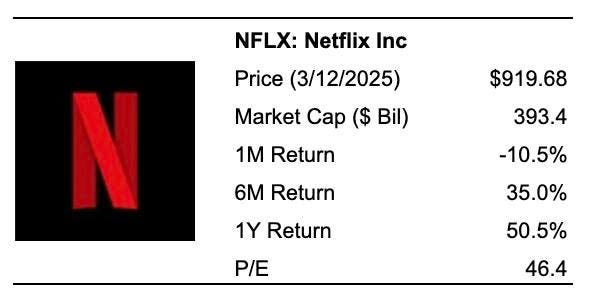

Question: How would you feel if you owned Netflix stock and it dropped 60%, or even 70%, within the next couple of months? It may sound extreme, but it has happened before – and it could happen again. Netflix has stayed roughly flat this year after a stellar 2024, during which the stock gained roughly 90%, driven by the company’s crackdown on password sharing and the expansion of its advertising-supported streaming plan. However, we see several near-term risks for the company due to mounting macroeconomic concerns in the U.S., following President Donald Trump’s imposition of tariffs on key trading partners and the possibility of lower subscriber additions for Netflix. We believe the stock could decline further to levels below $300 per share. Here’s why investors should be concerned.

The fact is, during a downturn, NFLX stock could lose a significant portion of its value. Evidence from as recently as 2022 shows that NFLX stock dropped over 70% of its value in just a few quarters. So, is it possible for NFLX’s roughly $870 stock to fall to below $300 if a repeat of 2022 occurs? Naturally, individual stocks are more volatile than diversified portfolios – and in this environment, if you are seeking upside with less volatility than that of a single stock, consider the High-Quality portfolio, which has outperformed the S&P 500 and achieved returns greater than 91% since inception.

Why Is It Relevant Now?

Netflix’s subscriber growth could slow in 2025 as key initiatives—such as the password-sharing crackdown and the rollout of ad-supported plans—have already been implemented across major markets. These strategies likely accelerated demand from future periods, potentially leading to subdued subscriber additions going forward. The company’s decision to stop reporting subscriber numbers starting in 2025 might indicate that it expects slower growth. See what to expect from Netflix in 2025. By the end of 2024, Netflix added over 40 million subscribers, bringing its paid subscriber base close to 302 million. This expansion was a major driver behind the company’s stock price gains.

Growth was driven by measures designed to curb password sharing, which required users either to pay for additional sharing options or to create new accounts. This initiative, now active in over 100 countries, helped Netflix both attract new subscribers and better monetize its existing base. Furthermore, the ad-supported tier—offering a more affordable entry point—has seen strong adoption, with over half of new subscribers in eligible regions opting for this plan as of the most recent quarter. However, with these growth drivers now largely exhausted, Netflix may face challenges in sustaining its momentum, potentially impacting the stock’s performance.

Economic uncertainty could also weigh on Netflix, which is highly dependent on consumer spending. Trump’s aggressive tariff measures—including a 20% tariff on Chinese imports and 25% on imports from Canada and Mexico, along with tighter immigration restrictions—have raised concerns that inflation might return. All of this suggests that the U.S. economy could encounter significant difficulties, and even a recession – our analysis here on the macro picture. On Monday, during an interview, the President did not rule out the possibility that new tariffs might trigger a recession, causing the Nasdaq index to fall by 4%.

When taking into account the heightened uncertainty from the Trump administration’s policies, these risks become especially critical. The ongoing Ukraine–Russia war and global trade tensions further obscure the economic outlook. Tariffs increase import costs, leading to higher prices, reduced disposable income, and weaker consumer spending. This is clearly negative for Netflix, which relies on discretionary income. It also does not help that Netflix plans have become more expensive, with its premium plan now priced at $25 per month and the standard HD plan recently rising by $2.50 to $18 per month. This could result in subscriber pushback or slower new sign-ups. Meanwhile, Netflix’s content costs are set to rise as it expands into live sports programming, such as NFL games and WWE wrestling. Additionally, intensified competition might lead to higher churn rates or a slowdown in new sign-ups, ultimately impacting margins. These combined pressures could weigh on both profitability and stock performance in the near term.

How resilient is NFLX stock during a downturn?

During some recent downturns, NFLX stock experienced losses that were slightly less severe than those of the benchmark S&P 500 index. Concerned about the impact of a market crash on NFLX stock? Our dashboard How Low Can Netflix Stock Go In A Market Crash? offers a detailed analysis of how the stock performed during and after previous market crashes.

Inflation Shock (2022)

• NFLX stock dropped 72.1% from a high of $597.37 on 3 January 2022 to $166.37 on 11 May 2022, compared to a peak-to-trough decline of 25.4% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 27 February 2024

• Since then, the stock climbed to a high of $1,058 on 17 February 2025 and currently trades at around $890

Covid Pandemic (2020)

• NFLX stock declined by 22.6% from a high of $386.19 on 19 February 2020 to $298.84 on 16 March 2020, compared to a peak-to-trough decline of 33.9% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 13 April 2020

Global Financial Crisis (2008)

• NFLX stock dropped 55.9% from a high of $5.81 on 17 April 2008 to $2.56 on 27 October 2008, compared to a peak-to-trough decline of 56.8% for the S&P 500

• The stock fully recovered to its pre-Crisis peak by 17 March 2009

Premium Valuation

At its current price of nearly $870 per share, Netflix is trading at approximately 35x consensus 2025 earnings, which seems somewhat expensive in our view. In contrast, the stock was trading at about 20x earnings in mid-2022. Although Netflix’s recent financial performance has been robust, markets tend to be short-sighted, projecting short-term successes into the long term. In Netflix’s case, the assumption is likely that the company will continue its strong record of subscriber additions and grow revenues at double-digit rates. However, there is a real possibility that subscriber growth may soon decelerate, as the benefits of the password-sharing crackdown and ad-supported tiers eventually stabilize, while economic uncertainty in the U.S. grows.

Given this potential slowdown in growth and the broader economic uncertainties, ask yourself the question: do you intend to hold on to your Netflix stock now, or will you panic and sell if it begins dropping to $300, $250, or even lower? Holding onto a declining stock is never easy. Trefis collaborates with Empirical Asset Management—a Boston area wealth manager—whose asset allocation strategies yielded positive returns during the 2008-09 period when the S&P lost more than 40%. Empirical has incorporated the Trefis HQ Portfolio into its asset allocation framework to provide clients with better returns and less risk compared to the benchmark index—a less turbulent ride, as shown in HQ Portfolio performance metrics.

Invest with Trefis

Market Beating Portfolios | Rules-Based Wealth

Read the full article here