Chinese EV maker BYD is piling the pain on Tesla.

It’s reported soaring sales and revenue even as Tesla has been battered by plunging sales in China, a diving stock price, and public backlash against CEO Elon Musk’s work for DOGE.

As BYD and Tesla square off, here are five charts showing how the two companies compare.

BYD’s overall vehicle sales dwarfed Tesla’s last year.

The Warren Buffett-backed EV giant sold 4,272,000 vehicles in 2024, compared to Tesla’s 1,789,200.

The caveat is that BYD, unlike Tesla, sells hybrids as well as EVs. The Chinese firm sold 1,764,992 battery-electric vehicles in 2024, meaning it fell just short of Tesla’s EV sales crown.

Tesla will face a fight to retain its status as the world’s largest EV maker this year, with sales plunging across the globe in the first few months of the year even as BYD has surged.

BYD reported blowout full-year earnings last week, with revenues overtaking Tesla’s for the first time since 2018.

The Chinese EV giant reported annual revenues of 777 billion yuan ($107 billion) in 2024, a near-30% rise from the previous year.

That saw BYD leapfrog Tesla’s annual revenue for 2024, which came in at $97.7 billion.

BYD’s profits also surged in 2024. The automaker said last Monday that net profit jumped 34% year-over-year to just over 40 billion yuan ($5.55 billion).

That still leaves it behind Tesla, with Elon Musk’s company booking $7.1 billion in net profit in 2024.

One thing that sets Tesla and BYD apart from legacy automakers is that they both make much more than cars.

The two companies have their own side hustles, with about 21% of Tesla’s revenue last year coming from its energy generation and services businesses.

In addition to selling Megapack and Powerwall battery systems, Tesla also sells regulatory credits to rivals that failed to sell enough EVs to meet government quotas.

BYD, meanwhile, has a lucrative side business assembling and building components for smartphones, including Apple’s iPhone.

The Chinese company, which began its life making phone batteries, said a fifth of its revenue last year came from “mobile handset components, assembly service and other products.”

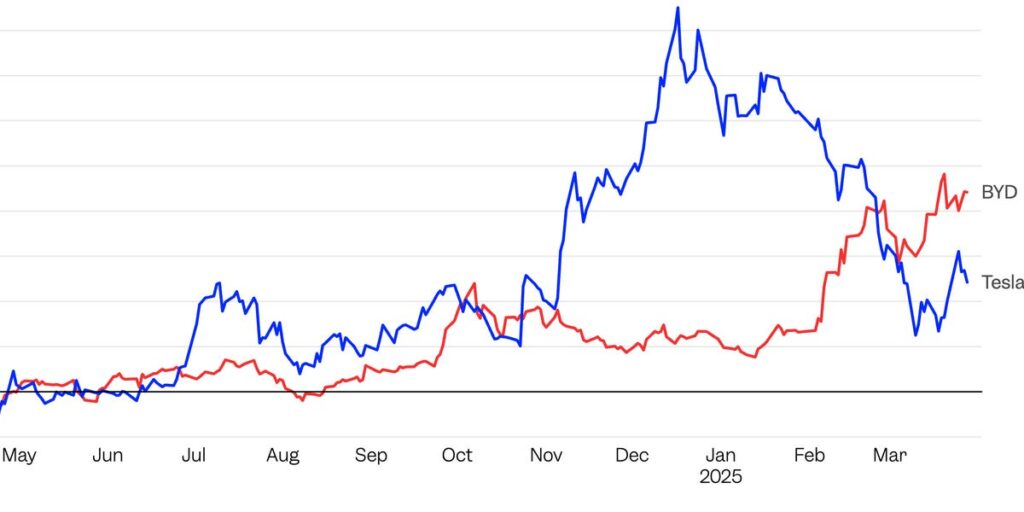

Tesla’s share price fall since the start of the year has been one for the history books.

Investor concerns over Musk’s work at DOGE and some alarming sales figures have seen the automaker’s stock slump 30% this year, despite a recent resurgence following Elon Musk’s late-night all-hands in March.

By contrast, BYD’s stock has surged in 2025 and hit a record high earlier in March after BYD announced new fast-chargers it said could charge an electric car in five minutes.

Tesla stock fell 5% that day as BYD announced its new “super E-platform.”

Read the full article here