier this week. US Treasury Secretary Scott Bessent assured that the 100% tariff threat is off the table, as China has agreed to delay the restrictions on rare earths at their talks in Malaysia over the weekend.

Meanwhile, the softer-than-expected US inflation data seen last week has practically confirmed that the Fed will cut the Federal Funds Rate by 25 basis points on Wednesday. The central bank is lacking key macroeconomic data to sustain its decisions, as the US government shutdown enters its fifth week, but markets are expecting the bank to hint at a third rate cut in December. Failure to do so might trigger a significant recovery in the US Dollar.

Before that, the US Housing Price Index and Consumer Confidence data might provide some guidance for US Dollar pairs, although a significant US Dollar recovery seems unlikely as long as investors’ appetite for risk remains alive.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.10% | 0.16% | -0.64% | 0.06% | 0.04% | 0.00% | -0.23% | |

| EUR | 0.10% | 0.27% | -0.53% | 0.16% | 0.15% | 0.08% | -0.13% | |

| GBP | -0.16% | -0.27% | -0.77% | -0.11% | -0.12% | -0.17% | -0.41% | |

| JPY | 0.64% | 0.53% | 0.77% | 0.69% | 0.67% | 0.63% | 0.39% | |

| CAD | -0.06% | -0.16% | 0.11% | -0.69% | -0.03% | -0.06% | -0.30% | |

| AUD | -0.04% | -0.15% | 0.12% | -0.67% | 0.03% | -0.04% | -0.28% | |

| NZD | -0.00% | -0.08% | 0.17% | -0.63% | 0.06% | 0.04% | -0.24% | |

| CHF | 0.23% | 0.13% | 0.41% | -0.39% | 0.30% | 0.28% | 0.24% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Euro remains buoyed by positive risk mood

- The positive market mood keeps buoying the Euro (EUR) at the detriment of the safe-haven US Dollar, offsetting the impact of downbeat Eurozone economic releases like the German GFK Consumer Confidence Index, which deteriorated beyond expectations in November.

- Data released by the German GfK research company revealed that consumer confidence in Germany dropped to -24.1 in November, its worst reading in the last seven months, from -22.3 in September, and against market expectations of a mild improvement to -22.0.

- US President Trump continues his tour through Asia. He has met Japanese Prime Minister Sanae Takaichi, while Treasury Secretary Bessent called for a “sound monetary policy” in Japan, putting some pressure on the Bank of Japan (BoJ) to continue its monetary tightening cycle.

- The US and Japan have signed a framework deal to secure the mining and processing of rare earths and other critical minerals and reduce their dependence on China. The news has contributed to lifting investors’ mood.

- A survey by the ECB revealed that consumers’ inflation expectations for the next 12 months eased to 2.7% in September, from 2.8% in August, while the three and five-year expectations remain unchanged at 2.5% and 2.2% repectively. The impact of the survey on the Euro has been muted.

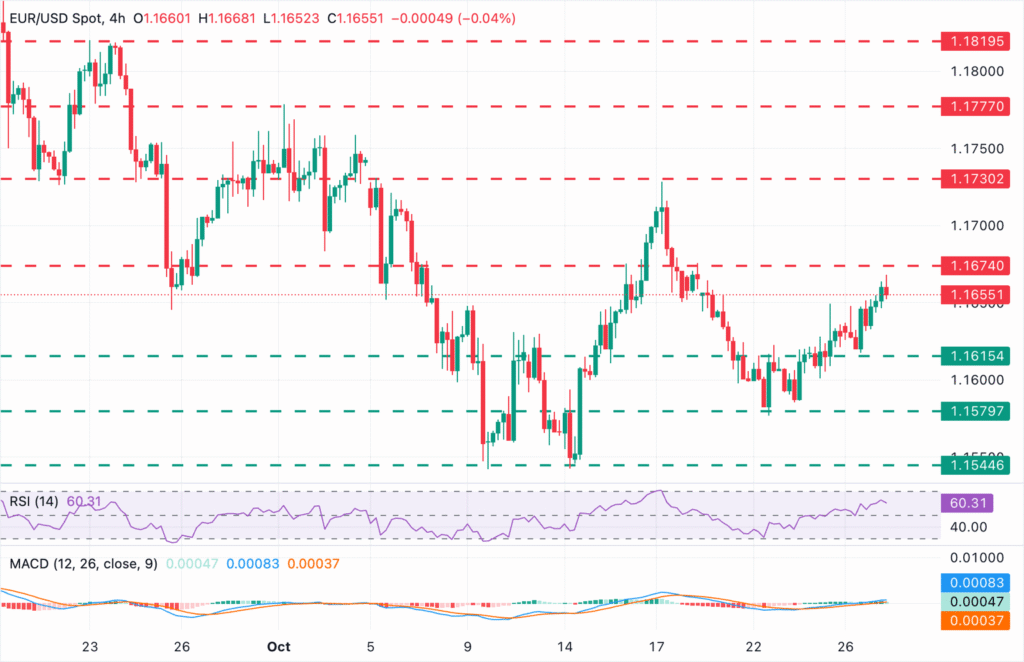

Technical Analysis: EUR/USD resistances are at 1.1670 and 1.1730

EUR/USD is on a short-term bullish trend from last week’s lows at 1.1580. The pair has been appreciating over the last five trading days, yet with momentum indicators on the 4-hour chart suggesting a frail trend. The Relative Strength Index (RSI) is in bullish territory above 50, but the Moving Average Convergence Divergence shows short green histogram bars.

Price action remains within previous ranges, with the October 20 high, at 1.1675, closing the path towards the October 17 highs, in the area of 1.1730. The pair needs to breach this level to confirm the bullish trend and aim for the October 1 high, near 1.1780.

On the downside, Monday’s low at the 1.1620 area is the prime support ahead of the October 22 low near 1.1575 and the key support level at the 1.1545 area (October 9 and 14 lows).

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Read the full article here