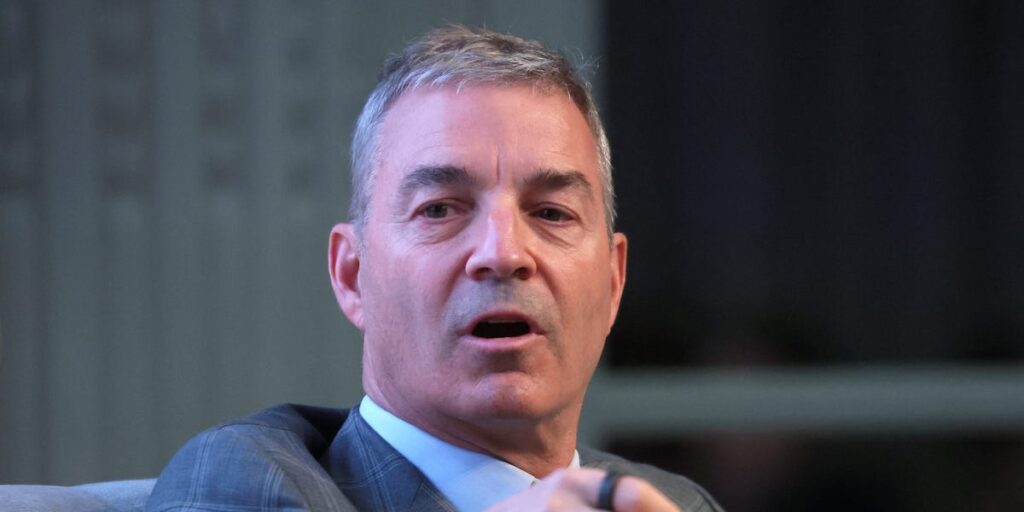

Billionaire Dan Loeb was one of several deep-pocketed supporters of President Donald Trump taken aback by his administration’s tariff policies.

The tariffs, which have roiled global equity and bond markets, were not done in a “conventional way,” causing foreign capital to flee the US, Loeb said Tuesday at the Economic Club of New York.

The result: “This giant whooshing sound of capital going back to their original sources,” the Third Point founder said.

Loeb believes the administration needs to get “some points on the board” and make some trade deals with key trading partners to help stem the outflow of money. He identified India, Japan, and Europe as potential targets for administration dealmakers.

But even if that happens, he doubts that everything returns to normal or that this is even the market bottom.

“I think there’ll be some residual concern about some of the capriciousness” of the tariffs, he said.

“All these things come with a cost,” he continued.

He said a friend who runs a private equity company lost an allocation from a Chinese sovereign wealth fund, something the country threatened in light of the tariffs Trump’s administration has levied on imports from China.

He’s not the only big Wall Street name hoping Trump cuts some deals soon. Goldman Sachs CEO David Solomon told CNBC’s “Squawk Box” earlier Tuesday that a deal or two could help “create a road map” for other countries and help put some confidence back into the markets.

Loeb’s fund is down close to 5% through April 15 for the year, roughly half of what the S&P 500 has shed in value in 2025. He’s protecting his portfolio by focusing mostly on event-driven bets, such as merger arbitrage opportunities and activism plays, he said. Third Point recently agreed to a new board arrangement with CoStar, a commercial real-estate data company.

In the meantime, he hopes Trump will focus on making deals and “walking away from the idea of taking over the Fed.” Trump has repeatedly threatened Federal Reserve Chair Jerome Powell for cutting interest rates too slowly and warned he could remove him from his post. The topic that has rattled markets and hurt the US in the eyes of global investors.

“You have a lot of capital going out,” he reiterated.

Read the full article here