This week, Microsoft reported a pure revenue number for its most important business for the first time ever.

It’s wild to write that. Azure is Microsoft’s cloud unit, which rents computing capacity over the internet. It’s been the key for Microsoft investors for years, and yet the company has smooshed Azure sales together with other services when reporting results, muddying the financial waters.

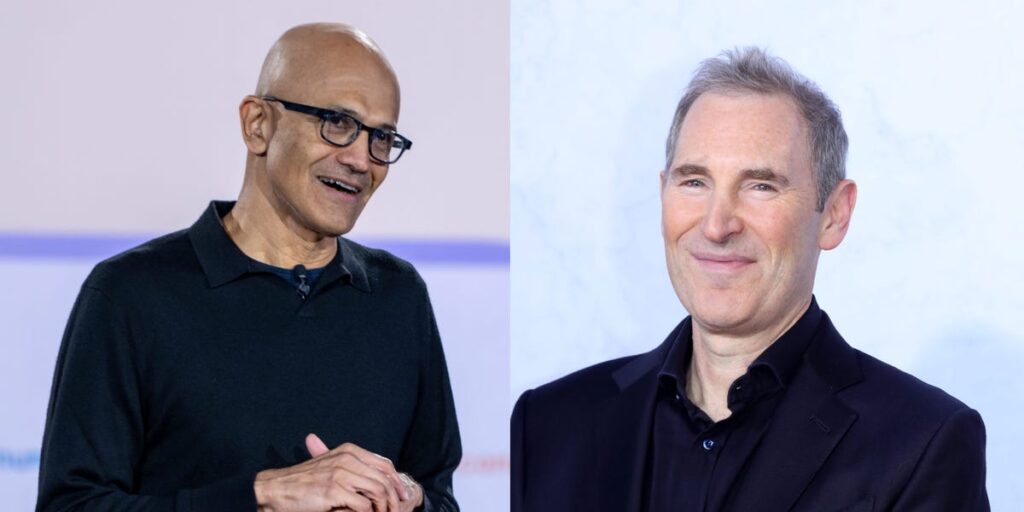

On Wednesday, though, CEO Satya Nadella changed things up by disclosing that, during Microsoft’s recent fiscal year, “Azure surpassed $75 billion in revenue, up 34 percent.”

It’s a great number, and Microsoft shares jumped afterwards, sending the company’s valuation to $4 trillion for the first time.

The most fascinating part of this is that we now have a more accurate way to compare Microsoft’s cloud business with Amazon Web Services, the industry big dog.

Amazon reported results late Thursday. For the past 12 months, through June 30, AWS generated revenue of $116.5 billion, up 18% from the previous 12-month period. (Microsoft’s fiscal year ends June 30, while Amazon reports on a calendar year. This is why we’re talking about a slightly strange 12-month period here.)

The big takeaway: Azure is growing faster, but it’s still a lot smaller than AWS.

“Amazon maintains a strong lead in the market, though Microsoft and Google continue to achieve higher growth rates,” said John Dinsdale, chief analyst at Synergy Research Group, which tracks the cloud industry closely.

Investors prize growth most of the time, especially during risk-on times like these. So, Amazon shares fell about 5% in after-hours trading on Thursday, while Microsoft stock continued its strong run.

Still, the market share of the top 3 cloud providers has barely changed in the past year.

In the second quarter, AWS had 30% of the market, while Microsoft got 20% and Google grabbed 13%. In the same period of 2024, the breakdown was 31%, 20%, and 12%, according to Synergy estimates.

Sign up for BI’s Tech Memo newsletter here. Reach out to me via email at abarr@busienssinsider.com.

Read the full article here